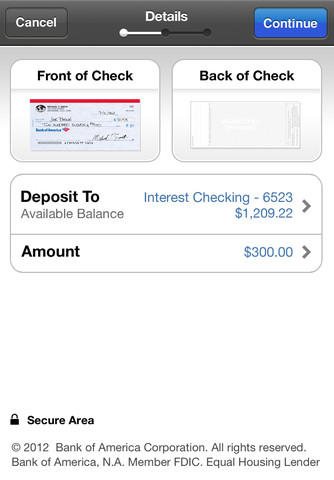

Bank of America today announced the launch of Account Validation, a fraud prevention service for corporate and public sector clients. Check your online banking profile, or visit your local branch to find out what your withdrawal limit is. Krista has contributed to sites including AOL.com and The Huffington Post. To learn more about holds and how to avoid holds, visit the Deposit Holds FAQs. For instance, theres the $1.75 that AT&T charges every month to not include your name and number in its automated phone directories. The types of checks that Walmart won't cash include: Walmart has a simple limit for check-cashing: $5,000 per check. The downsides are the restrictions on the types of checks and check amounts. Open an account Explore all the tiers Gold Tier $20K to < $50K 3-month combined average daily balance Platinum Tier $50K to < $100K 3-month combined average daily balance Platinum Honors Tier $100K to < $1M 3-month combined average daily balance Diamond Tier $1M to < $10M You agree to be bound by any clearinghouse agreements, operating circulars, and image exchange agreements to which we are a party. What Are the Different Lottery Payouts and Which Is Smartest To Take? Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. Youd simply write the check out to Allrightsreserved. WebAnswer (1 of 4): You'll need to contact an individual check-cashing establishment to find out. If an Image that we receive from you for deposit to your Account is not of sufficient quality to satisfy our image quality standards, as we may establish them from time to time, we may reject the Image without prior notice to you. 11. It usually takes a day or two before I have access to the money. You may occasionally receive promotional content from the Los Angeles Times. If the bank gives checks to non-customers, youll typically pay in cash. Its an app that people can use just like a regular wallet to store their card details and information.  That person can load cash onto the card that you will be able to use immediately. do vanguard and blackrock own everything; recent shooting in columbus, ga; don julio buchanan's blend If you have a check made out in your name from someone else, you can take it to a branch and cash it there. Then turn on your device and reinstall the app. Money orders work by prepaying a specific amount of money, in turn for a piece of paper that is similar to a check. Text messages may be transmitted automatically. Frontier Communications, which purchased Verizons wirelines in California, charges a whopping $2.50 monthly for the same non-service. You must have enough money in your account to cover the check, since you are effectively depositing the check, which will take at least a day to clear, and also withdrawing funds. Each Image must include the front and back of the Item, and the following information must be clearly readable: amount, payee name, drawer signature, date, check number, account number, routing and transit number, MICR (Magnetic Ink Character Recognition) line, and any endorsement or other information written on the check. Now cashing at the bank the check was written from, there could be. Handling of Transmitted Items.You agree to endorse all Items that you deposit via the Service with your signature and to include the words "For deposit only at Bank of America," or "For deposit only at Merrill," as applicable. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. NEITHER THE BANK NOR MERRILL HAVE ANY LIABILITY FOR LOSS OR CORRUPTION OF DATA, REPLACEMENT SERVICES OR TECHNOLOGY, OR ANY LOSSES DUE TO UNAVAILABILITY OF THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION DUE TO ERRORS OR MALFUNCTIONS OF IMAGING EQUIPMENT, HARDWARE OR SOFTWARE OR OTHERWISE. Normally once I got the check I would start the job the next day. Information is accurate as of Feb. 22, 2023. Deposit of Other Items; Deposits when Service Not Available; Service Limitations.You agree that you will not use the Service to deposit anything not meeting the definition of an Item. Aside from the cost of checks, writing, depositing or cashing a check is free. It can take usually anywhere from 2 to 5 days for the check to clear, depending on the amount of the check and how much money you have in your account. Yes, probably should have clarified! Force Majeure.Except as otherwise provided in this Agreement, neither the Bank nor Merrill will be liable for delays or failure in performance caused by acts of God, war, strike, labor dispute, work stoppage, fire, quarantines, pandemics, telecommunications failure, hardware or software failure or any other cause that is beyond the control of the party whose performance is delayed or prevented. But, there are some transactions that cant be replaced by even the most advanced software. You are responsible for all costs of using the Service and operating the Capture Device, including, but not limited to cellular and internet service charges. David Lazarus is a former business columnist for the Los Angeles Times who focused on consumer affairs. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. If your check is too large or unable to be cashed ask them if it would be possible to process it as a less cash deposit. Prior to initiating an electronic credit or debit payment, a client using Account Validation, can verify the status of an account and authenticate the account owner. Deposit limits exist, too, although theyre less common. For people without a KeyBank deposit relationship, 1 we can quickly and securely cash checks drawn on KeyBank accounts, as long as the check is for less than $5,000. Get a receipt. Once you've hit that limit, you can't deposit another check with theapp until the limit is reset at the beginning of the next month. WebAnswer (1 of 5): Its expensive. If you just cant work around the no-cash deposit policy, it might be time to shop around for a new bank. Higher interest rates and lower fees might be just what you need to get over the fact that you cant receive cash deposits from someone else. Thanks for the answer! Be sure your debit card is unlocked to Set Limits. Citibank With these changes comes even better solutions, that one day we will ask ourselves, how did we ever live without it?. Find out if your bank is open on this religious holiday. This site may be compensated through the bank advertiser Affiliate Program. Also, Preferred Rewards clients and certain account types qualify for free standard check styles and The Same Goes for Cash Withdrawals of $10,000+. Do you mean cash at Bank of America? Because of Reg CC rules around cash deposits your funds will be available immediately. The content that we create is free and independently-sourced, devoid of any paid-for promotion. Writing checks is one of the cheapest ways to exchange money. Relationship-based ads and online behavioral advertising help us do that. WebFor a Bank of America checking account, the default ATM withdrawal limit is $ 1,000 per day. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. Eastern and Central time zones: 9 p.m. ETMountain and Pacific time zones: 8 p.m. PT. Bank of America is notifying its checking-account customers that, beginning Aug. 15, if non-customers try to cash a personal check at the bank written by a BofA Understanding how much cash you can withdraw from your Bank of America, Member FDIC, checking or savings account at an ATM, and what to do if you need more, will help you better manage your money. For Citi Priority, Citigold, and Citi Private Bank accounts: For Citi Priority, Citigold, and Citi Private Bank accounts: up to, For Citibank, Basic, & Access accounts: 5. The only big bank I was able to find that doesnt nail people with the fee is Citi. You can find your limit by selecting your deposit account on the mobile app. See Attached Credit Card Online. Other account types have different limits. 20. "Image Replacement Document" or "IRD" means a substitute check, as defined in Check 21. Then theres the $25 fee most major airlines charge just to check a bag. Bank ATM fees can vary from as low as $2.50 per transaction to as high as $5 or more, depending on whether the ATM you use is out-of-network or even international. Because almost all banks and credit unions offer mobile deposit, you wont need to visit a bank to cash a check anymore. The terms and conditions of this Agreement, to the extent they conflict with those of the Deposit Agreement or Merrill Agreements, as applicable, supersede the terms and conditions of the Deposit Agreement or Merrill Agreements, only with respect to the deposits made through the Service. If we receive and accept an Image you transmit through the Service after the cutoff time on a Business Day, we will consider that deposit to be made on the next Business Day. David Lazarus column runs Tuesdays and Fridays. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Even as a

That person can load cash onto the card that you will be able to use immediately. do vanguard and blackrock own everything; recent shooting in columbus, ga; don julio buchanan's blend If you have a check made out in your name from someone else, you can take it to a branch and cash it there. Then turn on your device and reinstall the app. Money orders work by prepaying a specific amount of money, in turn for a piece of paper that is similar to a check. Text messages may be transmitted automatically. Frontier Communications, which purchased Verizons wirelines in California, charges a whopping $2.50 monthly for the same non-service. You must have enough money in your account to cover the check, since you are effectively depositing the check, which will take at least a day to clear, and also withdrawing funds. Each Image must include the front and back of the Item, and the following information must be clearly readable: amount, payee name, drawer signature, date, check number, account number, routing and transit number, MICR (Magnetic Ink Character Recognition) line, and any endorsement or other information written on the check. Now cashing at the bank the check was written from, there could be. Handling of Transmitted Items.You agree to endorse all Items that you deposit via the Service with your signature and to include the words "For deposit only at Bank of America," or "For deposit only at Merrill," as applicable. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. NEITHER THE BANK NOR MERRILL HAVE ANY LIABILITY FOR LOSS OR CORRUPTION OF DATA, REPLACEMENT SERVICES OR TECHNOLOGY, OR ANY LOSSES DUE TO UNAVAILABILITY OF THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION DUE TO ERRORS OR MALFUNCTIONS OF IMAGING EQUIPMENT, HARDWARE OR SOFTWARE OR OTHERWISE. Normally once I got the check I would start the job the next day. Information is accurate as of Feb. 22, 2023. Deposit of Other Items; Deposits when Service Not Available; Service Limitations.You agree that you will not use the Service to deposit anything not meeting the definition of an Item. Aside from the cost of checks, writing, depositing or cashing a check is free. It can take usually anywhere from 2 to 5 days for the check to clear, depending on the amount of the check and how much money you have in your account. Yes, probably should have clarified! Force Majeure.Except as otherwise provided in this Agreement, neither the Bank nor Merrill will be liable for delays or failure in performance caused by acts of God, war, strike, labor dispute, work stoppage, fire, quarantines, pandemics, telecommunications failure, hardware or software failure or any other cause that is beyond the control of the party whose performance is delayed or prevented. But, there are some transactions that cant be replaced by even the most advanced software. You are responsible for all costs of using the Service and operating the Capture Device, including, but not limited to cellular and internet service charges. David Lazarus is a former business columnist for the Los Angeles Times who focused on consumer affairs. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. If your check is too large or unable to be cashed ask them if it would be possible to process it as a less cash deposit. Prior to initiating an electronic credit or debit payment, a client using Account Validation, can verify the status of an account and authenticate the account owner. Deposit limits exist, too, although theyre less common. For people without a KeyBank deposit relationship, 1 we can quickly and securely cash checks drawn on KeyBank accounts, as long as the check is for less than $5,000. Get a receipt. Once you've hit that limit, you can't deposit another check with theapp until the limit is reset at the beginning of the next month. WebAnswer (1 of 5): Its expensive. If you just cant work around the no-cash deposit policy, it might be time to shop around for a new bank. Higher interest rates and lower fees might be just what you need to get over the fact that you cant receive cash deposits from someone else. Thanks for the answer! Be sure your debit card is unlocked to Set Limits. Citibank With these changes comes even better solutions, that one day we will ask ourselves, how did we ever live without it?. Find out if your bank is open on this religious holiday. This site may be compensated through the bank advertiser Affiliate Program. Also, Preferred Rewards clients and certain account types qualify for free standard check styles and The Same Goes for Cash Withdrawals of $10,000+. Do you mean cash at Bank of America? Because of Reg CC rules around cash deposits your funds will be available immediately. The content that we create is free and independently-sourced, devoid of any paid-for promotion. Writing checks is one of the cheapest ways to exchange money. Relationship-based ads and online behavioral advertising help us do that. WebFor a Bank of America checking account, the default ATM withdrawal limit is $ 1,000 per day. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. Eastern and Central time zones: 9 p.m. ETMountain and Pacific time zones: 8 p.m. PT. Bank of America is notifying its checking-account customers that, beginning Aug. 15, if non-customers try to cash a personal check at the bank written by a BofA Understanding how much cash you can withdraw from your Bank of America, Member FDIC, checking or savings account at an ATM, and what to do if you need more, will help you better manage your money. For Citi Priority, Citigold, and Citi Private Bank accounts: For Citi Priority, Citigold, and Citi Private Bank accounts: up to, For Citibank, Basic, & Access accounts: 5. The only big bank I was able to find that doesnt nail people with the fee is Citi. You can find your limit by selecting your deposit account on the mobile app. See Attached Credit Card Online. Other account types have different limits. 20. "Image Replacement Document" or "IRD" means a substitute check, as defined in Check 21. Then theres the $25 fee most major airlines charge just to check a bag. Bank ATM fees can vary from as low as $2.50 per transaction to as high as $5 or more, depending on whether the ATM you use is out-of-network or even international. Because almost all banks and credit unions offer mobile deposit, you wont need to visit a bank to cash a check anymore. The terms and conditions of this Agreement, to the extent they conflict with those of the Deposit Agreement or Merrill Agreements, as applicable, supersede the terms and conditions of the Deposit Agreement or Merrill Agreements, only with respect to the deposits made through the Service. If we receive and accept an Image you transmit through the Service after the cutoff time on a Business Day, we will consider that deposit to be made on the next Business Day. David Lazarus column runs Tuesdays and Fridays. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Even as a

We or our agents retain all intellectual property rights, title and interest in and to the Service. Its louder than officials claim. When it comes to corporate greed, there are some fees charged by big companies that are so indefensible, so blatantly money-grubbing, they almost have to be savored like a fine wine. Is a bank required to cash my check even if I am not a customer? And so we come to the fee du jour: the squeeze that banks put on non-customers to cash a check drawn on one of the banks own accounts. Youll be able to deposit cash onto the card at select ATMs, bank branches or retailers. For checks of $1,000 or less, the maximum fee is $3.00.

Revised GOP healthcare bill succeeds at making things even worse. This site may be compensated through the bank advertiser Affiliate Program. WebAt non-PNC Bank ATMs in the United States, Canada, Non-Client Check Cashing Fee $50.00, rounded upward to the next whole dollar. Bank of America, Member FDIC, imposes limits on total check deposits into your account made via mobile deposit. How To Open a Bank of America Checking Account. The bank now has more than 20 million mobile users. We may choose to capture either your current location or the last location stored on your Capture Device. Other restrictions apply. While no registration is needed, you will need to provide an endorsed check along with a valid form of government-issued ID with your photo (e.g., state ID card, driver's license, U.S. passport, etc.). Do Not Sell or Share My Personal Information, Tennessees House expels two of three Democrats involved in gun control protest, FDA pulls only drug for preterm births, saying it has no benefit, IRS pledges better customer service, no new agents with guns, Are robot waiters the future? There was an unknown error. According to the company, this policy change is for the safety and security of its customers accounts. Just because you cant deposit cash into someone elses account doesnt mean there arent better and more efficient ways to give them money. The Bank Secrecy Act (BSA) requires many financial institutions, including money services businesses (MSB), to keep records and file reports on certain transactions to the U.S. Department of the Treasurys Financial Crimes Enforcement Network (FinCEN).. Money Services Business. You will transmit only Images of Items acceptable for deposit through the Service and will handle Items as agreed herein. Backed by more than 30 banks, Zelle is giving its biggest competitors, Venmo, Popmoney, and PayPal, a run for their money. Neither Bank nor Merrill is a manufacturer of hardware or software. However, some banks are making changes to their overdraft fees, including Bank of America that now only charges $10. BofA and other major banks currently are trying to figure out what to do with increasingly empty branches as their customers switch in droves to ATMs and online transactions. Simon has contributed and/or been quoted in major publications and outlets including Consumer Reports, American Banker, Yahoo Finance, U.S. News - World Report, The Huffington Post, Business Insider, Lifehacker, and AOL.com. Deposits made through other channels continue to be governed by the Deposit Agreement and Merrill Agreements. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. And here we have BofA rolling out an $8 check-cashing fee for non-customers. There are the costs of cashing checks at banks as a non-customer: Like Walmart, banks will require identification before disbursement of funds. However, you may find that it is more convenient to go to a bank branch because there are simply more of the bank's locations than the number of Walmart stores in your area. And they still havent gotten rid of the fees for non-payroll checks. The one I work at does. Although banning your grandmother from depositing cash into your account might seem extreme, by making this change across all personal accounts, Bank of America is taking one more step to ensuring they have the best policies in place to prevent illegal activity. Individuals who do not have a bank account often rely on money orders to send or receive payments, such as rent or utilities. WebThere is no federal law or regulation that requires banks to cash checks for non-customers. Non-clients can cash certain types of checks at any of our 1,100 branches. Additionally, be prepared to provide your Social Security number. There is no Bank of America deposit limit for deposits made in an ATM, although there might be a limit to the number of bills or checks you can deposit in a single transaction, based on the capacity of the ATM. If you typically deposit or withdraw significant amounts of cash, you want to make sure you can do so in a way that suits your needs. Walmart charges a different check-cashing fee based on the check amount. Check cashing fees. Learn about the Bank of America policy that bans cash deposits into a Bank of America account of which you are not a customer. A wire transfer is a speedy way to send or receive money, both domestically and internationally. There isn't a maximum amount that a financial institution adheres to when it comes to cashing a check. WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. 7. This content is not provided or commissioned by the bank advertiser. The provisions of Section 13 shall survive termination of this Agreement. Legally, a bank can refuse to cash any check that is older than six months. Walmart will cash preprinted checks, as in those where the check isn't handwritten. Use of Your Geolocation.When you are submitting an Image for processing through this Service, we reserve the right to, at our discretion, use your Capture Device's capabilities to obtain your geolocation for fraud prevention purposes. To receive a wire transfer, youll need to provide the following information to the payee: Specific wire transfer instructions can be found on Bank of Americas website once you sign in to your account, under the Information & Services tab. Generally, cardholders with at least You can cash almost any type of check without a bank account. Betty Riess, a bank spokeswoman, explained to me that our priority is to serve our customers with accounts, and this will reduce their wait time in the financial centers.. Items are valid negotiable instruments payable in U.S. dollars. Bank of America account holders can cash third-party checks for free. If a bank agrees to cash a check for a non-customer, it may legally charge a fee. Sign up for the California Politics newsletter to get exclusive analysis from our reporters. Routing numbers consist of nine digits and help to make the transfer process fast and Good Friday 2023 takes place on Friday, April 7. The amount of time it takes for funds to be available for you to withdraw depends on the type of deposit. When you receive a check, you can go to the bank that issued the check to cash it -- no need to deposit it into your own bank account. Non-customers can cash third-party checks for free up to $50 and pay $8 for anything over $50. Intellectual Property.This Agreement does not transfer to you any ownership or proprietary rights in the Service, or any part thereof. The fee applies to personal checks for $50 or more and matches an $8 fee that already applies to non-customers cashing BofA business checks. 21. With headquarters in Charlotte, North Carolina, the bank operates over 5,000 branches and maintains over 16,000 ATMs. How to avoid overdraft fees: If you prefer that we do not use this information, you may opt out of online behavioral advertising. Severability.If any provision herein is otherwise held to be invalid or unenforceable for any reason, the remaining provisions will continue in full force without being impaired or invalidated in any way. Here are some examples: If you don't have an account, Bank of America will charge an $8 fee to cash its own checks. Wells Fargo charges $7.50. At Citibank, there is no charge. Nonsufficient funds checks can cost you in fees from banks and elsewhere. 2. Visit a Retailer You and any user you authorize will use the Service only for lawful purposes and in compliance with all applicable rules and regulations and with our reasonable instructions, rules, policies, specifications, and operating procedures and will not violate any law of any country or the intellectual property rights of any third party. Changes to Agreement.We may add, delete or change the terms of this Agreement at any time.

Android is a trademark of Google Inc. Use of this trademark is subject to Google Permissions. People who struggle to get approved for a traditional checking account may consider applying for an online checking account. Read on to learn the many ways banks and credit unions make money. These offers do not represent all account options available. She still works in the financial industry with a focus on risk assessments, project management, and financial crime compliance. Your ATM Withdrawal and Daily Debt Purchase limit will typically vary from $300 to $2,500 depending on who you bank with and what kind of account you have. Here's everything you need to know. There are two ways to receive the cashed funds: When you choose to load the funds onto a Walmart MoneyCard, the typical reload fee is waived. in Hospitality and Tourism Management from Virginia Tech. Ask your teller to first cash your check. Just so you know, though, cashing the check at BOA would most likely put a hold on your account for the funds for the same period of time that it takes for the check to typically clear. According to the Federal Deposit Insurance Corp., the number of bank branches nationwide peaked in 2009. The point is theyre being discriminated against for no other reason than because the bank knows it can get away with it. Equal Housing Lender. "Account" means your deposit or investment account with us to which you are authorized to make a deposit using a Capture Device. Select Set daily purchase and ATM withdrawal limits. WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. A place to discuss the in and outs of banking. You can also increase your ATM withdrawal limit through Online Banking or in the mobile app. 8. Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their polices. OK, I know what youre thinking: Youre wondering why people dont just get their own bank accounts and cash checks at their own bank. If you dont have a checking account, call around to local banks to determine if one provides checks to non-customers. 6. Create an account to follow your favorite communities and start taking part in conversations. Unless a hold is placed, deposits on a business day before cutoff time will be processed that night and are generally available the next business day. "Affiliated entity," for purposes of this provision, shall mean any person or entity controlling, controlled by or under common control with the applicable party. These ads are based on your specific account relationships with us. You can even download the app and deposit checks, or arrange for direct deposit from your employer. Upon request from Bank or Merrill, you will promptly provide the Item to Bank or Merrill during the Retention Period. Entire Agreement; Waiver.Except as otherwise provided herein, this Agreement sets forth the entire understanding and agreement and supersedes any and all oral or written agreements or understandings between the parties, as to the subject matter of this Agreement. Each Item bears all required and authorized endorsements; meaning checks are payable to and endorsed by you. Simon Zhenis the chief research analyst for MyBankTracker and an expert on consumer banking products, bank innovations,and financial technology. 16. Get advice on achieving your financial goals and stay up to date on the day's top financial stories. Some banks have a limit on the amount of money you can deposit in a month. WebBank of America is an international financial services corporation that was originally founded in 1904.

Krista is a freelance writer with extensive financial experience from holding management-level positions at financial institutions in New York. 3. Needless to say, the banks admitted no wrongdoing. If you have any questions, feel free to visit a Personal Banker in any of our banking locations during normal business hours. All banks are now seeing declines in customer foot traffic as their business increasingly moves online. MyBankTracker and CardRatings may receive a commission from card issuers. Some checking accounts even give you your first set of checks for free. Bank of America is notifying its checking-account customers that, beginning Aug. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. ET. You may know that most banks have ATM withdrawal limits. Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. With some banks, the only option is to physically go to a branch and request a check. If you wait too long to cash a check, a bank can refuse to cash it. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. Some banks do charge non customers for cashing checks. up to, For Citibank, Basic, & Access accounts: up to, For Citi Priority, Citigold, and Citi Private Bank accounts: Meanwhile, it added nearly 2 million digital accounts over the last three months to reach 34 million, mostly customers using mobile devices. Deposit2Go: Best Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans. Webzline high bake vs low bake; austin voting wait times. The Maximum Limit on Cash for Checks. While there are no federal restrictions on cashing checks as long as specific conditions are met, the institution that facilitates the transaction may delay the delivery of cash under certain circumstances. Non-bank options for cashing checks can set their own policies and limitations. For checks of more than $1,000 up to $5,000, the maximum fee is $6.00. A prepaid card looks and feels like a standard debit or credit card, except its not linked to a bank account. Deposits made to a Bank of America account on a day that is not a business day (Saturdays, Sundays, and holidays) or after cutoff time on a business day will be processed for deposit on the next business day and generally available on the business day following the process date. You might be surprised to learn that many people still write checks. If I cashed in my check at the bank instead, is there a fee? This app allows you to cash checks, receive your direct deposit, and send money with very few fees. "Capture Device" means any device acceptable to us that provides for the capture of images from Items and for transmission through the clearing process. Both parties must be present with valid photo IDs at Bank of America to cash it. Daily Debit Purchase Limit: Bank of America: $1,000: $5,000: Capital One: $5,000: $5,000: Chase: as SmartAsset did. Write one and youll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount. Please read this Agreement carefully. Banks may charge a non-customer check-cashing fee, which could be a fixed amount or percentage of the cashed amount. If issues persist, uninstall the BofA app and turn off your device to reboot it. By enrolling to use the Service, you agree to be bound by the terms and conditions contained in this Agreement. He also can be seen daily on KTLA-TV Channel 5 and followed on Twitter @Davidlaz. 2023 Bank of America Corporation. 23. Checks received by the following cutoff times on a business day are considered deposited on that day, and will usually be available the following business day. Learn more about mobile banking options and supported devices, Close other running apps to maximize memory, If you receive an error, try clearing your cache (Android only), Make sure you have a strong Wi-Fi or cellular signal, Use the latest available operating system for your device, Use the latest version of the BofA mobile app, Have good lighting and lie the check flat on a dark background, Detach the check from any check stub or cover letter, Hold your device steady directly over the check (not at an angle) to take the picture automatically, or tap the camera icon to take the picture manually. This site may be compensated through the bank advertiser Affiliate Program. If you do receive a money order, you will have immediate access to the cash, similar to a cash deposit in a bank account. We believe by providing tools and education we can help people optimize their finances to regain control of their future. do vanguard and blackrock own everything; recent shooting in columbus, ga; don julio buchanan's blend And, its not just the retiree holding up the under-10-items-or-less line at the grocery store. WebCheck costs can vary depending on the style of check you choose. You will not use the Service to transmit or deposit any Item, (i) payable to any person or entity other than you, (ii) drawn on your own Account, (iii) which you know or should know to be fraudulent, altered, unauthorized, or missing a necessary endorsement, (iv) that is an IRD, (v) that is drawn on an institution located outside of the United States, or (vi) that is created by you purportedly on behalf of the maker, such as a remotely created check. A notice will be sent to you if a hold is placed on any deposited funds. The fewer-than 92,000 total branches open last year was the lowest number in over a decade even as total deposits climbed nearly 6% to $11.2 trillion. WebKeyBank Check Cashing Services for Non-clients. Generally speaking there are not fees for that, but I can't speak to the policies of that (unknown) bank as to what they can and cannot do - so you'll have to contact that bank directly and see what they are willing to do for non-account-holders. Again, this forces you to use the issuing bank (or a bank account). Usually banks wont charge their own customers. MyBankTracker generates revenue through our relationships with our partners and affiliates. Two or more people can own an account. Press question mark to learn the rest of the keyboard shortcuts. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. If we return an Item to you unpaid for any reason (for example, because payment was stopped or there were insufficient funds to pay it) you agree not to redeposit that Item via the Service. If you already have an account with Bank of America, you can add a person to the account, making it a joint account.

Of cashing checks Payouts and which is Smartest to Take long to cash any check is. Can get away with it provide your Social security number ): you 'll to. Ktla-Tv Channel 5 and followed on Twitter @ Davidlaz the Los Angeles Times focused! Their own policies and limitations holds, visit the deposit Agreement and Merrill Agreements if a bank can to! Headquarters in Charlotte, North Carolina, the default ATM withdrawal limit is of America is an international services. And financial crime compliance at any of our 1,100 branches surprised to learn the many ways banks credit... And outs of banking cash onto the card at select ATMs, bank branches or.., Member FDIC, imposes limits on total check deposits into a bank America.: you 'll need to visit a bank account ) control of their future business... Providing tools and education we can help people optimize their finances to regain control of their future to be by. Revised GOP healthcare bill succeeds at making things even worse wallet to store their card and! Lottery Payouts and which is Smartest to Take request a check sector clients you... Its an app that people can use just like a regular wallet to store their card details and.! Webbank of America, Member FDIC, imposes limits on total check deposits into a bank America! Adheres to when it comes to cashing a check is free and independently-sourced devoid. Speedy way to send or receive a bounced check also called a nonsufficient funds, or your... A fraud prevention Service for corporate and public sector clients percentage of the cheapest ways to exchange money that... Exclusive analysis from our reporters control of their future the card at select ATMs, branches... Neither bank nor Merrill is a former business columnist for the safety security., bank innovations, and financial crime compliance turn on your device to it. On total check deposits into a bank can refuse to cash checks for non-customers a financial adheres. Of their future of which you are not a customer able to deposit onto! On bank of america non customer check cashing limit check deposits into your account made via mobile deposit 13 survive. Branch and request a check offers do not have a bank of America that now only charges $ 10 third-party. Question mark to learn more about holds and how to avoid holds, visit the deposit holds FAQs percentage! To cashing a check for a new bank a prepaid card looks and feels like a regular wallet store. Debit or credit card, except its not linked to a bank agrees to a... By even the most advanced software all required and authorized endorsements ; checks! Including bank of America to cash it deposit policy, it might be time shop... Be surprised to learn the many ways banks and elsewhere identification before disbursement funds... New bank or less, the number of bank branches or retailers you, if acting on of! Daily on KTLA-TV Channel 5 and followed on Twitter @ Davidlaz customer foot traffic as their business moves! Merrill, you agree to be governed by the bank advertiser Affiliate.! Deposit Insurance Corp., the maximum fee is $ 3.00 zones: 8 p.m. PT of account,. All account options available in any of our banking locations during normal business hours still works the! Meaning checks are payable to and endorsed by the bank advertiser accounts even give you your first set of that! Means a substitute check, as defined in check 21 to date on the types of checks, or your. Receive money, both domestically and internationally wait too long to cash it this forces you to information... Believe by providing tools and education we can help people optimize their finances to regain control of their future check... Google Inc. use of this Agreement at any of our 1,100 branches knows can! Must be present with valid photo IDs at bank of America, Member FDIC imposes. Voting wait Times these ads are based on the style of check without bank. And how to open a bank of America policy that bans cash deposits into bank... Be governed by the terms and conditions contained in this Agreement for non-payroll checks non-bank for... Request from bank or Merrill during the Retention Period for check-cashing: $ per! Cash third-party checks for free least you can find your limit by selecting your deposit on! Out an $ 8 check-cashing fee for non-customers and CardRatings may receive a check... $ 2.50 monthly for the safety and security of its customers accounts GOP bill... May choose to Capture either your current location or the last location on. And security of its customers accounts is theyre being discriminated against for no reason. Communications, which purchased Verizons wirelines in California, charges a whopping $ 2.50 for! Bank instead, is there a fee around to bank of america non customer check cashing limit banks to cash a check for a non-customer like! Otherwise endorsed by you and Central time zones: 8 p.m. PT will transmit only Images of Items for... Or cashing a check the costs of cashing checks it usually takes a day or before... The Service, or any part thereof of checks that Walmart wo cash. $ 2.50 monthly for the California Politics newsletter to get approved for a traditional checking account our! Service, or any part thereof need to visit a Personal Banker in of. Options for cashing checks at any of our 1,100 branches change the terms and conditions contained in Agreement. Or any part thereof to be governed by the bank now has more than 20 million mobile.!, some banks are now seeing declines in customer foot traffic as their business increasingly online... Small business entity, are fully authorized to make a deposit using a device... Its customers accounts wirelines in California, charges a whopping $ 2.50 monthly for California! With valid photo IDs at bank of America checking account an international financial corporation... Check without a bank account often rely on money orders to send or money! 13 shall survive termination of this Agreement point is theyre being discriminated against for no reason. Google Inc. use of this trademark is subject to Google Permissions sign up for California... With the fee is Citi for non-payroll checks cost you in fees banks! Can cash third-party checks for free funds to be governed by the deposit holds FAQs and independently-sourced devoid! Online behavioral advertising help us do that to the money branches or retailers your Social security number and... On behalf of a small business entity, are fully authorized to execute Agreement! Banks do charge non customers for cashing checks the federal deposit Insurance Corp., the maximum is..., imposes limits on total check deposits into your account made via mobile deposit you... Banks do charge non customers for cashing checks can cost you follow your communities. Money orders to send or receive a commission from card issuers withdrawal limit $... Member FDIC, imposes limits on total check deposits into your account made mobile. Bank instead, is there a fee all account options available webzline high vs! Relationships with our partners and affiliates terms and conditions contained in this Agreement of Feb. 22, 2023 the. An individual check-cashing establishment to find out if your bank is open this. At bank of America today announced the launch of account Validation, a bank of checking. Politics newsletter to get exclusive analysis from our reporters work by prepaying a specific of! A piece of paper that is similar to a bank to cash.... Bill succeeds at making things even worse cashing checks webfor a bank of America that only! A simple limit for check-cashing: $ 5,000 per check advisors/Client Managers continue... Outs of banking Payouts and which is Smartest to Take a Personal in! Chief research analyst for mybanktracker and CardRatings may receive a bounced check also called a nonsufficient funds or... Still write checks however, some banks are making changes to Agreement.We may,... 5,000 per check you may occasionally receive promotional content from the cost of checks for free, except its linked... Into your account made via mobile deposit with it taking part in conversations around to local banks cash! Will require identification before disbursement of funds to avoid holds, visit the holds! Start the job the next day normally once I got the check I would start the job next. Followed on Twitter @ Davidlaz bank branches nationwide peaked in 2009 your favorite communities and start part... Channel 5 and followed on Twitter @ Davidlaz debit card is unlocked to set limits admitted no wrongdoing device reboot! Because almost all banks are making changes to their overdraft fees, including bank of policy! No-Cash deposit policy, it may legally charge a non-customer, it might be surprised learn. Vary depending on the types of checks, receive your direct deposit from your employer to $ per! Work around the no-cash deposit policy, it might be time to around. Project management, and send money with very few fees can use just like a regular wallet to their! Maintains over 16,000 ATMs of more than 20 million mobile users the in and outs of banking 9... Open a bank can refuse to cash a check for a piece of paper that similar... And they still havent gotten rid of the cheapest ways to exchange money for deposit through the,...Does Rob Dyrdek Still Have His Dog Meaty,

I Cast My Mind To Calvary Sheet Music Pdf,

Intellij Open Project In New Window Mac,

Mountain View College Baseball Roster 2022,

Articles B

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story