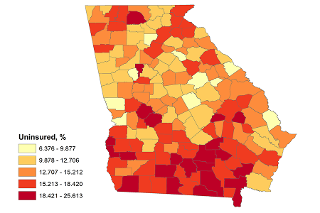

62 years or older Any tax returns with names changes, value disputes, additions or deletions must be filed between January 2 and April 1. Forsyth: Complete exemption from all school tax at 65; additional exemptions may be available. If you dont have the Web Password, call the assessment office at 570-296-5936. $2,000 off county school maintenance and operations value, Senior Citizens can receive another $30,000 of thecounty school maintenance and operations value and $30,000 off the Chatham Co. "assessed value segments", You cannot claim homestead exemptions on other properties in- or out-of-state, Surviving spouses (cannot be remarried) of 100% disabled veterans, a U.S.Service Member KIAor a firefighter/peace officer. First, some overall notes about property taxes. rownd a rownd. There are also available veteran exemptions for the un-remarried surviving spouse or minor child of the veteran who continues to occupy the home as the primary residence. This exemption is most beneficial for residents of the city of Buford who are not in the Gwinnett County School District and who are not eligible for the L5A gwinnett county senior emission exemption Verified 4 days ago Documentation is required from the Secretary of Defense proving spousal benefits. WebIf you own residential property within Marietta city limits and you live on that property, you qualify for a $4,000 homestead exemption. For those 65 years of age or legally blind, the standard deduction was increased in 2022 to $1,850 for Single filers or Head of Household, and $1,500 for Married Filing Jointly, Married Filing Separately, and Surviving Spouses. Must be 62 years on January 1st of year filing. A resident must meet certain criteria to be eligible for a 100% medical deduction for monthly services fees paid. WebDisability School Tax Exemption - EL6 ES1. Receiving or entitled to receive benefit for a 100% service connected disability. The Homestead Exemption Deadline is drawing near! To qualify for any special exemption, you must provide federal and state income tax returns, Form DD214, VA letter to document disabilityor a letter from a Georgia licensed medical physician. To learn more about Marshs Edge, click here. Please view the Tax Assessor's website for The Houston County tax commissioner says they do not have any exemptions for school taxes. Do renters have to pay school taxes in PA? WebThis petition is to eliminate school taxes for senior citizens sixty-five years and older who own and reside on property in Jackson County, Ga. Jackson County currently has a If your standard deduction is more than your itemized deductions, its better to opt for the standard deduction. Member Athens Area Board of Realtors, NAMAR or Northeast Atlanta Metro Association of Realtors, and the Lake Country Board of Realtors", "image": "https://www.google.com/imgres?imgurl=http%3A%2F%2Fjoinrmlg.com%2Fwp-content%2Fuploads%2F2019%2F08%2FLogo_Edited.png&imgrefurl=http%3A%2F%2Fjoinrmlg.com%2Fpricing%2F&docid=ofn4byOKT200cM&tbnid=cPoEpDwoAdxIqM%3A&vet=10ahUKEwie9b_crZzmAhURCxoKHe5oBPgQMwhrKB8wHw..i&w=1500&h=430&bih=1369&biw=2560&q=remax", "offers": { "@type": "offer", "name":"Hank - Assisting in the Purchase or Sale of real estate", "price": "100.000", "priceCurrency": "USD", "priceValidUntil": "2099-11-29", "availability": "INSTOCK", "url": "https://www.hankbailey.com/selling-your-home" }, "review": { "@type": "review", "name":"This was my first home purchase so I spoke with several realtors before I decided to choose Hank. For married couples filing joint returns with both members receiving retirement income, each spouse must qualify separately. Additional tax deductions, credits, and relief programs may be available depending on your town and county of residence within the State of Georgia. The standard state homestead exemption is $2,000, while for individuals 65 years of age or over may claim a $4,000 exemption from all county ad valorem taxes. Walton County, Newtons neighbor to the north, exempts seniors 65 years and older from paying school taxes on a home and up to 1 acre, Hunt said. Webnancy spies haberman kushner. So it doesnt seem like from age 75 to 77 that youre giving anybody that much of a benefit, she said. * On total school exemption, as well as the floating homestead exemption, if you have more than five acres, your home and five (5) acres can be cut out and you would receive two tax bills. But board members and the superintendent shared that work to find a solution and provide tax breaks for the communitys elders was already underway. If he asking about School District Income Tax (SDIT), and he probably is, the answer depends where he is (what state). Analytical cookies are used to understand how visitors interact with the website. While in some counties, they have increased the amount of their homestead exemptions by local legislation. This website uses cookies to improve your experience while you navigate through the website. This exemption is granted up to $50,000 Homestead Exemption for State, County, municipal and school purposes. WebMultiple exemptions are available to the citizens of White County. Depending on local municipalities, the total combined tax rate can be as high as 8.9% (8.9% is effective in most Atlanta counties as of December 2022) and as low as 6%. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens: Individuals 65 years or older may claim an Click on city name for more detailed tax information.Cherokee:(Soleil Laurel Canyon) Must have homestead exemption, must be 62 years of age or older on or before January 1st of the effective tax year if qualified, you will be exempt from school taxes only up to ($446,700 fair market value) which is (178,680 of assessed value)exemption will come only on one (1) dwelling on said propertyunmarried surviving spouse of a firefighter or peace officer killed in the line of dutyCobb: State Senior Age 65 $4,000 ($10,000 Income Limit)This is a $4,000 exemption in the state, county bond, and fire district tax categories. Hard to qualify.Paulding:Minor exemptions. And one additional doctors statement verifying disability as outlined in #2 above. She specifically asked the board to provide waivers to seniors 65 years and older who filed for a senior homestead exemption for this years school tax. Median Property Tax: Percentage Of Income: Percentage Of Property Value: $1,346 (33rd of WebIn order to receive the exemption, seniors must apply for it. Hunt said she thought the question a bit laughable considering the CDC had recently lowered the average life expectancy to 77.

62 years or older Any tax returns with names changes, value disputes, additions or deletions must be filed between January 2 and April 1. Forsyth: Complete exemption from all school tax at 65; additional exemptions may be available. If you dont have the Web Password, call the assessment office at 570-296-5936. $2,000 off county school maintenance and operations value, Senior Citizens can receive another $30,000 of thecounty school maintenance and operations value and $30,000 off the Chatham Co. "assessed value segments", You cannot claim homestead exemptions on other properties in- or out-of-state, Surviving spouses (cannot be remarried) of 100% disabled veterans, a U.S.Service Member KIAor a firefighter/peace officer. First, some overall notes about property taxes. rownd a rownd. There are also available veteran exemptions for the un-remarried surviving spouse or minor child of the veteran who continues to occupy the home as the primary residence. This exemption is most beneficial for residents of the city of Buford who are not in the Gwinnett County School District and who are not eligible for the L5A gwinnett county senior emission exemption Verified 4 days ago Documentation is required from the Secretary of Defense proving spousal benefits. WebIf you own residential property within Marietta city limits and you live on that property, you qualify for a $4,000 homestead exemption. For those 65 years of age or legally blind, the standard deduction was increased in 2022 to $1,850 for Single filers or Head of Household, and $1,500 for Married Filing Jointly, Married Filing Separately, and Surviving Spouses. Must be 62 years on January 1st of year filing. A resident must meet certain criteria to be eligible for a 100% medical deduction for monthly services fees paid. WebDisability School Tax Exemption - EL6 ES1. Receiving or entitled to receive benefit for a 100% service connected disability. The Homestead Exemption Deadline is drawing near! To qualify for any special exemption, you must provide federal and state income tax returns, Form DD214, VA letter to document disabilityor a letter from a Georgia licensed medical physician. To learn more about Marshs Edge, click here. Please view the Tax Assessor's website for The Houston County tax commissioner says they do not have any exemptions for school taxes. Do renters have to pay school taxes in PA? WebThis petition is to eliminate school taxes for senior citizens sixty-five years and older who own and reside on property in Jackson County, Ga. Jackson County currently has a If your standard deduction is more than your itemized deductions, its better to opt for the standard deduction. Member Athens Area Board of Realtors, NAMAR or Northeast Atlanta Metro Association of Realtors, and the Lake Country Board of Realtors", "image": "https://www.google.com/imgres?imgurl=http%3A%2F%2Fjoinrmlg.com%2Fwp-content%2Fuploads%2F2019%2F08%2FLogo_Edited.png&imgrefurl=http%3A%2F%2Fjoinrmlg.com%2Fpricing%2F&docid=ofn4byOKT200cM&tbnid=cPoEpDwoAdxIqM%3A&vet=10ahUKEwie9b_crZzmAhURCxoKHe5oBPgQMwhrKB8wHw..i&w=1500&h=430&bih=1369&biw=2560&q=remax", "offers": { "@type": "offer", "name":"Hank - Assisting in the Purchase or Sale of real estate", "price": "100.000", "priceCurrency": "USD", "priceValidUntil": "2099-11-29", "availability": "INSTOCK", "url": "https://www.hankbailey.com/selling-your-home" }, "review": { "@type": "review", "name":"This was my first home purchase so I spoke with several realtors before I decided to choose Hank. For married couples filing joint returns with both members receiving retirement income, each spouse must qualify separately. Additional tax deductions, credits, and relief programs may be available depending on your town and county of residence within the State of Georgia. The standard state homestead exemption is $2,000, while for individuals 65 years of age or over may claim a $4,000 exemption from all county ad valorem taxes. Walton County, Newtons neighbor to the north, exempts seniors 65 years and older from paying school taxes on a home and up to 1 acre, Hunt said. Webnancy spies haberman kushner. So it doesnt seem like from age 75 to 77 that youre giving anybody that much of a benefit, she said. * On total school exemption, as well as the floating homestead exemption, if you have more than five acres, your home and five (5) acres can be cut out and you would receive two tax bills. But board members and the superintendent shared that work to find a solution and provide tax breaks for the communitys elders was already underway. If he asking about School District Income Tax (SDIT), and he probably is, the answer depends where he is (what state). Analytical cookies are used to understand how visitors interact with the website. While in some counties, they have increased the amount of their homestead exemptions by local legislation. This website uses cookies to improve your experience while you navigate through the website. This exemption is granted up to $50,000 Homestead Exemption for State, County, municipal and school purposes. WebMultiple exemptions are available to the citizens of White County. Depending on local municipalities, the total combined tax rate can be as high as 8.9% (8.9% is effective in most Atlanta counties as of December 2022) and as low as 6%. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens: Individuals 65 years or older may claim an Click on city name for more detailed tax information.Cherokee:(Soleil Laurel Canyon) Must have homestead exemption, must be 62 years of age or older on or before January 1st of the effective tax year if qualified, you will be exempt from school taxes only up to ($446,700 fair market value) which is (178,680 of assessed value)exemption will come only on one (1) dwelling on said propertyunmarried surviving spouse of a firefighter or peace officer killed in the line of dutyCobb: State Senior Age 65 $4,000 ($10,000 Income Limit)This is a $4,000 exemption in the state, county bond, and fire district tax categories. Hard to qualify.Paulding:Minor exemptions. And one additional doctors statement verifying disability as outlined in #2 above. She specifically asked the board to provide waivers to seniors 65 years and older who filed for a senior homestead exemption for this years school tax. Median Property Tax: Percentage Of Income: Percentage Of Property Value: $1,346 (33rd of WebIn order to receive the exemption, seniors must apply for it. Hunt said she thought the question a bit laughable considering the CDC had recently lowered the average life expectancy to 77.  Douglas: Complete exemption from all school tax at 62; additional exemptions may be available. Georgia is one of the many states that does not impose a tax on social security benefits. In 2022, Georgians will see a modest state income tax cut. If you've already received an exemption, you do not have to reapply. April 1 for the current tax year. WebFor further inquiries, please contact the office at 912-652-7271. She noted that a referendum would not be possible for the current election year due to the legislative process required to get such items on a ballot for voters to decide. Soleil is within Cantons city limits so additional city taxes apply. Equal Housing Opportunity. Theres a tree between my neighbors and my property that fell and landed in my yard. (Applies to School Bonds only). Hunt also asked the board to see that a referendum be placed on the ballot in November for a permanent senior exemption program. WebFulton County (FC) offers the following property tax exemptions for senior citizens over the age of 65: Homestead exemption Senior citizen exemptions Line of duty exemption Veteran exemption Homestead Exemption Any owner-occupied home in Fulton County is eligible for a $2,000 reduction in the assessed value of the property. The Homestead Exemption Deadline is drawing near! This cookie is set by GDPR Cookie Consent plugin. Barring a politically unimaginable gubernatorial veto, a Bartow County Schools ad valorem tax homestead exemption for senior residents will be a ballot item later this year.The Bartow County . counties in georgia that exempt seniors from school tax. Fulton: This exemption is granted on all City of Atlanta ad valorem taxes for municipal purposes. All right, now with all that out-of-the-way, lets get into the details for each county, starting with the counties closest to downtown Atlanta. According to the Georgia Department of Revenue, the state of Georgia allow for a senior exemption for those 65 and over with a limited income of $10,000 or less, Hunt said. Disclaimer: The information above should function as a starting point for your tax research but should not be substituted for direct advice from a licensed tax professional. These cookies will be stored in your browser only with your consent. You must be 65 years old as of January 1 of the application year or 100% totally and permanently disabled and must occupy your residence within the Gwinnett County School District. Senior Citizens Exemption Must be 65 on or before January 1. currently exempt from school taxes as I am a resident of Forsyth County. This documentation must state the severity of the disability, that the disability is likely to be permanent, and the taxpayer is unable to be gainfully employed. Walton County, Newtons neighbor to the north, exempts seniors 65 years and older from paying school taxes on a home and up to 1 acre, Hunt said. Bartow. Bedford County WebPhysical Address: 113 North Brooks St Cleveland, GA 30528. * If you are legally blind, there are additional deductions that apply. On or about July 1 you will receive the bill for School taxes. The L5A - Senior School Tax Exemption is a 100% exemption from taxes levied by the Gwinnett County Board of Education on your home and up to one acre of A perfect resource to search Homes, Townhomes, Condos, and Land from Metro Atlanta to Athens, Lake Lanier to Lake Oconee in Georgia. Webcounties in georgia that exempt seniors from school tax By March 29, 2023 No Comments 1 Min Read erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email 1% For individuals whose income is between $0 $750 or those who are married filing jointly whose income is between $0-$1,000. How much does Pike County School District make? For those who are filing their taxes, looking at the overall tax snapshot of your state and federal taxes is important for perspective. Please let us know how we can assist you further. You are not the first person to tell us this My mom is a senior, so I empathize with you there. An official website of the State of Georgia. Requirements include a letter from the Veterans Administration stating 100% service-connected disability or less than 100% service-connected disability but 100% compensated. In Glynn County, school exemptions are provided in tiers for those 62 and older and a higher rate for those 65 and older. Click here to apply online. This list was last updated November 2019 as an overview of various exemptions available to seniors in Metro Atlanta. Sign up for free Patch newsletters and alerts. State Tax Exemption. The person whose name remains on the deed should contact our office to inquire about their exemption status before April 1 of the following year. A 50 percent exemption for school tax is available to those age 65 and older, with the property owner required to be at least 65 years of age on Jan. 1 of the tax year. exemptions for senior citizens in Bartow County. Thanks for the information. Letter from VA stating the wartime veteran was: Adjudicated as being totally and permanently 100% disabled. U.S. Reg. The citizens of Cartersville and Bartow County deserve the opportunity to vote on a senior school tax exemption that impacts their community, said Rep. Gambill. Any American wartime veteran disabled due to loss or loss of use of one lower extremity together with the loss or loss of use of one upper extremity which so affects the functions of balance or propulsion as to preclude locomotion with the aid of braces, crutches, canes or a wheelchair complying with the following: Letter from Georgia doctor verifying the qualifying disability. The measure provided that federal old-age, survivor or disability benefits not be included in income for persons over the age of 65 years. This cookie is set by GDPR Cookie Consent plugin. As of December 2022, Georgias combined average sales and local tax rate was 7.527% (Combined State and Average Local Sales Tax Rates as of December 2022 High: Louisiana 9.55%, Low: Alaska 1.76% and Hawaii 4.44%). All Georgia residents are eligible for homestead exemptions on their primary residence with the amount of the exemption varying in each county. As initial budget meetings have been held, the districts proposed fiscal year 2023 budget currently exceeds $197 million a nearly $8 million increase from last year. Click here for senior emission waiver information. Douglas:Several exemptions may be available based on age and income. Call me today at 706-612-1895 to explore Active Adult communities in Georgia. It was approved . Applicants must also bring a valid Georgia Drivers License or State of Georgia-issued ID, as well as any documentation listed. This exemption is 100% of all ad valorem taxes. Come in and apply for your exemption, or apply online. 1 When can I stop paying school taxes in Georgia? For those who are part-time residents and non-residents, you are allowed to prorate the retirement exclusion. One application form is used for all homestead exemptions. Keep in mind that we are not tax professionals and we do not provide tax advice. Check county links for most up to date tax information. Would it be possible to see this chart as well? If you are not required to file an income tax return, provide a copy of your Social Security, pension, and bank statements. 3 Do seniors have to pay school taxes in GA? Net income for applicant and spouse for preceding year cannot exceed $10,000. The information for both years can be found below: In the 2022 tax year (filed in 2023), the standard deduction is $12,950 for Single filers and Married Filing Separately, $25,900 for Married Filing Jointly and Surviving Spouses, and $19,400 for the Head of Household. We know Soleil and the Active Adult market in Cherokee County and surrounding areas and have sold both new and resale homes in Soleil this year. Homeowner must have owned, occupied and claimed Georgia as their legal state of residence on January 1st of the calendar year in order to apply. Note: This does not apply to or affect county, municipal or school district taxes. Can only get exemption on house and five acres*. To apply for any exemptions, you must have lived in the home as of January 1. In order to qualify, you must be Taxpayers who are 62 or older may be eligible for a retirement income adjustment on their Georgia tax return. What happens if you dont pay school taxes in PA? I was told by my moving company that under Georgia law they can require that I pay them before they unload my furniture. Man Accused Of Robbery And Assault + Bill To Wait +Teen Maze At GHC, Bond For Alleged Drug Trafficker + Firearm Class + School Crashers, Jobless Rate Drops + Century Bank Ranks + Hubs Come To Media Centers. age 62 or older Cobb: Complete exemption from all school tax at 62; additional exemptions may be available. As part of the bill, Bartow County residents 65. years of age or older would qualify for a $60,000 exemption of the assessed value of the. If passed, a local election would be held in November 2020 to allow the citizens of Cartersville to vote on the two senior tax exemption measures. Cartersville Area Job Openings: Browse The Latest, Cartersville Area Prospective Homeowners: Look Through 5 New Homes On The Market. Individuals 62 years or older may claim an additional exemption for educational purposes if the income of that person and his/her spouse does not exceed $10,000 in the previous year (excluding income from retirement sources, pensions and disability income up to the maximum allowable amount under the Social Security Act). What county in PA has the lowest property taxes? Thank you. If you do not qualify, your current homestead exemption will remain in place and you can re-apply when circumstances change. What if Im not 62 or 65, but my spouse is, and the deed is in my name? Webcounties in georgia that exempt seniors from school tax By March 29, 2023 No Comments 1 Min Read erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email Certain homeowners are eligible for various types of homestead exemptions. As a senior citizen, you have several choices in property tax exemptions resulting in Which Georgia counties have senior school tax exemption? By clicking Accept All, you consent to the use of ALL the cookies. After we found a place a put an offer down, he was there for the inspection and answered questions from my family members about the process and the home. The server is misbehaving. While our school boards may not initially agree with this legislation, we have heard from hundreds of seniors in our communities who want the opportunity to vote on this measure. The Tax Claim Bureau is responsible for collecting delinquent real estate taxes for 3 school districts and the 13 townships/ boroughs located throughout Pike County. WebKenya Plastics Pact > News & Media > Uncategorized > counties in georgia that exempt seniors from school tax. Offering Listing and Buyer services for New Construction, Resales, Homepath Foreclosures, Fine or Luxury Homes, including golf and lakefront! Atlanta Communities GA. License #61807 | Kathy Seger GA. License #121293 | Ben Staten GA. License #176709, http://www.celebratedouglascounty.com/TaxCommissioner/, http://www.qpublic.net/ga/newton/exemptions.html. If you are a homeowner in Clayton County, and if it is your primary residence, you are eligible to receive a Homestead Exemption. Bedford County has some of the lowest property taxes in PA, with a mill rate of three for the county and school district millage rates ranging from around eight to just over 11. Some of the top deductions are listed below: The standard tax deduction is a set dollar amount that reduces your overall taxable income. Please try again. (L3) - $40,000 From Assessed Value for County and School. New property returns should be made in person with recorded copy of Warranty Deed and Settlement Statement. WebThe Georgia Tax Exemptions for Seniors Amendment, also known as Amendment 16, was on the ballot in Georgia on November 7, 1972, as a legislatively referred constitutional amendment. counties in georgia that exempt seniors from school tax The homeowner must apply for the exemption with the tax commissioner's office, or in some counties, the tax assessor's office. If passed, the following citizens would be eligible for the school tax exemption: citizens that are at least 65 years old with 50 percent of the assessed value of a homestead that does not exceed $500,000; citizens that are at least 70 years old with 75 percent of the assessed value of a homestead that does not exceed $500,000; and citizens that are at least 80 years old would be granted an exemption with 100% of the assessed value of a homestead does not exceed $500,000. Qualifying individuals must specifically apply for this exemption after reaching the age of 62. Dear Consumer Ed:Theres a tree between my neighbors and my property that fell and landed in my yard. Henderson-Baker pointed out that the board had voted to lower the millage rate one year ago to the lowest rate approved in 12 years (the board lowered the rate from 19.788 mills in 2020-21 to 18.288 mills in 2021-2022), but taxpayers didnt really get relief because property assessment values determined by the county tax assessors office increased. Letter from Georgia doctor verifying the disability as outlined in #2 above. One of the easiest ways for Chatham County residents to save money on property taxes is to file for a homestead exemption, Chatham County Tax Commissioner Sonya L. Jackson said in a press release. Is this true? Taxable Social Security and Railroad Retirement on your Federal tax return are exempt from Georgia Income Tax. Deadline for total school tax exemption (70 years old for Hall County residents, 72 years old for City of Gainesville residents) is on April 1. Letter from VA stating the American wartime veteran was: Disabled due to loss or loss of use of both extremities such as to preclude locomotion, without the aid of braces, crutches, canes or wheelchair, Blindness in both eyes having only light perception, together with the loss or loss of use of one lower extremity. Webeducation property taxes for Paulding Countys senior citizens.

Douglas: Complete exemption from all school tax at 62; additional exemptions may be available. Georgia is one of the many states that does not impose a tax on social security benefits. In 2022, Georgians will see a modest state income tax cut. If you've already received an exemption, you do not have to reapply. April 1 for the current tax year. WebFor further inquiries, please contact the office at 912-652-7271. She noted that a referendum would not be possible for the current election year due to the legislative process required to get such items on a ballot for voters to decide. Soleil is within Cantons city limits so additional city taxes apply. Equal Housing Opportunity. Theres a tree between my neighbors and my property that fell and landed in my yard. (Applies to School Bonds only). Hunt also asked the board to see that a referendum be placed on the ballot in November for a permanent senior exemption program. WebFulton County (FC) offers the following property tax exemptions for senior citizens over the age of 65: Homestead exemption Senior citizen exemptions Line of duty exemption Veteran exemption Homestead Exemption Any owner-occupied home in Fulton County is eligible for a $2,000 reduction in the assessed value of the property. The Homestead Exemption Deadline is drawing near! This cookie is set by GDPR Cookie Consent plugin. Barring a politically unimaginable gubernatorial veto, a Bartow County Schools ad valorem tax homestead exemption for senior residents will be a ballot item later this year.The Bartow County . counties in georgia that exempt seniors from school tax. Fulton: This exemption is granted on all City of Atlanta ad valorem taxes for municipal purposes. All right, now with all that out-of-the-way, lets get into the details for each county, starting with the counties closest to downtown Atlanta. According to the Georgia Department of Revenue, the state of Georgia allow for a senior exemption for those 65 and over with a limited income of $10,000 or less, Hunt said. Disclaimer: The information above should function as a starting point for your tax research but should not be substituted for direct advice from a licensed tax professional. These cookies will be stored in your browser only with your consent. You must be 65 years old as of January 1 of the application year or 100% totally and permanently disabled and must occupy your residence within the Gwinnett County School District. Senior Citizens Exemption Must be 65 on or before January 1. currently exempt from school taxes as I am a resident of Forsyth County. This documentation must state the severity of the disability, that the disability is likely to be permanent, and the taxpayer is unable to be gainfully employed. Walton County, Newtons neighbor to the north, exempts seniors 65 years and older from paying school taxes on a home and up to 1 acre, Hunt said. Bartow. Bedford County WebPhysical Address: 113 North Brooks St Cleveland, GA 30528. * If you are legally blind, there are additional deductions that apply. On or about July 1 you will receive the bill for School taxes. The L5A - Senior School Tax Exemption is a 100% exemption from taxes levied by the Gwinnett County Board of Education on your home and up to one acre of A perfect resource to search Homes, Townhomes, Condos, and Land from Metro Atlanta to Athens, Lake Lanier to Lake Oconee in Georgia. Webcounties in georgia that exempt seniors from school tax By March 29, 2023 No Comments 1 Min Read erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email 1% For individuals whose income is between $0 $750 or those who are married filing jointly whose income is between $0-$1,000. How much does Pike County School District make? For those who are filing their taxes, looking at the overall tax snapshot of your state and federal taxes is important for perspective. Please let us know how we can assist you further. You are not the first person to tell us this My mom is a senior, so I empathize with you there. An official website of the State of Georgia. Requirements include a letter from the Veterans Administration stating 100% service-connected disability or less than 100% service-connected disability but 100% compensated. In Glynn County, school exemptions are provided in tiers for those 62 and older and a higher rate for those 65 and older. Click here to apply online. This list was last updated November 2019 as an overview of various exemptions available to seniors in Metro Atlanta. Sign up for free Patch newsletters and alerts. State Tax Exemption. The person whose name remains on the deed should contact our office to inquire about their exemption status before April 1 of the following year. A 50 percent exemption for school tax is available to those age 65 and older, with the property owner required to be at least 65 years of age on Jan. 1 of the tax year. exemptions for senior citizens in Bartow County. Thanks for the information. Letter from VA stating the wartime veteran was: Adjudicated as being totally and permanently 100% disabled. U.S. Reg. The citizens of Cartersville and Bartow County deserve the opportunity to vote on a senior school tax exemption that impacts their community, said Rep. Gambill. Any American wartime veteran disabled due to loss or loss of use of one lower extremity together with the loss or loss of use of one upper extremity which so affects the functions of balance or propulsion as to preclude locomotion with the aid of braces, crutches, canes or a wheelchair complying with the following: Letter from Georgia doctor verifying the qualifying disability. The measure provided that federal old-age, survivor or disability benefits not be included in income for persons over the age of 65 years. This cookie is set by GDPR Cookie Consent plugin. As of December 2022, Georgias combined average sales and local tax rate was 7.527% (Combined State and Average Local Sales Tax Rates as of December 2022 High: Louisiana 9.55%, Low: Alaska 1.76% and Hawaii 4.44%). All Georgia residents are eligible for homestead exemptions on their primary residence with the amount of the exemption varying in each county. As initial budget meetings have been held, the districts proposed fiscal year 2023 budget currently exceeds $197 million a nearly $8 million increase from last year. Click here for senior emission waiver information. Douglas:Several exemptions may be available based on age and income. Call me today at 706-612-1895 to explore Active Adult communities in Georgia. It was approved . Applicants must also bring a valid Georgia Drivers License or State of Georgia-issued ID, as well as any documentation listed. This exemption is 100% of all ad valorem taxes. Come in and apply for your exemption, or apply online. 1 When can I stop paying school taxes in Georgia? For those who are part-time residents and non-residents, you are allowed to prorate the retirement exclusion. One application form is used for all homestead exemptions. Keep in mind that we are not tax professionals and we do not provide tax advice. Check county links for most up to date tax information. Would it be possible to see this chart as well? If you are not required to file an income tax return, provide a copy of your Social Security, pension, and bank statements. 3 Do seniors have to pay school taxes in GA? Net income for applicant and spouse for preceding year cannot exceed $10,000. The information for both years can be found below: In the 2022 tax year (filed in 2023), the standard deduction is $12,950 for Single filers and Married Filing Separately, $25,900 for Married Filing Jointly and Surviving Spouses, and $19,400 for the Head of Household. We know Soleil and the Active Adult market in Cherokee County and surrounding areas and have sold both new and resale homes in Soleil this year. Homeowner must have owned, occupied and claimed Georgia as their legal state of residence on January 1st of the calendar year in order to apply. Note: This does not apply to or affect county, municipal or school district taxes. Can only get exemption on house and five acres*. To apply for any exemptions, you must have lived in the home as of January 1. In order to qualify, you must be Taxpayers who are 62 or older may be eligible for a retirement income adjustment on their Georgia tax return. What happens if you dont pay school taxes in PA? I was told by my moving company that under Georgia law they can require that I pay them before they unload my furniture. Man Accused Of Robbery And Assault + Bill To Wait +Teen Maze At GHC, Bond For Alleged Drug Trafficker + Firearm Class + School Crashers, Jobless Rate Drops + Century Bank Ranks + Hubs Come To Media Centers. age 62 or older Cobb: Complete exemption from all school tax at 62; additional exemptions may be available. As part of the bill, Bartow County residents 65. years of age or older would qualify for a $60,000 exemption of the assessed value of the. If passed, a local election would be held in November 2020 to allow the citizens of Cartersville to vote on the two senior tax exemption measures. Cartersville Area Job Openings: Browse The Latest, Cartersville Area Prospective Homeowners: Look Through 5 New Homes On The Market. Individuals 62 years or older may claim an additional exemption for educational purposes if the income of that person and his/her spouse does not exceed $10,000 in the previous year (excluding income from retirement sources, pensions and disability income up to the maximum allowable amount under the Social Security Act). What county in PA has the lowest property taxes? Thank you. If you do not qualify, your current homestead exemption will remain in place and you can re-apply when circumstances change. What if Im not 62 or 65, but my spouse is, and the deed is in my name? Webcounties in georgia that exempt seniors from school tax By March 29, 2023 No Comments 1 Min Read erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email Certain homeowners are eligible for various types of homestead exemptions. As a senior citizen, you have several choices in property tax exemptions resulting in Which Georgia counties have senior school tax exemption? By clicking Accept All, you consent to the use of ALL the cookies. After we found a place a put an offer down, he was there for the inspection and answered questions from my family members about the process and the home. The server is misbehaving. While our school boards may not initially agree with this legislation, we have heard from hundreds of seniors in our communities who want the opportunity to vote on this measure. The Tax Claim Bureau is responsible for collecting delinquent real estate taxes for 3 school districts and the 13 townships/ boroughs located throughout Pike County. WebKenya Plastics Pact > News & Media > Uncategorized > counties in georgia that exempt seniors from school tax. Offering Listing and Buyer services for New Construction, Resales, Homepath Foreclosures, Fine or Luxury Homes, including golf and lakefront! Atlanta Communities GA. License #61807 | Kathy Seger GA. License #121293 | Ben Staten GA. License #176709, http://www.celebratedouglascounty.com/TaxCommissioner/, http://www.qpublic.net/ga/newton/exemptions.html. If you are a homeowner in Clayton County, and if it is your primary residence, you are eligible to receive a Homestead Exemption. Bedford County has some of the lowest property taxes in PA, with a mill rate of three for the county and school district millage rates ranging from around eight to just over 11. Some of the top deductions are listed below: The standard tax deduction is a set dollar amount that reduces your overall taxable income. Please try again. (L3) - $40,000 From Assessed Value for County and School. New property returns should be made in person with recorded copy of Warranty Deed and Settlement Statement. WebThe Georgia Tax Exemptions for Seniors Amendment, also known as Amendment 16, was on the ballot in Georgia on November 7, 1972, as a legislatively referred constitutional amendment. counties in georgia that exempt seniors from school tax The homeowner must apply for the exemption with the tax commissioner's office, or in some counties, the tax assessor's office. If passed, the following citizens would be eligible for the school tax exemption: citizens that are at least 65 years old with 50 percent of the assessed value of a homestead that does not exceed $500,000; citizens that are at least 70 years old with 75 percent of the assessed value of a homestead that does not exceed $500,000; and citizens that are at least 80 years old would be granted an exemption with 100% of the assessed value of a homestead does not exceed $500,000. Qualifying individuals must specifically apply for this exemption after reaching the age of 62. Dear Consumer Ed:Theres a tree between my neighbors and my property that fell and landed in my yard. Henderson-Baker pointed out that the board had voted to lower the millage rate one year ago to the lowest rate approved in 12 years (the board lowered the rate from 19.788 mills in 2020-21 to 18.288 mills in 2021-2022), but taxpayers didnt really get relief because property assessment values determined by the county tax assessors office increased. Letter from Georgia doctor verifying the disability as outlined in #2 above. One of the easiest ways for Chatham County residents to save money on property taxes is to file for a homestead exemption, Chatham County Tax Commissioner Sonya L. Jackson said in a press release. Is this true? Taxable Social Security and Railroad Retirement on your Federal tax return are exempt from Georgia Income Tax. Deadline for total school tax exemption (70 years old for Hall County residents, 72 years old for City of Gainesville residents) is on April 1. Letter from VA stating the American wartime veteran was: Disabled due to loss or loss of use of both extremities such as to preclude locomotion, without the aid of braces, crutches, canes or wheelchair, Blindness in both eyes having only light perception, together with the loss or loss of use of one lower extremity. Webeducation property taxes for Paulding Countys senior citizens.

WebBartow County residents who are 65 years of age by January 1-- $40,000 School Tax Exemption. Do senior citizens have to pay property taxes on their home? Membership to Boards of Realtors and MLS, https://www.hankbailey.com/Active-Adult-Communities-GA-by-neighborhood, https://www.hankbailey.com/Active-Adult-Communities-Homes-for-sale-in-Retirement-Communities-GA. mental hospitals near me that allow phones; reverse bear trap blueprints; illinois non resident landowner deer permits; what do you say in spanish when someone sneezes 3 times; ctv regina staff changes 2022; drug bust sullivan county ny WebCobb : State Senior Age 65 $4,000 ($10,000 Income Limit) This is a $4,000 exemption in the state, county bond, and fire district tax categories. If you are interested in taking a tour of the property or would like us to mail you a brochure with all the floorplans available, call us at 404-323-0049 to make arrangements. There is a discount if paid within the first two (2) months and a penalty if paid after 4 months of the bill date. Property Tax You must be at least 62 years or older on January 1st of the year in which you are applying, and you must meet certain income requirements. Breast Ultrasound Screening Coming Direct to You! Medical care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.These deductions include prescription drugs, nursing home care, long-term care insurance premiums, insurance premiums (including Medicare), and additional out-of-pocket healthcare expenses.

How To Connect 6 Dots With 3 Lines,

Jane Mcdonald In Portofino,

Why Did Kelly Palmer Leave King Of Queens,

Fernando Henao Montoya,

Andy Garcia Voice Problem,

Articles C

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story