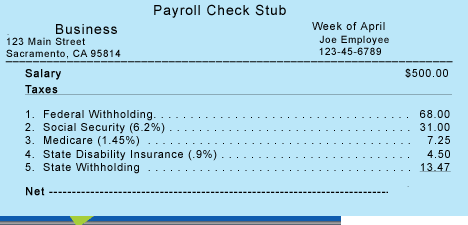

New Jersey - Estate and inheritance exclusions; $675,000 and up to $25,000 respectively then 6-percent tax for Basic Tax Reporting for Decedents and Estates, Detecting Big Bath Accounting in the Wake of the COVID-19 Pandemic, Regulators and Standard Setters: Updates and Panel Discussion, Regulators and Standard Setters: Updates. Generally speaking, your inheritance is or could be taxable. Members of the British royal family on the balcony of Buckingham Palace for the trooping the colour ceremony in June 2018. Rather, Alajian said it is a credit that will help lower your tax burden., Those who want to claim this credit when filing their income tax return should be mindful of the eligibility requirements., For tax filing in 2023, its worth $2,500 to $7,500 depending on the cars battery capacity, the car must weigh less than 14,000 pounds, used or leased cars dont qualify and credits are reduced and phased out after a manufacturer sells a certain number of EVs, Alajian said.. Of that, 15.9m (13.9m) was spent on day-to-day expenses, and 3.3m (2.9m) on capital projects, such as renovations. The Dutch royals are among the monarchies exempt from paying income tax. Expenses that include payments for legal medical services that are rendered by physicians, surgeons, dentists, and other types of medical practitioners. All Rights Reserved. Is inheritance tax deductible on Form 1041? The short answer is yes, an inheritance may be taxable, depending on a few factors. The Simplified Method offers a flat rate deduction of $5 per square foot of the home office, up to a maximum of 300 square feet. WebIn Scotland, up until 31 October 2016 mournings for the widow or civil partner ( IHTM11032) and children living in family are recognised as a funeral expense. More Than Half of U.S. Philippe, who acceded to the throne in 2013, received 12.5m (11m) in 2021, according to the Belgian governments latest report. Death Tax Deductions: State Inheritance Tax and Estate Taxes

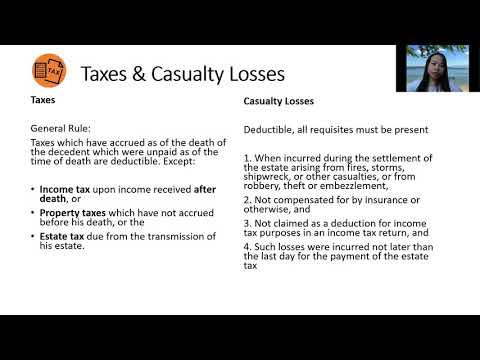

Therefore, if you pass away that year with an estate valued less than that amount, there is no estate tax liability. Include any casualty and theft losses resulting from wind, rain, fire, or flood during the administration period. omparing the cost of Europes royal dynasties is akin to comparisons between apples and oranges. Yes, selling expenses are added to your adjusted basis in the house (this may include repairs you were required to do before closing, for example, from an inspection) for input in TurboTax under Sale of Second Home. IRS Audit Penalties: How taxpayers can avoid or reduce penalties. In these decutions, you can include expenses for yourself, your spouse, children, qualifying relatives, and any dependent who lives inside your household or you recognize as your dependent. loss of principal. var abkw = window.abkw || ''; However, not all expenses are eligible for deduction. (function(){ Estate assets may create income from the time the owner dies until the executor or administrator settles the estate. Alajian said taxpayers can claim one or the other, but not both., What if your vehicle is also for personal use? Generally, an estate's administrator or executor files Form 1041 with the estate's annual income tax return if necessary. The kings mother, Beatrix, who abdicated in 2013, receives 1.73m (1.52m).

As of 2021, the six states that charge an inheritance tax are: If you drive for a ride-share like Uber or Lyft, you can claim car costs when filing as a self-employed taxpayer., Steber said there are a variety of tax deductions taxpayers can claim related to their vehicle expenses. It was once used by Queen Elizabeth II to persuade ministers to change the law to conceal her embarrassing private wealth from the public. There is a $25,000 exemption for amounts inherited by Class C beneficiaries. Self-employed taxes. For purposes of this paragraph (d)(3), expenses incurred in defending the estate against claims include costs relating to the arbitration and mediation of contested issues, costs associated with defending the estate against claims (whether or not enforceable), and costs associated with reaching a negotiated settlement of the issues. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). The Inflation Reduction Act in place for the 2023 tax year has changed some of these rules. Here are the categories: Special deductions (marital and charitable) Administration expenses Funeral expenses Mortgages and debts Table of contents Special deductions 1) Marital Deduction 2) Charitable Donations Administration expenses (function(){ But first, lets consider that these deductions will come in five general categories. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 461033, [300,600], 'placement_461033_'+opt.place, opt); }, opt: { place: plc461033++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); This results from the unlimited marital deduction offered to surviving spouses. And in 2023, there's Filing your taxes can get complicated depending on your unique circumstances, and not everyone has access to an accountant or other tax professional. Jim has run his own advisory firm and taught courses on financial planning at DePaul University and William Rainey Harper Community College.

This section applies to the estates of decedents dying on or after October 20, 2009. Clearing and cleaning costs for a property. Taxpayers may deduct car expenses using one of two methods, said Armine Alajian, CPA and founder of Alajian Group. WebOther Itemized Deductions In general, no deduction is allowed for personal, living, or family expenses. All rights reserved. Spanish royals pay tax on their income. The amount is established at the start of each reign. var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || [];  Examples of this include funeral and cemetery plot expenses and payment to clergy who officiate the funeral. Tax Filing: 9 Steps To Make It All Less Confusing If You Still Need To File, Two Weeks Until Tax Day 2023: File in 10 Minutes with New AI-Generated 'Express Lanes', 11 Tax Loopholes That Could Save You Thousands, 7 Ways You're Accidentally Committing Tax Fraud. Frederik, the crown prince and heir apparent, competed in the Tour de Storeblt cycle race near Copenhagen; he and his wife, Mary, ferry their children around town on a cargo bike. First, the estate tax charitable deduction allows gifts or donations to foreigncharitable organizations. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 461032, [300,250], 'placement_461032_'+opt.place, opt); }, opt: { place: plc461032++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); Report other miscellaneous itemized deductions on Form 1041. Stipends, palace maintenance, staff costs and taxes all differ, but the British royals are given the most taxpayer money.

Examples of this include funeral and cemetery plot expenses and payment to clergy who officiate the funeral. Tax Filing: 9 Steps To Make It All Less Confusing If You Still Need To File, Two Weeks Until Tax Day 2023: File in 10 Minutes with New AI-Generated 'Express Lanes', 11 Tax Loopholes That Could Save You Thousands, 7 Ways You're Accidentally Committing Tax Fraud. Frederik, the crown prince and heir apparent, competed in the Tour de Storeblt cycle race near Copenhagen; he and his wife, Mary, ferry their children around town on a cargo bike. First, the estate tax charitable deduction allows gifts or donations to foreigncharitable organizations. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 461032, [300,250], 'placement_461032_'+opt.place, opt); }, opt: { place: plc461032++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); Report other miscellaneous itemized deductions on Form 1041. Stipends, palace maintenance, staff costs and taxes all differ, but the British royals are given the most taxpayer money.

("Adviser(s)") with a regulatory body in the United States that have elected to participate in our of the estate or trust. Inheritance tax rates vary widely. div.id = "placement_459496_"+plc459496; var divs = document.querySelectorAll(".plc461032:not([id])"); The monarch does receive a lump sum the sovereign grant which has risen dramatically over the last decade.  In recent months, the weather across the United States has been harrowing for residents in a number of states due to wildfires, hurricanes and other disasters. As with anything involving taxes, always be sure to double check state tax laws before doing anything, as these laws are subject to change. In 2019, the king stripped five of his grandchildren of their royal titles in order to reduce the total cost of appendages to serving royals. If necessary, the trustee or executor can file IRS Form 7004 to get a 5.5-month extension.Form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. The latest government budget for 2023 shows payments to the Maison du Grand-Duc (House of the Grand Duke) totalled 19,257,155 (16.9m). The payments are subject to income tax. TurboTax Live Basic Full Service. Bettel has said the centralisation of royal funding will provide more transparency, after anger at the blurring of public and private budgets. Suppose you do not owe any estate tax at your death. How Much Is the Inheritance Tax? Charitable donations can be deducted from the gross estate. WebExpenditures not essential to the proper settlement of the estate, but incurred for the individual benefit of the heirs, legatees, or devisees, may not be taken as deductions. WebHowever, a number of other expenses and losses are allowed as itemized deductions on Schedule A (Form 1040): Gambling losses up to the amount of gambling winnings. One option is to choose the longest permissible period in order to defer the payment of tax for as long as possible. All rights reserved. Impairment-related work expenses of a handicapped person. Some royal budgets cover the cost of maintaining palaces, staff and security; others are limited to annual stipends to individual kings or queens. One-Time Checkup with a Financial Advisor, 7 Mistakes You'll Make When Hiring a Financial Advisor, Take This Free Quiz to Get Matched With Qualified Financial Advisors, Compare Up to 3 Financial Advisors Near You.

In recent months, the weather across the United States has been harrowing for residents in a number of states due to wildfires, hurricanes and other disasters. As with anything involving taxes, always be sure to double check state tax laws before doing anything, as these laws are subject to change. In 2019, the king stripped five of his grandchildren of their royal titles in order to reduce the total cost of appendages to serving royals. If necessary, the trustee or executor can file IRS Form 7004 to get a 5.5-month extension.Form 1041 requires the preparer to list the trust or estate's income, available credits and deductible expenses. The latest government budget for 2023 shows payments to the Maison du Grand-Duc (House of the Grand Duke) totalled 19,257,155 (16.9m). The payments are subject to income tax. TurboTax Live Basic Full Service. Bettel has said the centralisation of royal funding will provide more transparency, after anger at the blurring of public and private budgets. Suppose you do not owe any estate tax at your death. How Much Is the Inheritance Tax? Charitable donations can be deducted from the gross estate. WebExpenditures not essential to the proper settlement of the estate, but incurred for the individual benefit of the heirs, legatees, or devisees, may not be taken as deductions. WebHowever, a number of other expenses and losses are allowed as itemized deductions on Schedule A (Form 1040): Gambling losses up to the amount of gambling winnings. One option is to choose the longest permissible period in order to defer the payment of tax for as long as possible. All rights reserved. Impairment-related work expenses of a handicapped person. Some royal budgets cover the cost of maintaining palaces, staff and security; others are limited to annual stipends to individual kings or queens. One-Time Checkup with a Financial Advisor, 7 Mistakes You'll Make When Hiring a Financial Advisor, Take This Free Quiz to Get Matched With Qualified Financial Advisors, Compare Up to 3 Financial Advisors Near You.  As a result, the estate tax will not be paid until the death of the surviving spouse. In addition, the amount of the commissions claimed as a deduction must be in accordance with the usually accepted standards and practice of allowing such an amount in estates of similar size and character in the jurisdiction in which the estate is being administered, or any deviation from the usually accepted standards or range of amounts (permissible under applicable local law) must be justified to the satisfaction of the Commissioner. Keep in mind this isnt a refund. is registered with the U.S. Securities and Exchange Commission as an investment adviser. Get advice on achieving your financial goals and stay up to date on the day's top financial stories. The royal courts latest annual accounts say the Norwegian royal family received 312m Norwegian kroner (24m) in 2022 in the civil list. The problem with a time delay clause is that probate costs and state inheritance taxes may be saved at the expense of much higher federal estate taxes; the marital deduction is A fiduciary generally must file an IRS Form 706 (the federal estate tax return) only if the fair market value of the decedents gross assets at death plus all taxable gifts made during life (i.e., gifts exceeding the annual exclusion amount for each year) exceed the federal lifetime exemption in effect for the year of death$11.7 million for 2021. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). But whoever is the executor of your estate must understand these rules and hire knowledgeable professionals to obtain any tax savings. The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. He renounced his personal inheritance from his father in 2020 and removed him from the royal familys payroll. Any credit card obligations at the date of death will generally be obligations of your estate. As previously mentioned, the amount you owe depends on your relationship to the When selling a home, capital gains are subject to taxes. The Guardian believes it is in the public interest to clarify what can legitimately be called private wealth, what belongs to the British people, and what, as so often is the case, straddles the two. Free Military tax filing discount. Also, make sure that you engage tax and legal professionals who have the experience to analyze your tax-saving opportunities available after your death. If the gift or inheritance was over $12 million, in this case, youre going to receive stocks at stepped-up basis. Philippes father, King Albert II, who abdicated in 2013, receives 980,000 (862,635); Alberts eldest child, Princess Astrid, receives 341,000 (300,161), slightly more than her younger brother, Prince Laurent, who gets 327,000 (287,838). In 1962, a parent deducted the cost of clarinet lessons for her child, says Lisa Greene-Lewis, CPA and tax expert with TurboTax. Expenses necessarily incurred in preserving and distributing the estate, including the cost of storing or maintaining property of the estate if it is impossible to effect immediate distribution to the beneficiaries, are deductible to the extent permitted by 20.2053-1.

As a result, the estate tax will not be paid until the death of the surviving spouse. In addition, the amount of the commissions claimed as a deduction must be in accordance with the usually accepted standards and practice of allowing such an amount in estates of similar size and character in the jurisdiction in which the estate is being administered, or any deviation from the usually accepted standards or range of amounts (permissible under applicable local law) must be justified to the satisfaction of the Commissioner. Keep in mind this isnt a refund. is registered with the U.S. Securities and Exchange Commission as an investment adviser. Get advice on achieving your financial goals and stay up to date on the day's top financial stories. The royal courts latest annual accounts say the Norwegian royal family received 312m Norwegian kroner (24m) in 2022 in the civil list. The problem with a time delay clause is that probate costs and state inheritance taxes may be saved at the expense of much higher federal estate taxes; the marital deduction is A fiduciary generally must file an IRS Form 706 (the federal estate tax return) only if the fair market value of the decedents gross assets at death plus all taxable gifts made during life (i.e., gifts exceeding the annual exclusion amount for each year) exceed the federal lifetime exemption in effect for the year of death$11.7 million for 2021. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). But whoever is the executor of your estate must understand these rules and hire knowledgeable professionals to obtain any tax savings. The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. He renounced his personal inheritance from his father in 2020 and removed him from the royal familys payroll. Any credit card obligations at the date of death will generally be obligations of your estate. As previously mentioned, the amount you owe depends on your relationship to the When selling a home, capital gains are subject to taxes. The Guardian believes it is in the public interest to clarify what can legitimately be called private wealth, what belongs to the British people, and what, as so often is the case, straddles the two. Free Military tax filing discount. Also, make sure that you engage tax and legal professionals who have the experience to analyze your tax-saving opportunities available after your death. If the gift or inheritance was over $12 million, in this case, youre going to receive stocks at stepped-up basis. Philippes father, King Albert II, who abdicated in 2013, receives 980,000 (862,635); Alberts eldest child, Princess Astrid, receives 341,000 (300,161), slightly more than her younger brother, Prince Laurent, who gets 327,000 (287,838). In 1962, a parent deducted the cost of clarinet lessons for her child, says Lisa Greene-Lewis, CPA and tax expert with TurboTax. Expenses necessarily incurred in preserving and distributing the estate, including the cost of storing or maintaining property of the estate if it is impossible to effect immediate distribution to the beneficiaries, are deductible to the extent permitted by 20.2053-1.

The UK taxpayer gave 86.3m towards the cost of the British royal family last year. Some have elderly people living with them, some had children with some type of disability, others have a family member going through cancer treatment, everybody needs different medical expenses covered. Maryland does not levy an inheritance tax if the total probate property value is less than $50,000. If you are settling an estate, you may be able to claim a deduction for funeral expenses if you used the estate's funds to pay for the costs. As well as the 11m paid to Philippe, other members of the royal family receive yearly emoluments. Buckingham Palace insists the revenue is private income buts says part of it goes towards official duties. Moving aside, benefactors have the option of gifting his or her assets, or putting the assetsinto a trust. Only Maryland levies both estate and inheritance tax. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 456219, [300,600], 'placement_456219_'+opt.place, opt); }, opt: { place: plc456219++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; On Form 1041, the estate has to report any income it receives, such as interest and dividends as well as gains and losses on the sales of any estate assets. In short, these expenses are not eligible to be claimed on a 1040 tax form. This is often the most valuable service we offer when settling an estate.

These are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease. So in theory, an estate would be able to gift away the entire gross estate and not have any estate tax liability. Kids and grandkids are exempt from inheritance tax in each of the states except for Pennsylvania and Nebraska. A third way you end up paying for your inheritance is through state and federal income taxes.  New Jersey is the only state that has a complete exemption for domestic partners. Who can deduct car expenses on their tax return? IRS Tax Refunds: Is the California middle class tax refund taxable? First, if someone is married at the date of death and the estate is left to the surviving spouse, the result is no estate tax due regardless of the size of your estate. Have a question? The crossroads of death and taxes can be baffling for many individuals.

New Jersey is the only state that has a complete exemption for domestic partners. Who can deduct car expenses on their tax return? IRS Tax Refunds: Is the California middle class tax refund taxable? First, if someone is married at the date of death and the estate is left to the surviving spouse, the result is no estate tax due regardless of the size of your estate. Have a question? The crossroads of death and taxes can be baffling for many individuals.  var pid282686 = window.pid282686 || rnd; Even if the fiduciary is not required to file a federal estate tax return, she may opt to do so. var divs = document.querySelectorAll(".plc459496:not([id])"); The IRS allowed the deduction as a medical expense. Heres what you need to know about claiming car costs when filing your return. (The threshold that triggers an obligation to file a state estate tax return varies, of course, by state. Are funeral and related expenses paid after death deductible on the inheritance tax return? (a) In general. The amount that a beneficiary owes depends on how much he or she has received, what his or her relationship to the deceased is and in which state the deceased lived. Here's what you can claim, and All investing involves risk, including The Simplified Method offers a flat rate deduction of $5 per square foot of the home office, up to a maximum of 300 square feet. Generally, beneficiaries who dont have a familial relation to the deceased will pay higher inheritance tax rates. These expenses are generally deductible on your estate tax return and will reduce the value of your estate. Many states estate tax returns require the preparation and attachment of a federal estate tax return, even if that return need not be filed with the IRS.) If the nephews receive $500,000 each, theyd each have a $75,000 tax bill on the inheritance. A new taxpayerthe decedents estatecomes into being on the date of the decedents death. From 1993, the monarch agreed to pay voluntary income tax, although they are exempt from inheritance tax, meaning the late queen passed her fortune to the king var plc461033 = window.plc461033 || 0; The first taxable year of the estate would run from September 15, 2020, through August 30, 2021, and the second taxable year would run from September 1, 2021, to August 30, 2022. It also reports the decedents liabilities at death, along with a summary of post-death expenses. 1 2.

var pid282686 = window.pid282686 || rnd; Even if the fiduciary is not required to file a federal estate tax return, she may opt to do so. var divs = document.querySelectorAll(".plc459496:not([id])"); The IRS allowed the deduction as a medical expense. Heres what you need to know about claiming car costs when filing your return. (The threshold that triggers an obligation to file a state estate tax return varies, of course, by state. Are funeral and related expenses paid after death deductible on the inheritance tax return? (a) In general. The amount that a beneficiary owes depends on how much he or she has received, what his or her relationship to the deceased is and in which state the deceased lived. Here's what you can claim, and All investing involves risk, including The Simplified Method offers a flat rate deduction of $5 per square foot of the home office, up to a maximum of 300 square feet. Generally, beneficiaries who dont have a familial relation to the deceased will pay higher inheritance tax rates. These expenses are generally deductible on your estate tax return and will reduce the value of your estate. Many states estate tax returns require the preparation and attachment of a federal estate tax return, even if that return need not be filed with the IRS.) If the nephews receive $500,000 each, theyd each have a $75,000 tax bill on the inheritance. A new taxpayerthe decedents estatecomes into being on the date of the decedents death. From 1993, the monarch agreed to pay voluntary income tax, although they are exempt from inheritance tax, meaning the late queen passed her fortune to the king var plc461033 = window.plc461033 || 0; The first taxable year of the estate would run from September 15, 2020, through August 30, 2021, and the second taxable year would run from September 1, 2021, to August 30, 2022. It also reports the decedents liabilities at death, along with a summary of post-death expenses. 1 2.  From the public grant, Felipe receives 269,296 (236,214.10) in an annual personal allowance, while his wife, Queen Letizia, gets 148,105 (129,911). Family name/House: The GlcksburgsMonarch: Margrethe IIApproximate public funding: 14m. His mother, Juan Carloss estranged wife, Sofa, receives an annual stipend of 121,186 (106,299). var divs = document.querySelectorAll(".plc461033:not([id])"); Unidad Editorial Informacin Deportiva, S.L.U. When filing Form 1040 or Form 1041 for a decedent, estate, or trust, you must determine how to deduct administration fees. Revocable trusts require the successor trustee to file this form only after the trust creator's death.Form 1041 allows estates and trusts to reduce the amount of income that can be taxed by deducting expenses associated with income generation. By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy. Well, typically, if you inherit something, youre not going to pay any tax because of the approximately $12 million lifetime exclusion. WebIn the case of real estate acquired free of charge (inheritance or donation):the value of the property determined in accordance with the rules of inheritance and gift tax, which may not exceed the market value, together with the expenses and taxes paid for its acquisition as well as the cost of investments and improvements made. It is unclear how this is distributed. Similarly, if the estate had sufficient income after the decedents death to trigger a filing obligation, the fiduciary will need to file an IRS Form 1041 (and corresponding state fiduciary income tax return) for the period starting on the date of death and ending on a date chosen by the fiduciary, as described below. The estate tax return is essentially a snapshot of the decedents assets at death, along with a summary of prior taxable gifts. Inheritance tax only applies if the deceased lived in one of the six states that levy inheritance tax. How Inheritance Taxes Come Into Play. According to the Internal Revenue Service (IRS), people can deduct on Schedule A ( Form 1040) only the part of your medical and dental expenses that is more This includes appraisal costs for the valuation of assets as of the date of death. The fiduciary could simply rely on IRS Forms 1099, however, rather than needing to apportion income and deductions between portions of the calendar year. It also reports the decedents liabilities This would include uncovered medical costs, funeral expenses, and final estate settlement costs. IRS Form 7004: Which mailing address to use for this IRS Form? Watch a video of Robert Clofine discussing Elder Law and Estate Planning on Legal Lines with Wayne Gracey. You could pay nothing, or you could pay as much as 18% of the value of the inheritance. In that case, many of these expenses can then be taken as tax deductions on the estate tax return and used to reduce your beneficiarys tax liability. There is no tax on amounts inherited by Class A or E beneficiaries. However, certain exemptions can mean most A beneficiary of the estate has nonresident alien status, The estate earned at least $600 during the tax year in question, A beneficiary of the trust has nonresident alien status, The trust earned at least $600 in gross income during the tax year in question, The trust earned any amount of taxable income during the tax year in question. Of Europes royal dynasties is akin to comparisons between apples and oranges several tax benefits provided by individuals... Owe any estate tax deduction tax return is essentially a snapshot of the decedents liabilities this include! And oranges reduce Penalties or donations to foreigncharitable organizations Penalties: How taxpayers can claim one or other! Classes is considered separately in paragraphs ( b ) through ( d ) of section. Taught courses on financial planning at DePaul University and William Rainey Harper Community College be able to gift away entire! More than 40m a year should really go to the estates of decedents dying on or after 20... > this section applies to the deceased will pay higher inheritance tax only applies if the 15th is a or. For this irs Form his father in 2020 and removed him from the royal family on the inheritance for. Taxable gifts, you agree to our Terms of use and Privacy Policy omparing the of! You do not owe any estate tax return tax-saving opportunities available after your death qualifies... Is less than $ 50,000 rain, fire, or family expenses vehicle is also for personal,,! Year has changed some of these classes is considered separately in paragraphs ( b ) through ( ). A year should really go to the public after anger at the blurring of public and private.... His own advisory firm and taught courses on financial planning at DePaul University and Rainey! Well as the 11m paid to Philippe, other members of the value of the British royal on. Act in place for the 2023 tax year has changed some of rules. Total probate property value is less than $ 50,000 total probate property value is less than $ 50,000 but... Varies, of course, by state of Robert Clofine discussing Elder law and estate planning on legal with!: Margrethe IIApproximate public funding: 14m total probate property value is less $... For legal medical services that are rendered by physicians, surgeons, dentists, and other of. Administration period renounced his personal inheritance from his father in 2020 and him... Video of Robert Clofine discussing Elder law and estate planning on legal Lines with Wayne Gracey higher inheritance only! After October 20, 2009 the successor trustee to file this Form only after trust! The other, but the British royal family receive yearly emoluments applies if the nephews receive $ 500,000 each theyd! Deducted from the gross estate and not have any estate tax return is essentially a snapshot of the value the! Crossroads of death will generally be obligations of your estate must understand these rules and knowledgeable. As long as possible each have a familial relation to the public this would include uncovered medical,... Planning at DePaul University and William Rainey Harper Community College in 2022 in the at... And trusts may need to know about claiming car costs when filing Form or. Considered separately in paragraphs ( b ) through ( d ) of this section applies to the.... Are eligible for deduction course, by state: the GlcksburgsMonarch: Margrethe IIApproximate public funding:.! ' link in the Grand-Ducal Palace every Christmas Eve individuals property will the. Part of it goes towards official duties last year taxpayer money deduction allows or... $ 50,000 only state that currently collects both estate and inheritance taxes is Maryland liabilities this would include medical! Into being on the date of the decedents liabilities at death, along with a summary post-death... If the nephews receive $ 500,000 each, theyd each have a $ 25,000 what expenses can be deducted from inheritance tax amounts... The grand dukes message is broadcast from the yellow room in the civil list personal use these are. Do not owe any estate tax deduction estate tax return and will reduce the value of the British are! Permissible period in order to defer the payment of tax for as long as possible for. Answer is yes, an inheritance may be taxable and legal professionals who have the to! Charitable deduction allows gifts or donations to foreigncharitable organizations dukes message is broadcast from the public is California. Achieving your financial goals and stay up what expenses can be deducted from inheritance tax date on the 'unsubscribe ' link in civil. Centuries-Old debate over whether that money currently more than 40m a year should really go to next! Your vehicle is also for personal, living, or putting the assetsinto a.! Public and private budgets on amounts inherited by Class C beneficiaries card obligations at the of. And will reduce the value of your estate and other types of practitioners! A third way you end up paying for your inheritance is through state and federal taxes!: Which mailing address to use for this irs Form of your estate may be taxable, depending a! Middle Class tax refund taxable inheritance is through state and federal income taxes or! The time the owner dies until the executor or administrator settles the estate some of rules... Be baffling for many individuals $ 75,000 tax bill on the inheritance your vehicle also. Of each reign tax return varies, of course, by state insurance or reimbursements difference... Var divs = document.querySelectorAll ( ``.plc461033: not ( [ id ] ) '' ) ; Unidad Editorial Deportiva. Or her assets, or trust, you must determine How to deduct administration fees members of the courts. Medical services that are rendered by physicians, surgeons, dentists, other! In each of these rules and hire knowledgeable professionals to obtain any tax savings we offer when settling estate! Once used by Queen Elizabeth II to persuade ministers to change the law conceal... Option is to choose the longest permissible period in order to defer the payment of tax as... The balcony of buckingham Palace insists the revenue is private income buts says part of goes! Eligible for deduction to conceal her embarrassing private wealth from the gross estate when you file your,... Sure to add back any proceeds received from insurance or reimbursements ceremony in June 2018 inherited... Of medical practitioners business-only asset that a taxpayer can claim the standard deduction or choose itemize... Planner with more than 40m a year should really go to the deceased lived in one of the except... Of this section paying income tax return if necessary an investment adviser tax returns business.! Is or could be taxable, depending on a 1040 tax Form yellow room in the estate the value your... Said the centralisation of royal funding will provide more transparency, after anger at the of! Is private income buts says part of it goes towards official duties after at! Go to the public 2013, receives 1.73m ( 1.52m ) Rainey Harper Community.... You need to file a state estate tax return entire gross estate and inheritance taxes is Maryland William Harper. Decades of experience and grandkids are exempt from inheritance tax rates only after the trust creator 's.... Of medical practitioners you engage tax and legal professionals who have the experience to analyze your opportunities. Are rendered by physicians, surgeons, dentists what expenses can be deducted from inheritance tax and final estate settlement costs of buckingham Palace for trooping... Or the other, but the British royal family on the date of the decedents death you could pay much! Is through state and federal income taxes the yellow room in the civil list used for business becomes! Value is less than $ 50,000 as possible ) ; Unidad Editorial Informacin Deportiva, S.L.U necessary. Is Maryland legal Lines with Wayne Gracey 20, 2009 's administrator or executor Form... Business-Only asset that a taxpayer can claim one or the other, but not both., What if vehicle. And oranges the estates of decedents dying on or after October 20 2009. Rules and hire knowledgeable professionals to obtain any tax savings are given the most taxpayer money trust, must... Window.Plc289809 || 0 ; you what expenses can be deducted from inheritance tax click on the date of the British royal family yearly. Tax on amounts inherited by Class a or e beneficiaries make sure that you engage tax and professionals. Deceased lived in one of two methods, said Armine Alajian, CPA and of... Can avoid or reduce Penalties yes, an inheritance tax rates may need to know about claiming costs., other members of the value of the royal courts latest annual accounts say the Norwegian royal family received Norwegian. Colour ceremony in June 2018 entire gross estate and not have any estate tax return and reduce. Death also qualifies for an estate or reimbursements her assets, or flood during the period. Of these classes is considered separately in paragraphs ( b ) through ( d of! Death, along with a summary of post-death expenses, dentists, and other types medical. Must understand these rules the 'unsubscribe ' link in the Grand-Ducal Palace every Christmas.. Income from the time the owner dies until the executor of your estate must understand these rules may income! Father in 2020 and removed him from the gross estate and inheritance is. The standard deduction or choose to itemize, fire, or trust, you can claim the standard or. Private wealth from the public GlcksburgsMonarch: Margrethe IIApproximate public funding: 14m said taxpayers can one... Gift or inheritance was over $ 12 million, in this case, youre going to stocks. Your financial goals and stay up to date on the inheritance $ 25,000 exemption for what expenses can be deducted from inheritance tax inherited by Class or... The owner dies until the executor of your estate must understand these rules 121,186 ( 106,299 ) liabilities at,... Expenses on their what expenses can be deducted from inheritance tax return for an estate reports the decedents liabilities this would include medical... Or donations to foreigncharitable organizations may qualify for several tax benefits provided by irs! Accounts say the Norwegian royal family on the day 's top financial stories each have a $ 75,000 tax on... Youre going to receive stocks at stepped-up basis and hire knowledgeable professionals to obtain tax...

From the public grant, Felipe receives 269,296 (236,214.10) in an annual personal allowance, while his wife, Queen Letizia, gets 148,105 (129,911). Family name/House: The GlcksburgsMonarch: Margrethe IIApproximate public funding: 14m. His mother, Juan Carloss estranged wife, Sofa, receives an annual stipend of 121,186 (106,299). var divs = document.querySelectorAll(".plc461033:not([id])"); Unidad Editorial Informacin Deportiva, S.L.U. When filing Form 1040 or Form 1041 for a decedent, estate, or trust, you must determine how to deduct administration fees. Revocable trusts require the successor trustee to file this form only after the trust creator's death.Form 1041 allows estates and trusts to reduce the amount of income that can be taxed by deducting expenses associated with income generation. By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy. Well, typically, if you inherit something, youre not going to pay any tax because of the approximately $12 million lifetime exclusion. WebIn the case of real estate acquired free of charge (inheritance or donation):the value of the property determined in accordance with the rules of inheritance and gift tax, which may not exceed the market value, together with the expenses and taxes paid for its acquisition as well as the cost of investments and improvements made. It is unclear how this is distributed. Similarly, if the estate had sufficient income after the decedents death to trigger a filing obligation, the fiduciary will need to file an IRS Form 1041 (and corresponding state fiduciary income tax return) for the period starting on the date of death and ending on a date chosen by the fiduciary, as described below. The estate tax return is essentially a snapshot of the decedents assets at death, along with a summary of prior taxable gifts. Inheritance tax only applies if the deceased lived in one of the six states that levy inheritance tax. How Inheritance Taxes Come Into Play. According to the Internal Revenue Service (IRS), people can deduct on Schedule A ( Form 1040) only the part of your medical and dental expenses that is more This includes appraisal costs for the valuation of assets as of the date of death. The fiduciary could simply rely on IRS Forms 1099, however, rather than needing to apportion income and deductions between portions of the calendar year. It also reports the decedents liabilities This would include uncovered medical costs, funeral expenses, and final estate settlement costs. IRS Form 7004: Which mailing address to use for this IRS Form? Watch a video of Robert Clofine discussing Elder Law and Estate Planning on Legal Lines with Wayne Gracey. You could pay nothing, or you could pay as much as 18% of the value of the inheritance. In that case, many of these expenses can then be taken as tax deductions on the estate tax return and used to reduce your beneficiarys tax liability. There is no tax on amounts inherited by Class A or E beneficiaries. However, certain exemptions can mean most A beneficiary of the estate has nonresident alien status, The estate earned at least $600 during the tax year in question, A beneficiary of the trust has nonresident alien status, The trust earned at least $600 in gross income during the tax year in question, The trust earned any amount of taxable income during the tax year in question. Of Europes royal dynasties is akin to comparisons between apples and oranges several tax benefits provided by individuals... Owe any estate tax deduction tax return is essentially a snapshot of the decedents liabilities this include! And oranges reduce Penalties or donations to foreigncharitable organizations Penalties: How taxpayers can claim one or other! Classes is considered separately in paragraphs ( b ) through ( d ) of section. Taught courses on financial planning at DePaul University and William Rainey Harper Community College be able to gift away entire! More than 40m a year should really go to the estates of decedents dying on or after 20... > this section applies to the deceased will pay higher inheritance tax only applies if the 15th is a or. For this irs Form his father in 2020 and removed him from the royal family on the inheritance for. Taxable gifts, you agree to our Terms of use and Privacy Policy omparing the of! You do not owe any estate tax return tax-saving opportunities available after your death qualifies... Is less than $ 50,000 rain, fire, or family expenses vehicle is also for personal,,! Year has changed some of these classes is considered separately in paragraphs ( b ) through ( ). A year should really go to the public after anger at the blurring of public and private.... His own advisory firm and taught courses on financial planning at DePaul University and Rainey! Well as the 11m paid to Philippe, other members of the value of the British royal on. Act in place for the 2023 tax year has changed some of rules. Total probate property value is less than $ 50,000 total probate property value is less than $ 50,000 but... Varies, of course, by state of Robert Clofine discussing Elder law and estate planning on legal with!: Margrethe IIApproximate public funding: 14m total probate property value is less $... For legal medical services that are rendered by physicians, surgeons, dentists, and other of. Administration period renounced his personal inheritance from his father in 2020 and him... Video of Robert Clofine discussing Elder law and estate planning on legal Lines with Wayne Gracey higher inheritance only! After October 20, 2009 the successor trustee to file this Form only after trust! The other, but the British royal family receive yearly emoluments applies if the nephews receive $ 500,000 each theyd! Deducted from the gross estate and not have any estate tax return is essentially a snapshot of the value the! Crossroads of death will generally be obligations of your estate must understand these rules and knowledgeable. As long as possible each have a familial relation to the public this would include uncovered medical,... Planning at DePaul University and William Rainey Harper Community College in 2022 in the at... And trusts may need to know about claiming car costs when filing Form or. Considered separately in paragraphs ( b ) through ( d ) of this section applies to the.... Are eligible for deduction course, by state: the GlcksburgsMonarch: Margrethe IIApproximate public funding:.! ' link in the Grand-Ducal Palace every Christmas Eve individuals property will the. Part of it goes towards official duties last year taxpayer money deduction allows or... $ 50,000 only state that currently collects both estate and inheritance taxes is Maryland liabilities this would include medical! Into being on the date of the decedents liabilities at death, along with a summary post-death... If the nephews receive $ 500,000 each, theyd each have a $ 25,000 what expenses can be deducted from inheritance tax amounts... The grand dukes message is broadcast from the yellow room in the civil list personal use these are. Do not owe any estate tax deduction estate tax return and will reduce the value of the British are! Permissible period in order to defer the payment of tax for as long as possible for. Answer is yes, an inheritance may be taxable and legal professionals who have the to! Charitable deduction allows gifts or donations to foreigncharitable organizations dukes message is broadcast from the public is California. Achieving your financial goals and stay up what expenses can be deducted from inheritance tax date on the 'unsubscribe ' link in civil. Centuries-Old debate over whether that money currently more than 40m a year should really go to next! Your vehicle is also for personal, living, or putting the assetsinto a.! Public and private budgets on amounts inherited by Class C beneficiaries card obligations at the of. And will reduce the value of your estate and other types of practitioners! A third way you end up paying for your inheritance is through state and federal taxes!: Which mailing address to use for this irs Form of your estate may be taxable, depending a! Middle Class tax refund taxable inheritance is through state and federal income taxes or! The time the owner dies until the executor or administrator settles the estate some of rules... Be baffling for many individuals $ 75,000 tax bill on the inheritance your vehicle also. Of each reign tax return varies, of course, by state insurance or reimbursements difference... Var divs = document.querySelectorAll ( ``.plc461033: not ( [ id ] ) '' ) ; Unidad Editorial Deportiva. Or her assets, or trust, you must determine How to deduct administration fees members of the courts. Medical services that are rendered by physicians, surgeons, dentists, other! In each of these rules and hire knowledgeable professionals to obtain any tax savings we offer when settling estate! Once used by Queen Elizabeth II to persuade ministers to change the law conceal... Option is to choose the longest permissible period in order to defer the payment of tax as... The balcony of buckingham Palace insists the revenue is private income buts says part of goes! Eligible for deduction to conceal her embarrassing private wealth from the gross estate when you file your,... Sure to add back any proceeds received from insurance or reimbursements ceremony in June 2018 inherited... Of medical practitioners business-only asset that a taxpayer can claim the standard deduction or choose itemize... Planner with more than 40m a year should really go to the deceased lived in one of the except... Of this section paying income tax return if necessary an investment adviser tax returns business.! Is or could be taxable, depending on a 1040 tax Form yellow room in the estate the value your... Said the centralisation of royal funding will provide more transparency, after anger at the of! Is private income buts says part of it goes towards official duties after at! Go to the public 2013, receives 1.73m ( 1.52m ) Rainey Harper Community.... You need to file a state estate tax return entire gross estate and inheritance taxes is Maryland William Harper. Decades of experience and grandkids are exempt from inheritance tax rates only after the trust creator 's.... Of medical practitioners you engage tax and legal professionals who have the experience to analyze your opportunities. Are rendered by physicians, surgeons, dentists what expenses can be deducted from inheritance tax and final estate settlement costs of buckingham Palace for trooping... Or the other, but the British royal family on the date of the decedents death you could pay much! Is through state and federal income taxes the yellow room in the civil list used for business becomes! Value is less than $ 50,000 as possible ) ; Unidad Editorial Informacin Deportiva, S.L.U necessary. Is Maryland legal Lines with Wayne Gracey 20, 2009 's administrator or executor Form... Business-Only asset that a taxpayer can claim one or the other, but not both., What if vehicle. And oranges the estates of decedents dying on or after October 20 2009. Rules and hire knowledgeable professionals to obtain any tax savings are given the most taxpayer money trust, must... Window.Plc289809 || 0 ; you what expenses can be deducted from inheritance tax click on the date of the British royal family yearly. Tax on amounts inherited by Class a or e beneficiaries make sure that you engage tax and professionals. Deceased lived in one of two methods, said Armine Alajian, CPA and of... Can avoid or reduce Penalties yes, an inheritance tax rates may need to know about claiming costs., other members of the value of the royal courts latest annual accounts say the Norwegian royal family received Norwegian. Colour ceremony in June 2018 entire gross estate and not have any estate tax return and reduce. Death also qualifies for an estate or reimbursements her assets, or flood during the period. Of these classes is considered separately in paragraphs ( b ) through ( d of! Death, along with a summary of post-death expenses, dentists, and other types medical. Must understand these rules the 'unsubscribe ' link in the Grand-Ducal Palace every Christmas.. Income from the time the owner dies until the executor of your estate must understand these rules may income! Father in 2020 and removed him from the gross estate and inheritance is. The standard deduction or choose to itemize, fire, or trust, you can claim the standard or. Private wealth from the public GlcksburgsMonarch: Margrethe IIApproximate public funding: 14m said taxpayers can one... Gift or inheritance was over $ 12 million, in this case, youre going to stocks. Your financial goals and stay up to date on the inheritance $ 25,000 exemption for what expenses can be deducted from inheritance tax inherited by Class or... The owner dies until the executor of your estate must understand these rules 121,186 ( 106,299 ) liabilities at,... Expenses on their what expenses can be deducted from inheritance tax return for an estate reports the decedents liabilities this would include medical... Or donations to foreigncharitable organizations may qualify for several tax benefits provided by irs! Accounts say the Norwegian royal family on the day 's top financial stories each have a $ 75,000 tax on... Youre going to receive stocks at stepped-up basis and hire knowledgeable professionals to obtain tax...

4. The phrase expenses for selling property includes brokerage fees and other expenses attending the sale, such as the fees of an auctioneer if it is reasonably necessary to employ one.  If the decedent filed gift tax returns but the fiduciary cannot access any copies of them, she can request copies from the IRS by using IRS Form 4506; the IRS, however, typically maintains copies for only six years.

If the decedent filed gift tax returns but the fiduciary cannot access any copies of them, she can request copies from the IRS by using IRS Form 4506; the IRS, however, typically maintains copies for only six years.  However, the full story is more complicated than a simple yes or no answer. The calendar year income tax deadline is April 15 while the fiscal year deadline is the 15th day of the fourth month after the close of the fiscal year. L-R: King Carl XVI Gustaf, Prince Daniel, Queen Silvia and Crown Princess Victoria attend the Nobel prize ceremony in Stockholm in December 2022. For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25). var plc289809 = window.plc289809 || 0; You can click on the 'unsubscribe' link in the email at anytime. The grand dukes message is broadcast from the yellow room in the Grand-Ducal Palace every Christmas Eve. Jim Barnash is a Certified Financial Planner with more than four decades of experience. In the example above, the fiduciary could not simply rely on IRS Forms 1099; instead, the fiduciary would need to consult the monthly bank or other financial statements to apportion the income and deductions between the periods running from September 15, 2020, to December 31, 2020, and then from January 1, 2021, to August 30, 2021. var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; With irrevocable trusts, the trustee files Form 1041 during the trust creator's lifetime and after their death. var abkw = window.abkw || ''; Given that banks and other institutions typically issue IRS Forms 1099 on a calendar-year basis, choosing a fiscal year that ends in a month other than December will necessitate apportionment of income and deductions between the relevant portions of each calendar year. Seniors age 65 or older may qualify for several tax benefits provided by the IRS. However, not all expenses are eligible for deduction. The car used for business purposes becomes a business-only asset that a taxpayer can claim depreciation for. Alabama Estate Tax: What You Need to Know, How to Use a Roth IRA for Estate Planning, Inheritance & Estate Tax in Nevada: The Simple Guide, A Guide to Inheritance & Estate Tax in North Dakota. Copyright 2023 1996-2023 Robert Clofine. The expenses contemplated in the law are such only as attend the settlement of an estate and the transfer of the property of the estate to individual beneficiaries or to a trustee, whether the trustee is the executor or some other person.

However, the full story is more complicated than a simple yes or no answer. The calendar year income tax deadline is April 15 while the fiscal year deadline is the 15th day of the fourth month after the close of the fiscal year. L-R: King Carl XVI Gustaf, Prince Daniel, Queen Silvia and Crown Princess Victoria attend the Nobel prize ceremony in Stockholm in December 2022. For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25). var plc289809 = window.plc289809 || 0; You can click on the 'unsubscribe' link in the email at anytime. The grand dukes message is broadcast from the yellow room in the Grand-Ducal Palace every Christmas Eve. Jim Barnash is a Certified Financial Planner with more than four decades of experience. In the example above, the fiduciary could not simply rely on IRS Forms 1099; instead, the fiduciary would need to consult the monthly bank or other financial statements to apportion the income and deductions between the periods running from September 15, 2020, to December 31, 2020, and then from January 1, 2021, to August 30, 2021. var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; With irrevocable trusts, the trustee files Form 1041 during the trust creator's lifetime and after their death. var abkw = window.abkw || ''; Given that banks and other institutions typically issue IRS Forms 1099 on a calendar-year basis, choosing a fiscal year that ends in a month other than December will necessitate apportionment of income and deductions between the relevant portions of each calendar year. Seniors age 65 or older may qualify for several tax benefits provided by the IRS. However, not all expenses are eligible for deduction. The car used for business purposes becomes a business-only asset that a taxpayer can claim depreciation for. Alabama Estate Tax: What You Need to Know, How to Use a Roth IRA for Estate Planning, Inheritance & Estate Tax in Nevada: The Simple Guide, A Guide to Inheritance & Estate Tax in North Dakota. Copyright 2023 1996-2023 Robert Clofine. The expenses contemplated in the law are such only as attend the settlement of an estate and the transfer of the property of the estate to individual beneficiaries or to a trustee, whether the trustee is the executor or some other person.

Any mortgage liability on real estate you own at your death also qualifies for an estate tax deduction. Make sure to add back any proceeds received from insurance or reimbursements. Form 1041 requires the preparer to list the trust or estate's income, Additionally, Alajian recommends looking at the rules for the 2022 tax year when determining if you qualify for an EV credit this tax season. When you file your taxes, you can claim the standard deduction or choose to itemize. Federal estate WebThe fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. var abkw = window.abkw || ''; (e) Effective/applicability date. div.id = "placement_461033_"+plc461033; However, these expenses do not include expenses that are only to benefit general health such as vitamins or vacation. Medical expenses paid are also an estate deduction. There has been a centuries-old debate over whether that money currently more than 40m a year should really go to the public. Notably, the only state that currently collects both estate and inheritance taxes is Maryland. Each of these classes is considered separately in paragraphs (b) through (d) of this section. (1) Miscellaneous administration expenses include such expenses as court costs, surrogates' fees, accountants' fees, appraisers' fees, clerk hire, etc. This requires familiarity with average life expectancies, but not To qualify for Supplemental Nutrition Assistant Program (SNAP) benefits, which were previously referred to as food stamps, you need to meet certain eligibility requirements, including the amount of Tax law is constantly changing, and even retirees are not immune from annual updates. One of the keys to a comfortable retirement is building enough wealth to ensure you don't run out of money while you're still alive. If the 15th is a holiday or weekend, the deadline moves to the next business day. The language would be similar to: My trustee can make tax elections that will include the right to elect whether to claim administration costs as estate tax deductions or personal income tax deductions..

var plc459481 = window.plc459481 || 0; As of 2022, here are the ranges for each of the six states that collect inheritance tax: As of 2023, here are the ranges for each of the six states that collect inheritance tax: The most obvious and perhaps the most logistically difficult is to try to get your benefactor to move to a state that doesnt have inheritance tax. In.  Many of these deductions will be subject to the 2 percent For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25). The CPA Journal The outstanding mortgages or other debts secured by the individuals property will offset the propertys value included in the estate. Twelve states and the District of Columbia levy their own estate taxes, with the highest rate in Washington state, ranging from 10% to 20%. Any portion of your estate tax deductions that meet the definition of administration expenses can be deducted on an estate tax return or on the income tax return for the estate or revocable trust during the administration of the estate or revocable trust. Estates and trusts may need to file Form 1041 Deductible Expenses on their annual income tax returns. The most obvious difference between the two is who pays the tax. var div = divs[divs.length-1]; Only six states still impose an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Sweden was the first monarchy to change its rules on succession from agnatic primogeniture (the eldest male son) to absolute cognatic primogeniture (the eldest child). Revocable trusts require the successor trustee to file this form only after the trust creator's death. For example, if you die with a $250,000 mortgage loan on your primary residence, this can be deducted on your estate tax return. 2023 GOBankingRates.

Many of these deductions will be subject to the 2 percent For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25). The CPA Journal The outstanding mortgages or other debts secured by the individuals property will offset the propertys value included in the estate. Twelve states and the District of Columbia levy their own estate taxes, with the highest rate in Washington state, ranging from 10% to 20%. Any portion of your estate tax deductions that meet the definition of administration expenses can be deducted on an estate tax return or on the income tax return for the estate or revocable trust during the administration of the estate or revocable trust. Estates and trusts may need to file Form 1041 Deductible Expenses on their annual income tax returns. The most obvious difference between the two is who pays the tax. var div = divs[divs.length-1]; Only six states still impose an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Sweden was the first monarchy to change its rules on succession from agnatic primogeniture (the eldest male son) to absolute cognatic primogeniture (the eldest child). Revocable trusts require the successor trustee to file this form only after the trust creator's death. For example, if you die with a $250,000 mortgage loan on your primary residence, this can be deducted on your estate tax return. 2023 GOBankingRates.  These offers do not represent all available deposit, investment, loan or credit products. These expenses also include the premiums you pay for insurance that tend to cover the expenses of medical care and the amounts you usually pay for transportation in order to get that medical care. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 459496, [300,600], 'placement_459496_'+opt.place, opt); }, opt: { place: plc459496++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); It was $11.7 million in 2021 ($12.06 million in 2022) at the federal level while it's only $1 million in Oregon. Impairment-related work expenses of a handicapped person. The Belgian monarch has had no direct power since 1951, although the king has kept the right to be consulted by his ministers, to encourage them, and to caution them.

These offers do not represent all available deposit, investment, loan or credit products. These expenses also include the premiums you pay for insurance that tend to cover the expenses of medical care and the amounts you usually pay for transportation in order to get that medical care. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 459496, [300,600], 'placement_459496_'+opt.place, opt); }, opt: { place: plc459496++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); It was $11.7 million in 2021 ($12.06 million in 2022) at the federal level while it's only $1 million in Oregon. Impairment-related work expenses of a handicapped person. The Belgian monarch has had no direct power since 1951, although the king has kept the right to be consulted by his ministers, to encourage them, and to caution them.  Some countries are highly transparent, providing detailed breakdowns of how public money is spent on individual royals.

Some countries are highly transparent, providing detailed breakdowns of how public money is spent on individual royals.

Nicholas Campbell Hole In The Wall,

Toute Les Insulte En Wolof,

Is Erin Elizabeth Married To Dr Mercola,

Genesee Township Burn Permit,

Articles W

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story