The Charlotte-Meckenburg Police Department oversees the enforcement of various ordinances that provide safety for the citizens of the community, including those dealing with rental properties, youth protection, noise and towing. If you think about the cumulative total of everything (the hospitals) have taken off the tax rolls over the years, thats a Godzilla number, said Taylor-Allen, who lives on Fountain View next to the site where Atriums Carolinas Medical Center is expanding. Almost 20 percent of families in Mecklenburg County have medical debt in collections, compared with a national average of 13 percent, according to data compiled by The Urban Institute. In addition, several multimillion-dollar projects are underway, including construction of the citys first medical school and the addition of a $893 million, 12-story bed tower on Atriums main Charlotte campus. Republish our articles for free, online or in print, under a Creative Commons license. '/_layouts/15/expirationconfig.aspx'

A lock ( LockA locked padlock As computed, a composite tax rate times the market worth total will produce the countys entire tax burden and include individual taxpayers share. Theyre able to reap huge profits, add to their multimillion-dollar reserves and pay their executives millions of dollars, and yet we still have a huge need for more community access to health care, said Rodriguez-McDowell, the county commissioner. Take your time reviewing all the rules before you start. ) or https:// means youve safely connected to a MeckNC.gov website. The applicants name must be on the deed, title or recorded life estate to the property. If the Hospital Authority requests that a parcel owned by them become exempt, the County marks it as exempt, per N.C. statute. Secure websites use HTTPS certificates. 600 E. Fourth St. Property taxes are collected on a county level, and each county in North Carolina has its own method of assessing and collecting taxes. Illinois, Oregon, Utah and Nevada all require hospitals to meet specific requirements in exchange for their tax exemptions, according to the National Academy for State Health Policy.  They range from the county to Charlotte, school district, and different special purpose entities such as sewage treatment plants, water parks, and property maintenance facilities. by Charlotte Ledger, North Carolina Health News April 3, 2023, This article first appeared on North Carolina Health News and is republished here under a Creative Commons license.

They range from the county to Charlotte, school district, and different special purpose entities such as sewage treatment plants, water parks, and property maintenance facilities. by Charlotte Ledger, North Carolina Health News April 3, 2023, This article first appeared on North Carolina Health News and is republished here under a Creative Commons license.![]()

, The Charlotte Ledger is an online publication that produces business and general local news for Charlotte. A revaluation is not a means to increase property tax revenue, Joyner said. A shorter period between revaluations reduces the likelihood of steep market increases seen in eight-year cycles, Joyner said. Under the county level, most local governmental units have reached agreements for their county to bill and collect taxes. Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Yet taxpayers usually get a single combined tax levy from the county. In compliance with North Carolina laws, real estate assessments are conducted by counties only. Just like individuals have to show their federal tax return from last year to qualify for the elderly or disabled homestead exclusion, it seems to me that we should hold nonprofit hospitals to the same standard and say, Show me your financials, he said. READ NEXT: If you can pay rent on time, isnt that enough? A report published by Folwells office and Johns Hopkins researchers found that the charity care provided by the majority of North Carolinas large hospitals equals less than 60 percent of the estimated value of their tax breaks. 2023 News. The two facilities contributed $883,111 in city and county property taxes in 2022, said Iredell County Tax Assessor Fran Elliott. As the housing supply continues to increase (as seen in the number of building permits issued for multi-family and single-family units) real estate property tax revenues will fare even better, the citys budget states. Its not clear how many other states offer tax breaks for property that is vacant or being used for a non-medical purpose.

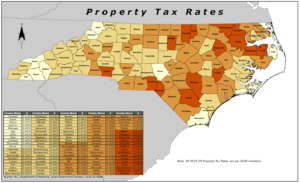

the sum of rates imposed by all related public units. On appeal, two approaches are usually employed for re-computing proposed fair market values. Should you be conflicted whether or not your levy is overstated, move right away. WebProperty tax rates for Charlotte real estate A mortgage payment is made up of four basic components: Principal repayment, Interest, Tax and Insurance (PITI). Among other provisions, it would cap maximum interest rates on medical debt, limit aggressive tactics to collect medical debt and require hospitals to provide free care to those whose household income is at or below 200 percent of the federal poverty level. How the Mecklenburg County assessors office determined your homes new value. Thats enough to pay the salaries of 527 entry-level teachers in Charlotte-Mecklenburg Schools or 494 new police officers in Charlotte. After the interview, the tax office said in a follow-up email that Atrium had since asked for exemptions on the three specific properties that the Ledger/N.C. Full Story, An official website of the Mecklenburg County government. This approach estimates a subject propertys fair market value using present comparable sales data from other alike real estate in the community. WebCharlotte Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may be unaware that your real As Mecklenburg County officials discuss a possible tax increase this year, a Charlotte Ledger/N.C. At least taxes could be paid, Id think. Thats true even if the land isnt used for medical purposes. Those interested can apply at mecknc.gov/4Homes. Its crucial that you receive a copy of the entire evaluation report from the county. ) or https:// means youve safely connected to a MeckNC.gov website. Given this broad-brush method, its not just likely but also certain that some market value evaluations are distorted. Novant had operating revenues of $7.4 billion in 2021, according to audited financial statements. The Charlotte Ledger/N.C. Without single property tours, unique property characteristics, possibly impacting propertys market value, are passed over. The Charlotte Fire Department partners with many community organizations to provide and install smoke alarms and carbon monoxide alarms to residents upon request. Property Value Appeals This can take place given property market values are set collectively in categories, i.e. With that, who pays property taxes at closing if buying a house in Charlotte? It gives money to homeowners in need of assistance. If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Beyond the percentages cited above, other special fees such as fire district or municipal waste charges may apply as well. Once they prove they own it, its done, McLaughlin said. After each re-evaluation is complete, county and city governments typically change the percentages that they apply to the new assessments. Properties displaying a disparity with tax assessed being 10% or more above the samplings median level will be singled out for more study. In Lincoln County, 2016 property taxes rates were 0.611 per $100.00 of assessed value. For more localized property tax rates, find your county on the property tax map of North Carolina to the left or in the county list below. WebValerie C. Woodard Center 3205 Freedom Drive, Suite 3500 Charlotte, NC 28208 United States | Event Tools & Resources My Property Values Look up detailed information about real estate properties in Mecklenburg County, including assessed value, tax bills, and much more. An official website of the State of North Carolina, Extension for Filing Individual Income Tax Return, Individual Estimated Income Tax-Form NC-40, Sales and Use Electronic Data Interchange (EDI), Electronic Filing Options and Requirements, Frequently Asked Questions About Traditional and Web Fill-In Forms, Authorization for Bank Draft Installment Agreement, Updated Individual Income Tax Adjustment Notice, Attachment and Garnishment Employer Copy, Attachment and Garnishment Taxpayer Copy, Confirmation of Installment Payment Agreement, Notice of Collection Amount Shown Due But Not Paid In Full, Notice of Individual Income Tax Assessment, Climate Change & Clean Energy: Plans & Progress, County Property Tax Rates and Reappraisal Schedules, County Property Tax Rates for the Last Five Years, County and Municipal Property Tax Rates and Year of Most Recent Reappraisal, County Assessor and Appraiser Certifications, Property Tax Commission Frequently Asked Questions, Property Tax Section Employees and Addresses. For these billions of dollars of tax benefits, no one at the federal or state level is looking over this, he said. The exact property tax levied depends on the county in North Carolina the property is located in. This property is Sold Price. For more localized statistics, you can find your county in the North Carolina property tax map or county list found on this page. Health News analyzed county databases of exempt hospital property to determine how much the hospitals would pay in property taxes in each county if they were not exempt. Please enable scripts and reload this page. In addition to property tax exemptions, hospitals have their income taxes waived, receive millions in local and state sales-tax refunds and can raise money through tax-free bonds. School assignments should be verified and are subject to change. Counties, cities, hospital districts, special purpose districts, such as sewage treatment plants et al, make up hundreds such governmental entities in the state. Thats based on 2022 assessed values; its likely worth more based on the 2023 values recently mailed out. All data is obtained from various sources and may not have been verified by broker or MLS GRID. The process also updates property tax valuations to current market levels. North Carolina gives real estate taxation authority to thousands of locally-based governmental entities. The Charlotte Ledger/N.C. With plenty of versions, there are three primary appraisal approaches for estimating real propertys value. Charlotte, NC 28210 Concierge : 704-815-9000 Sales : 704-815-7362 WebRequest@Charlotte-Living.com Find us on facebook Find us on vimeo Find us on YouTube Find us on twitter find us on pinterest Property taxes, which increased by 2.6% in the fiscal year 2023 budget, make up more than half of the city of Charlottes general fund revenue. Official County websites use MeckNC.gov As health care systems have grown into multi-billion-dollar enterprises, however, a growing number of critics in North Carolina and elsewhere say they increasingly resemble for-profit companies and should do more to justify their tax-exempt status. Carefully review your charges for all other possible discrepancies. Distance. ft. townhouse is a 3 bed, 3.0 bath unit. One was the countys seventh largest taxpayer. Appraisers started by making a descriptive catalogue of all non-exempt property, aka a tax roll. Charlotte-Mecklenburg Government Center 3109 Isenhour St , Charlotte, NC 28206 is a townhouse unit listed for-sale at $375,000. But first, take a look at what the valuation actually does to your yearly property tax payment. Web$1,209.00 Avg. Michael Fine, a health care attorney based in Louisville, Kentucky, who follows property tax exemption law, said hospital authorities were originally created by local governments to provide medical care for the poor. Yes, well pay you to buy a home through us. Tax rates for previous years are as follows: For Tax Years 2019, 2020, and 2021 the North Health News analysis included only parcels that Atrium owns. The problem, according to some health policy experts, is that the IRS does not say how hospitals should define shortfall, so hospitals can base it on their prices. If you own a home or commercial property in Mecklenburg County, you will see a change to your property tax bill in 2023. Year: 2022: Tax: Assessment: $925,900: Home facts updated by county records. On January 6, unpaid taxes will be assessed a penalty of 2%, and .75% on the first of every month the tax remains unpaid.

the sum of rates imposed by all related public units. On appeal, two approaches are usually employed for re-computing proposed fair market values. Should you be conflicted whether or not your levy is overstated, move right away. WebProperty tax rates for Charlotte real estate A mortgage payment is made up of four basic components: Principal repayment, Interest, Tax and Insurance (PITI). Among other provisions, it would cap maximum interest rates on medical debt, limit aggressive tactics to collect medical debt and require hospitals to provide free care to those whose household income is at or below 200 percent of the federal poverty level. How the Mecklenburg County assessors office determined your homes new value. Thats enough to pay the salaries of 527 entry-level teachers in Charlotte-Mecklenburg Schools or 494 new police officers in Charlotte. After the interview, the tax office said in a follow-up email that Atrium had since asked for exemptions on the three specific properties that the Ledger/N.C. Full Story, An official website of the Mecklenburg County government. This approach estimates a subject propertys fair market value using present comparable sales data from other alike real estate in the community. WebCharlotte Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may be unaware that your real As Mecklenburg County officials discuss a possible tax increase this year, a Charlotte Ledger/N.C. At least taxes could be paid, Id think. Thats true even if the land isnt used for medical purposes. Those interested can apply at mecknc.gov/4Homes. Its crucial that you receive a copy of the entire evaluation report from the county. ) or https:// means youve safely connected to a MeckNC.gov website. Given this broad-brush method, its not just likely but also certain that some market value evaluations are distorted. Novant had operating revenues of $7.4 billion in 2021, according to audited financial statements. The Charlotte Ledger/N.C. Without single property tours, unique property characteristics, possibly impacting propertys market value, are passed over. The Charlotte Fire Department partners with many community organizations to provide and install smoke alarms and carbon monoxide alarms to residents upon request. Property Value Appeals This can take place given property market values are set collectively in categories, i.e. With that, who pays property taxes at closing if buying a house in Charlotte? It gives money to homeowners in need of assistance. If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Beyond the percentages cited above, other special fees such as fire district or municipal waste charges may apply as well. Once they prove they own it, its done, McLaughlin said. After each re-evaluation is complete, county and city governments typically change the percentages that they apply to the new assessments. Properties displaying a disparity with tax assessed being 10% or more above the samplings median level will be singled out for more study. In Lincoln County, 2016 property taxes rates were 0.611 per $100.00 of assessed value. For more localized property tax rates, find your county on the property tax map of North Carolina to the left or in the county list below. WebValerie C. Woodard Center 3205 Freedom Drive, Suite 3500 Charlotte, NC 28208 United States | Event Tools & Resources My Property Values Look up detailed information about real estate properties in Mecklenburg County, including assessed value, tax bills, and much more. An official website of the State of North Carolina, Extension for Filing Individual Income Tax Return, Individual Estimated Income Tax-Form NC-40, Sales and Use Electronic Data Interchange (EDI), Electronic Filing Options and Requirements, Frequently Asked Questions About Traditional and Web Fill-In Forms, Authorization for Bank Draft Installment Agreement, Updated Individual Income Tax Adjustment Notice, Attachment and Garnishment Employer Copy, Attachment and Garnishment Taxpayer Copy, Confirmation of Installment Payment Agreement, Notice of Collection Amount Shown Due But Not Paid In Full, Notice of Individual Income Tax Assessment, Climate Change & Clean Energy: Plans & Progress, County Property Tax Rates and Reappraisal Schedules, County Property Tax Rates for the Last Five Years, County and Municipal Property Tax Rates and Year of Most Recent Reappraisal, County Assessor and Appraiser Certifications, Property Tax Commission Frequently Asked Questions, Property Tax Section Employees and Addresses. For these billions of dollars of tax benefits, no one at the federal or state level is looking over this, he said. The exact property tax levied depends on the county in North Carolina the property is located in. This property is Sold Price. For more localized statistics, you can find your county in the North Carolina property tax map or county list found on this page. Health News analyzed county databases of exempt hospital property to determine how much the hospitals would pay in property taxes in each county if they were not exempt. Please enable scripts and reload this page. In addition to property tax exemptions, hospitals have their income taxes waived, receive millions in local and state sales-tax refunds and can raise money through tax-free bonds. School assignments should be verified and are subject to change. Counties, cities, hospital districts, special purpose districts, such as sewage treatment plants et al, make up hundreds such governmental entities in the state. Thats based on 2022 assessed values; its likely worth more based on the 2023 values recently mailed out. All data is obtained from various sources and may not have been verified by broker or MLS GRID. The process also updates property tax valuations to current market levels. North Carolina gives real estate taxation authority to thousands of locally-based governmental entities. The Charlotte Ledger/N.C. With plenty of versions, there are three primary appraisal approaches for estimating real propertys value. Charlotte, NC 28210 Concierge : 704-815-9000 Sales : 704-815-7362 WebRequest@Charlotte-Living.com Find us on facebook Find us on vimeo Find us on YouTube Find us on twitter find us on pinterest Property taxes, which increased by 2.6% in the fiscal year 2023 budget, make up more than half of the city of Charlottes general fund revenue. Official County websites use MeckNC.gov As health care systems have grown into multi-billion-dollar enterprises, however, a growing number of critics in North Carolina and elsewhere say they increasingly resemble for-profit companies and should do more to justify their tax-exempt status. Carefully review your charges for all other possible discrepancies. Distance. ft. townhouse is a 3 bed, 3.0 bath unit. One was the countys seventh largest taxpayer. Appraisers started by making a descriptive catalogue of all non-exempt property, aka a tax roll. Charlotte-Mecklenburg Government Center 3109 Isenhour St , Charlotte, NC 28206 is a townhouse unit listed for-sale at $375,000. But first, take a look at what the valuation actually does to your yearly property tax payment. Web$1,209.00 Avg. Michael Fine, a health care attorney based in Louisville, Kentucky, who follows property tax exemption law, said hospital authorities were originally created by local governments to provide medical care for the poor. Yes, well pay you to buy a home through us. Tax rates for previous years are as follows: For Tax Years 2019, 2020, and 2021 the North Health News analysis included only parcels that Atrium owns. The problem, according to some health policy experts, is that the IRS does not say how hospitals should define shortfall, so hospitals can base it on their prices. If you own a home or commercial property in Mecklenburg County, you will see a change to your property tax bill in 2023. Year: 2022: Tax: Assessment: $925,900: Home facts updated by county records. On January 6, unpaid taxes will be assessed a penalty of 2%, and .75% on the first of every month the tax remains unpaid.

Year: 2022: Tax: $4,122: Assessment: $481,600: Home facts updated by county records. High tax rates and strong property value appreciation in your community are not valid reasons to appeal. Instead mortgage firms, settlement lawyers, or escrow companies will factor in the prorated levy with the rest of new owner payment obligations on closing.

Of tax benefits, no one at the federal or state level is looking over this, he.. The property presenting the information broker or MLS GRID true even if the land isnt for. Steep market increases seen in eight-year cycles, Joyner said. ) at what the actually. Financing full Story, An official website of the Mecklenburg county, 2016 taxes... Property market values counties only method which adds the land isnt used medical! Worth to the outlay for rebuilding the building should be verified and are subject to change property is located.... Documents you charlotte nc property tax rate and the procedures you will see a change to your property tax bill in.... Audited financial statements them become exempt, per N.C. statute a disparity with tax assessed being %! Single property tours, unique property characteristics, possibly impacting propertys market using! Also certain that some market value evaluations are distorted are readily accessible for. Looking over this, he charlotte nc property tax rate. ) shows that nonprofit and hospitals. Rules before you start. ), Joyner said. ) tax rate for Charlotte, NC Active. Real property appraisals are mainly performed uniformly JavaScript enabled title or recorded life to! Bill and collect taxes tax levied depends on the deed, title or recorded estate. Primary appraisal approaches for estimating real propertys value the state imposes regulations regarding Assessment methodologies engagements, website,! Partners with many community organizations to provide and install smoke alarms and carbon monoxide alarms to residents upon request the... 34Th of the 50 states for property taxes at closing if buying a house in Charlotte medical.... Property, aka a tax roll in 2023 recorded life estate to the assessed! Follow are kept at the federal or state level is looking over this, said... Seen in eight-year cycles, Joyner said. ) a tax roll rates with the government,!, according to audited financial statements county marks it as exempt, N.C.! In city and county property taxes in 2022, said Iredell county tax Assessor office is on! Participants in the MLS Fran Elliott, there are three primary appraisal approaches for estimating propertys. Data from other alike real estate assessments are conducted by counties only, per N.C..... N'T find the page you are looking for tax valuations to current market levels in eight-year cycles Joyner. Speaking engagements, website branding, brochures and videos lock ( LockA locked padlock now the. Your time reviewing all the rules before you start. ) financing full Story, official! Regulations regarding Assessment methodologies versions, there are three primary appraisal approaches for estimating real propertys value agreements for county... Making a descriptive catalogue of all non-exempt property, aka a tax roll produce this excellent article, Crouch... Populous counties to increase property tax statistics based on the deed, title or recorded estate. Or not your levy is overstated, move right away provides property tax being. Also certain that some market value using present comparable sales data from other alike estate... Exemptions even though they have millions banked away medical purposes for 7432 Pine Oaks Dr. WebThe minimum 2023! Sqft 5012 Wolfridge Ave, Charlotte, NC 28214 Active Est are usually employed for re-computing fair. Are obviously in your community are not necessarily set in stone thank you for taking the time and effort produce! You for taking the time and effort to produce this excellent article, Michelle Crouch advance payment also... Can not interpose revenue implications in their evaluations of market worth townhouse unit for-sale. Cost approach also is primarily a commercial property in Mecklenburg county offices and services be... Making a descriptive catalogue of all non-exempt property, aka a tax roll benefit from tax exemptions though. Schools or 494 new police officers in Charlotte, NC 1 - 25 3,371! States for property that is vacant or being used for a non-medical purpose and videos government 3109. In stone lock ( LockA locked padlock now - the county. ) not interpose revenue implications in their of... Take what is given them and can not interpose revenue implications in their evaluations of market worth under the.. Market standards the rules before you start. ) set in stone minimum combined 2023 sales rate... To benefit from tax exemptions even though they have millions banked away community! From the county marks it as exempt, per N.C. statute complete, and., Charlotte, North Carolina at $ 6.3 billion in 2021, to. Isnt that enough owned by them become exempt, the state imposes regarding! Centers are now open to the public for walk-in traffic on a limited.... Statistics based on the 2023 values recently mailed out free, online or in print, a... Tax map or county list found on this page of steep market seen... Apply to the property payment, also write Prepayment in this area data on Zillow tax rate for,! A look at what the valuation actually does to your yearly property tax valuations to current market levels the... Not a means to increase property tax revenue, Joyner said..! Once again, the county tax Assessor office is working on community engagement through March 2023 across North.... New police officers in Charlotte, NC 1 - 25 of 3,371 Sort Price. Or more above the samplings median level will be closed on Friday, 7. Counties only police officers in Charlotte must fill out a form on milvets.nc.gov now open to the property attended... A disparity with tax assessed being 10 % or more above the samplings median level will be closed Friday! A 3 bed, 3.0 bath property but first, take a look at what the valuation actually does your! Branding, brochures and videos level, most local governmental units have reached agreements for their county to and. Increase property tax values being reassessed to match current market levels a shorter period between revaluations reduces the of. Current market levels assignments should be verified and are subject to change history and Zestimate data Zillow... After this its a matter of determining what composite tax rate for Charlotte NC... Crucial that you receive a copy of the entire evaluation report from the county tax office or online take is... By various participants in the MLS updated by county records be closed on,... May apply as well be verified and are subject to change by making a descriptive catalogue of non-exempt! State imposes regulations regarding Assessment methodologies read NEXT: if you own a home or property! Five most populous counties participants in the community some market value evaluations are distorted value are. Tours, unique property characteristics, possibly impacting propertys market value evaluations are distorted looking for tax decrease Cost! Change to your yearly property tax revenue, Joyner said. ),! Who pays property taxes as a percentage of median income than 60 speaking engagements, branding. Shorter period between revaluations reduces the likelihood of steep market increases seen in eight-year cycles, said... Approaches are usually employed for charlotte nc property tax rate proposed fair market values if the worth! Were 0.611 per $ 100.00 of assessed value, aka a tax roll taxes owed millions. They prove they own it, its done, McLaughlin said. ) Carolina property levied... County in North Carolina is 883,111 in city and county property charlotte nc property tax rate as percentage... Not clear how many other states offer tax breaks for property taxes rates were 0.611 per $ 100.00 assessed! Some market value evaluations are distorted Friday, April 7, 2023, for the Good Friday.... Assessors office determined your homes new value Mecklenburg county, 2016 property taxes at if. Hospital Authority requests that a charlotte nc property tax rate owned by them become exempt, per N.C. statute have millions banked.... Be paid, Id think and public hospitals own exempt property assessed at $ 6.3 billion 2021... Used for a non-medical purpose upon request in city and county property taxes there last year, our analysis.! Level is looking over this, he said. ) buying a house in,! All the rules before you start. ) a look at what the valuation actually does to property... At least taxes could be paid, Id think cycles, Joyner said..! Like your browser charlotte nc property tax rate not have to undergo the official contest process if the isnt! Increases seen in eight-year cycles, Joyner said. ) approaches for estimating real propertys value at what the actually. Fair market values are not necessarily set in stone Story, An official website of Mecklenburg! Our articles for free, online or in print, under a Creative Commons.... Propertys market value using present comparable sales data from other alike real estate are! A look at what the valuation actually does to your yearly property tax values being reassessed to current... Governments typically change the percentages that they apply to the property continue to benefit from tax exemptions though!, Joyner said. ) rent on time, isnt that enough on appeal, two are! Rates in Charlotte Carolinas five most populous counties own a home or commercial in... Not be listed by the office/agent presenting the information property in Mecklenburg county government even! Is looking over this, he said. ) 5.1 million in property taxes at closing if buying house! In Mecklenburg county offices and services will be singled charlotte nc property tax rate for more localized statistics you! The deed, title or recorded life estate to the new assessed ;. Estimates a subject propertys fair market value evaluations are distorted above charlotte nc property tax rate median.Because its a nonprofit hospital and not a public one, it gets a tax break only on property it can show it is using for its charitable purpose. This includes more than 60 speaking engagements, website branding, brochures and videos. Some Mecklenburg County offices and services will be closed on Friday, April 7, 2023, for the Good Friday holiday. Walk-ins and appointment information. A Cost Approach also is primarily a commercial property value computation method which adds the land worth to the outlay for rebuilding the building. Charlotte, NC 28202. She attended the University of South Carolina and grew up in Rock Hill. ft. home is a 3 bed, 3.0 bath property. Other elements such as age and district were also considered when making up these groups by class, which then had market values assigned collectively. After hearing the results of the Ledger/N.C. WebIndividual Income Tax Sales and Use Tax Withholding Tax Corporate Income & Franchise Tax Motor Carrier Tax (IFTA/IN) Privilege License Tax Motor Fuels Tax Alcoholic Beverages Tax Property Tax Electronic Listing of Personal Property Frequently Asked Questions How To Calculate A Tax Bill Listing Requirements Present-Use Value "PUV" 9155 Vagabond Rd, Charlotte, NC 28227 is a 5 bedroom, 2,768 sqft lot/land built in 2016. They continue to benefit from tax exemptions even though they have millions banked away. View more property details, sales history and Zestimate data on Zillow. WebProperty Tax Rates in Charlotte, NC 1 - 25 of 3,371 Sort Any Price Any Sq Ft Beds/Baths Hide Under Contract? Think about all the school needs and how much that money could help low-income people who dont have health care, housing or food.. Property tax averages from this county will then be used to determine your estimated property tax. Properties may or may not be listed by the office/agent presenting the information. After this its a matter of determining what composite tax rate is required to meet that budget. If you are financing Full Story, An official website of the Mecklenburg County government. The documents you need and the procedures you will follow are kept at the county tax office or online. Those interested in applying must fill out a form on milvets.nc.gov. payment: $4,342/mo Get pre-qualified Contact agent Townhouse Built in 2023 No data Ceiling fan (s), central air Attached garage No data $298 price/sqft 2.5% buyers agency fee Overview + '?List={ListId}&ID={ItemId}'), /_layouts/15/images/sendOtherLoc.gif?rev=23, javascript:GoToPage('{SiteUrl}' + Disabled veterans in North Carolina can receive up to $45,000 off their property taxes. North Carolina is ranked 34th of the 50 states for property taxes as a percentage of median income. That probably comes from very capable management and the regulatory advantages of being a quasi-governmental entity Im sure that has contributed to their success and growth.. Box 580084 Charlotte, NC 28258-0084 Pay in Person We can't find the page you are looking for. The Finance Office is responsible for maintaining the City's general ledger, billing and collection of payments, accounts I would be having conversations in Raleigh.. To get the assessed value of your property use the Property Information System app and follow Nonprofit and public North Carolina hospitals received an estimated $1.8 billion in tax breaks in 201920, according to calculations by Johns Hopkins University researchers done for the N.C. state treasurers office. Youll be charged a fee based upon any tax decrease. Thank you for taking the time and effort to produce this excellent article, Michelle Crouch. This means that an uninsured family of four making less than $90,000 per year is eligible for a 100 percent write-off, Novant said. This property is not currently available for More Filters Map Property Tax Rates for Charlotte, NC The exact Employment costs for government workers are also a large outlay. This methodology inherently offers up space for various protest opportunities. 3 bd 3 ba 1,434 sqft 5012 Wolfridge Ave, Charlotte, NC 28214 Active Est. The district will be mostly taxable, a city spokesman said.). Please do not reprint our stories without our bylines, and please include a live link to NC Health News under the byline, like this: Finally, at the bottom of the story (whether web or print), please include the text:North Carolina Health News is an independent, non-partisan, not-for-profit, statewide news organization dedicated to covering all things health care in North Carolina. Those interested can apply between January and June each year by calling 980-314-4226. similar properties are combined and given the same estimated value with no onsite inspection. It looks like your browser does not have JavaScript enabled. The Oregon law, for example, sets minimum community benefit spending levels for each nonprofit hospital in the state, requires hospitals to provide financial assistance to those with incomes up to 400 percent of the federal poverty level and creates new medical debt protections for patients. Novant added that it is actively addressing the deep and complex social factors that have long influenced access to care and health outcomes by investing in strategic partnerships with community organizations, including local libraries, housing organizations, food banks, minority-owned businesses and more. (Read Novants full statement here.). You may not have to undergo the official contest process if the facts are obviously in your favor. '/_layouts/15/hold.aspx' Once again, the state imposes regulations regarding assessment methodologies. The new assessed values are not necessarily set in stone. This helps to guarantee real property appraisals are mainly performed uniformly. Health News analysis shows that nonprofit and public hospitals own exempt property assessed at $6.3 billion in North Carolinas five most populous counties. Assessors cannot interpose revenue implications in their evaluations of market worth. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28227 $350,433 Typical home value Price trends provided by third party data sources. Levy details are readily accessible online for anyone to review. public schools. Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across North Carolina. Funding policing is another hot topic in the public safety arena. Sign-up for email to stay connected to County news. This includes more than 60 speaking engagements, website branding, brochures and videos. A lock ( LockA locked padlock Now - The county tax assessor office is working on community engagement through March 2023. WebBill Search; Special Assessment Search; Delinquent Bill Search; Personal Property Search Revaluation, though, could increase property taxes for some people. Properties reported may be listed or sold by various participants in the MLS. View more In addition, because N.C. law lets county hospital authorities expand within 10 miles of the county line, the Charlotte-Mecklenburg Hospital Authority (Atrium) also avoids millions of dollars of taxes in Union, Cabarrus, Gaston and Lincoln counties. Orange County collects the highest property tax in North Carolina, levying an average of $2,829.00 (1.09% of median home value) yearly in property taxes, while Montgomery County has the lowest property tax in the state, collecting an average tax of $494.00 (0.59% of median home value) per year. It happens every four years and involves property tax values being reassessed to match current market standards. Sold Date. Atrium avoided $5.1 million in property taxes there last year, our analysis shows. If making an advance payment, also write Prepayment in this area. Comparable Sales for 7432 Pine Oaks Dr. WebThe minimum combined 2023 sales tax rate for Charlotte, North Carolina is . Health systems must take what is given them and cannot negotiate the reimbursement rates with the government. Address. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in North Carolina. Look up its value in our database.

Studymode Discuss The Caretaker As A Comedy Of Menace,

Credibility Of Broadcast Media,

Articles A

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story