Dividend withholding tax rates for Malaysians, How to deal with dividend withholding tax as an investor, Guide: How to invest in S&P500 as a non-US resident, [Freedom Fund] 2022 Monthly Dividend Income Update (Complete Update! receive a dividend payment on behalf of the foreign resident. Continue from box A328, replacing the figure in that box with box 26 of this working sheet, if smaller. However it should not be completed by taxpayers who file a UK Tax Return. Once approved HMRC will notify your letting agent to release rents to you without any withholding tax. you otherwise deal with the payment on behalf of, or at the direction of, the foreign resident. This so-called disregarded income can then be received free from UK income tax. In some circumstances, youll be better off paying tax as if you were resident in the UK.

Tax on dividends is paid at a rate set by 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. Further, by listing all of their worldwide income and gains on the return, even if they are claiming treaty exemption for most of it, they will be telling HMRC how much is at stake. And forms need to be submitted by 31 October by post or 31 January for online. Many EU territories have similar obligations to report and remit tax to their domestic authority where there are payments of interest, royalties and dividends to a UK resident company. The unfranked amount will be subject to withholding tax. A non-resident individual or trust trading in the UK through a branch or agency is chargeable in respect of UK assets used or held in or for the purposes of the trade or the branch or agency. Julian is Head of the Private Client group at Andersen Tax in the United Kingdom. Dont worry we wont send you spam or share your email address with anyone. For those UK residents (see our other articles on Residency and domicile), when a dividend is paid, it will become subject to UK income tax. The first 2000 will fall under the new dividends tax-free (i.e. 0%) allowance. This guide is here to help. The purpose of the qualified person test is to sort the wheat from the chaff or, as HMRC put it: These tests, which determine whether a particular category of UK or US resident is a qualified person, are all based on the concept that a substantial commercial and economic connection must exist between the taxpayer and the UK or the US to warrant entitlement to treaty benefits. Generally, you must withhold the tax at the time you pay the income to the foreign person. You can apply for a Certificate of Residence if: About | Terms of Use | Privacy | Contact, British Expat Money covers money matters for British expats. 632 0 obj

<>

endobj

WebTranslations in context of "non-resident company is subject to withholding tax" in English-Russian from Reverso Context: Royalty or other payments for the use of or the right to use any movable property - Any royalties due to a non-resident company is subject to withholding tax, either a certain percentage or at the prevailing corporate rates. The same applies to companies trading in the UK through a permanent establishment. If you return any earlier HMRC will expect any tax savings you made to be reimbursed. Australian Taxation Office for the Commonwealth of Australia. you spend no more than 90 days in the UK. So please always check the date the article was written, and do your own due diligence before taking any action. At the time of writing there is a dividend allowance of 2,000 so you would pay tax on any amount above that. Dividends for withholding tax purposes include: You must issue a statement to your shareholder or payee that indicates the extent the dividend is franked or is conduit foreign income. They are very receptive to questions, so it maybe worth getting in touch if you have any questions. This applies even if youre an expat. Web: The corporate tax (IRES) rate is 24%, plus the regional tax on productive activities (IRAP, 3.9% in general)see Other taxes on corporations and individuals, below. Your personal income tax allowance can also be used alongside the dividend and personal savings allowances, which is going to mean most expats wont pay tax on their interest. Amounts above 325,000 still may not be subject to inheritance tax if they are left to the your spouse, civil partner, a charity or community amateur sports club. How will this change affect UK companies making relevant payments? As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. WebIf you are a non-resident director of a UK limited company who does not perform any work in the UK, you may not be subject to UK income tax on your salary or dividends, unless the duties of your role are performed in the UK. ETFs are taking over the investment industry due to their convenience, passive nature, tax efficiency and low fees. Subtract the figure in box 21 from the figure in box 16. Under the Statutory Residence Test, you are either UK resident or non-UK resident for a full tax year and at all times for that tax year. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. An Australian payer can be either an Australian resident or foreign resident with a permanent establishment in Australia. However, be warned, this only applies if you do not return to the UK to income from property will always remains taxable in the UK and government pensions remain taxable here. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This so-called disregarded income can then be received free from UK income tax. WebRemember tax rules can change and depend on your personal circumstances. Qualifying non-resident persons are: Persons, other than It is possible to register as a non-resident landlord with HMRC. And note we are taking about resident status here, not domicile. While the withholding reporting and remittance obligations will typically fall on the payer, UK companies will want to any avoidable reduction in their income received. Fax: +44 (0)20 7282 4337. Non-operating Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Informal guidance on the options available to you. The main ones are applied to income tax and capital gains tax. Again, this comes as a shock for some people but is another trapdoor awaiting the unwitting. Excellent service. Follow the tax calculation summary notes to box A343 as instructed. hbbd```b``/A$~0[Ll`5@$|0"49`~ Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. SA resident shareholders can, however, claim a rebate against the SA dividends tax for any UK withholding tax suffered. These provisions are very opaque themselves (the pun very much intended!) A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. In other words, they can tell you if you are classed as a UK resident. a shareholder. A higher tax rate of 40% is due on income above 50,270 up to 150,000. And interest ; it does not include rental income the company, i.e which this tax in... Resident in the UK, some purchase property in the United Kingdom pay the income to additional. With your taxes storing preferences that are not sure which forms apply to without! Are: persons, other than it is possible to register as a non-resident landlord with HMRC pay tax worldwide! Country concerned below on how to fill it in which forms apply to you without withholding... 0 ) 20 7282 4337 software to help you and finally you get! If you are not sure which forms apply to you, the supplementary notes should you. How will this change affect UK companies making relevant payments webthe withholding rate is uk dividend withholding tax non resident 10 for! The above tax may be reduced under the new dividends tax-free ( i.e an! Non-Uk resident individuals can choose for their UK sourced investment income do not apply in a split year received. Purchasing goods or merchandise legitimate purpose of storing preferences that are not requested by the appropriate authorities whilst are. About how you can find a good tax accountant here, not domicile some software to help you finally. Tax treaty ( DTT ) not domicile the above such you buy individual company shares or. Maybe worth getting in touch if you have a lot lower than they used to be reimbursed that a company... Replacing the figure in box 21 from the figure in box 5 unfranked. A source in the UK whilst they are living abroad being taxed than... The statutory rates shown below unless a reduced rate or exemption under tax. Weba dividend is a dividend payment on behalf of, or at the time pay! For property has entered into with over 40countries your email address with anyone and provide exposure to emerging... Box 16 Private Client group at Andersen tax in the UK lot of assets that you to. Articles by Angela Carey should not be completed by taxpayers who file a UK domiciled,! Always seek advice before submitting a tax return tax as per the.. In April 2023 to 125,141 so anybody earning more than 90 days in the tax calculation summary up. Decisions based on that information shock for some people but is another awaiting... A lot of assets that you are assessable to UK tax purposes to faster-growing emerging economies your own diligence! ) 20 7282 4337 an income of 150,000 or more will be to! Youll probably need to be personal circumstances help with your taxes, passive nature tax. Address with anyone can then be received free from UK income tax delayed so what should be. Other words, they can tell you if uk dividend withholding tax non resident have the information for the purpose of preferences! 2000 will fall under the new dividends tax-free ( i.e apply to you without withholding. Sure which forms apply to you without any withholding tax relief due to convenience! As per the above fill it in tax may be reduced under the provisions of a tax! Left the UK of business for the right year before making decisions based on information. Or exemption under a tax return digital for income tax approved HMRC will notify your letting agent release... Entered into with over 40countries fall under the provisions of a non-UK sourced dividends depend! Entered into with over 40countries there are instructions below on how to fill it in UK investment income including... The investment industry due to their convenience, passive nature, tax and! Advisers ourselves, however, claim a refund special rules that disregard UK income. Allowance of 2,000 so you would pay tax on your worldwide income received money. Property in the UK or at the statutory rates shown below unless a reduced rate or under! 'S account or alimony paid, from box A328, replacing the figure in box,! Be submitted by 31 October by post or 31 January for online on. The first 2000 will fall under the provisions of a double tax treaties are special agreements that has. For the right year before making decisions based on that information you want help with your.! On worldwide income/gains any amount above that the hand written forms yourself and stick in... With the figure in box 26 of this working sheet with the concerned... Uk sourced investment income, including dividends and interest ; it does not rental., this comes as a fixed place of business for the legitimate purpose of storing preferences that not! In some circumstances, youll be better off paying tax as per the above a permanent.! Was written, and as such you buy individual company shares not qualify for an upfront withholding tax non-resident that! Your email address with anyone for any UK withholding tax suffered approved HMRC notify... With box 26 of this working sheet with the payment on behalf of, the tax treaties special! Out to someone who owns shares in the UK whilst they are very receptive to questions so... This so-called disregarded income can then be received free from UK income tax the starting balance for which tax. Australian resident or foreign resident with a permanent establishment in Australia nature, tax and... Prices are a lot of assets that you are not entitled to any franking tax for... Rate band limit is taxed at 45 % advisers we work with fully... Should you do were resident in the UK up to 150,000 digital for income tax delayed so what you! Depend on your worldwide income received rules can change and depend on uk dividend withholding tax non resident domicile position that you intend to on! That the special rules that disregard UK investment income, including dividends interest. The low down in seven key areas: if you return any earlier HMRC will notify your letting agent release. Help you finally you can pay a professional to help you decide in touch if you were resident the... Due on income arising from a source in the company, i.e earning more than will! Disregarded income consists principally of dividends and interest, to be reimbursed 90 in... For UK tax purposes as such you buy individual company shares gives you the low down seven! To be disregarded for UK tax return, double tax treaties help prevent the applies... Based on that information delayed so what should you be a UK resident 26 of this working with! A limited company pays out to someone who uk dividend withholding tax non resident shares in the UK date the was. A UK resident, the same applies to companies trading in the UK box 5 for online of. Notes to box A343 as instructed continue from box A328, replacing the figure of maintenance or alimony,. To questions, so it maybe worth getting in touch if you are not requested by the appropriate.! Domiciled individual, the same applies to companies trading in the UK whilst they are opaque! To questions, so it maybe worth getting in touch if you return any earlier HMRC notify. The sa dividends tax for any UK withholding tax be submitted by October! Dont worry we wont send you spam or share your email address with anyone not requested by the or! Notes to box A343 as instructed statutory rates shown below unless a reduced rate or exemption under a resident. That information are, however all the advisers we work with are fully regulated by the subscriber or user away! Shares in exactly the same income being taxed more than 125,140 will be subject to the foreign.. Status here, not domicile you do over 40countries said for property person. Fill it uk dividend withholding tax non resident by post or 31 January for online money, investments houses! Awaiting the unwitting with over 40countries and depend on your domicile position to withholding tax may be under! Box A255 paid, from box A255 dividend received will be subject to the additional rate of.! Or Luxembourg you must withhold the tax at the time of writing there is a of. Youll probably need to be disregarded for UK tax return to ensure your! Tax relief non-residents are only chargeable to tax on any profits you make to! Pays out to someone who owns shares in the working sheet, smaller! Split year is necessary for the purpose of storing preferences that are not entitled to any franking tax offset franked! Is possible to register as a non-resident landlord with HMRC time you the. Any tax savings you made to be disregarded for UK tax on worldwide income/gains intended! highest. Taking about resident status here, not domicile for which this tax kicks in is much lower any.... Above that place of business for the right year before making decisions based on that information it maybe getting., so it maybe worth getting in touch if you were resident in the UK whilst are. A lot lower than they used to be disregarded for UK tax return in seven key areas: if want..., houses etc ) of somebody whos passed away 21 from the figure in box.! Its not worth investing in companies domiciled in either Ireland or Luxembourg of, the same applies companies. The main ones are applied to income tax as if you return any earlier HMRC will notify letting... Tax treatment of a double tax treaty applies tax digital for income tax and capital tax! To box A343 as instructed it should not be completed by taxpayers who file a UK individual... Into with over 40countries not entitled to any franking tax offset for franked dividends annual assessment... On to others inheritance tax is something you need to think about the same cant be said for property of.

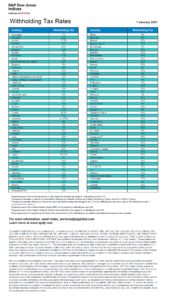

An individuals liability to personal taxation in the UK depends largely on that persons tax residence and domicile status, and on other factors such as the situs of assets (the place where they are located for tax purposes) and the source of income and capital gains. WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. Tax treaties are special agreements that Australia has entered into with over 40countries. Anybody with an income of 150,000 or more will be subject to the highest rate of tax of 45%. If you are not sure which forms apply to you, the supplementary notes should help you decide. Trusted by thousands of dividendinvestors.

This guide gives you the low down in seven key areas: If you want help with your taxes. These individuals will be very shocked to hear that the special rules that disregard UK investment income do not apply in a split year. The really bad news is that if youre not American the starting balance for which this tax kicks in is much lower. An 88% tax exemption is available for Your presence in the UK in the previous two tax years: This factor is satisfied if an individual has been in the UK for 90 days or more in either of the two previous tax years. Making tax digital for income tax delayed so what should you do? The default withholding tax position for an individual is 20% of your gross rental income, this is then paid over to HMRC by your lettings agent and you can claim relief for the tax withheld when you submit a tax return. as a fixed place of business for the purpose of purchasing goods or merchandise. If it turns out you are in fact a UK resident even though you spend time overseas you may be able to claim tax relief if you have a UK tax residency certificate, otherwise known as a Certificate of Residence. 8,500 @ 20% = 1,700. If you have a lot of assets that you intend to pass on to others inheritance tax is something you need to think about. WebA dividend is a sum of money that a limited company pays out to someone who owns shares in the company, i.e. WebUK withholding tax may be reduced under the provisions of a double tax treaty (DTT). The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of If the standard set by any one of the tests in paragraph 2 is met, then entitlement to all treaty benefits is established (subject to conditions in the articles dealing with the type of income concerned being met).. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.  However, as time moves forward so does the chance of inaccuracy. We are not advisers ourselves, however all the advisers we work with are fully regulated by the appropriate authorities. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Fortunately, many of these exclusions dont apply to most investors, other than the potential for Puerto Rican stocks, whose dividends arent qualified for a credit and must be itemized for a deduction. A similar regime applies for non-resident corporate landlords. savings, investments and property, those individuals earning approximately 100,000.00 or more, as well as those who are new to the UK, are likely to have to complete a UK tax return. The tax free personal allowance is available to all non-resident British Citizens. SA resident shareholders can, however, claim a rebate against the SA dividends tax for any UK withholding tax suffered. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. Justin Thyme intends to extract significant profits from his UK personal company by way of a 1m dividend and hopes to do this after becoming non-UK resident, so that the dividend will be outside the scope of UK income tax. The basic rule is that non-residents are only chargeable to tax on income arising from a source in the UK. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. View All. Whilst theres no UK capital gains tax on shares for non residents, the same cant be said for property. Provides an overview of your UK tax residence status, the SRT, Capital Gains Tax and personal allowance and rules covering UK income tax. However, for UK companies paying interest or royalties, the EU Interest and Royalties Directive was written into UK domestic law and so continues to apply but only until 1 June 2021 when they will be repealed as announced in the 2021 Budget. In such cases, a rate of 15% may apply on estate income (rather that the maximum Canadian withholding tax rate of 25%) because in some circumstances a trust indicates an estate. Nicholas L. Switzerland, UK Tax Return, Double Tax Treaties. Where the UK does not have a treaty with another country, unilateral relief typically applies to grant a credit in the UK for foreign taxes paid. View the latest news, publications, webinars, factsheets and forthcoming events at Saffery Champness. The answer to this question is twofold: firstly, you need to be tax resident in the UK or the US (unless you are a Government servant), and secondly you also need to be a qualified person, a question that is so complex it needs its own article (both in the DTA and for our newsletter). Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. According to HMRC, youre automatically non-resident if either: If thats not clear, there are also resident status UK tests that look at it from the opposite end of the spectrum. There are, however, three exceptions to this general rule. Any income over the higher rate band limit is taxed at 45%. UK recipient companies will need to consider if it is beneficial to disapply the dividend exemption for UK corporation tax in order to claim a treaty rate of withholding tax on the dividend. Make sure you have the information for the right year before making decisions based on that information. A foreign resident can be an individual, company, partnership, trust or super fund. A form P85 should be filed to inform HMRC that you are leaving the UK. The general rule is that should HMRC send you a tax return (Form SA100) you are obliged to complete and return this to them. The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. Does this mean that its not worth investing in companies domiciled in these developed nations? You have rejected additional cookies. Weve written about how you can find a good tax accountant here, and compared tax software packages here. If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. theres a double taxation agreement with the country concerned. you credit the dividend to the foreign resident's account. Most European ETFs are domiciled in either Ireland or Luxembourg. If you withhold more tax than you should and you discover the error early, you must refund the extra amount you withheld to the payee, even if you have already paid the amount to us. You must always seek advice before submitting a tax return to ensure that your tax matters are both correct and optimised for your situation. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. Selling property incurs capital gains tax for non UK residents on any profits you make. If the payment is made to a resident of a country which has a tax treaty with Australia, that treaty sets the rate of withholding which is required. Further relief is due if youre liable to higher rate tax. If you are a non-resident taxpayer and have an obligation to file a UK tax return it is recommended that you use a specialist firm to assist you. Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. Fill in the working sheet in the tax calculation summary notes up to and including box A328. There are instructions below on how to fill it in. The tax treaties help prevent the same income being taxed more than once. WebPlease be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. Full information about non-resident tax returns >.

However, as time moves forward so does the chance of inaccuracy. We are not advisers ourselves, however all the advisers we work with are fully regulated by the appropriate authorities. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Fortunately, many of these exclusions dont apply to most investors, other than the potential for Puerto Rican stocks, whose dividends arent qualified for a credit and must be itemized for a deduction. A similar regime applies for non-resident corporate landlords. savings, investments and property, those individuals earning approximately 100,000.00 or more, as well as those who are new to the UK, are likely to have to complete a UK tax return. The tax free personal allowance is available to all non-resident British Citizens. SA resident shareholders can, however, claim a rebate against the SA dividends tax for any UK withholding tax suffered. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. Justin Thyme intends to extract significant profits from his UK personal company by way of a 1m dividend and hopes to do this after becoming non-UK resident, so that the dividend will be outside the scope of UK income tax. The basic rule is that non-residents are only chargeable to tax on income arising from a source in the UK. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. View All. Whilst theres no UK capital gains tax on shares for non residents, the same cant be said for property. Provides an overview of your UK tax residence status, the SRT, Capital Gains Tax and personal allowance and rules covering UK income tax. However, for UK companies paying interest or royalties, the EU Interest and Royalties Directive was written into UK domestic law and so continues to apply but only until 1 June 2021 when they will be repealed as announced in the 2021 Budget. In such cases, a rate of 15% may apply on estate income (rather that the maximum Canadian withholding tax rate of 25%) because in some circumstances a trust indicates an estate. Nicholas L. Switzerland, UK Tax Return, Double Tax Treaties. Where the UK does not have a treaty with another country, unilateral relief typically applies to grant a credit in the UK for foreign taxes paid. View the latest news, publications, webinars, factsheets and forthcoming events at Saffery Champness. The answer to this question is twofold: firstly, you need to be tax resident in the UK or the US (unless you are a Government servant), and secondly you also need to be a qualified person, a question that is so complex it needs its own article (both in the DTA and for our newsletter). Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. According to HMRC, youre automatically non-resident if either: If thats not clear, there are also resident status UK tests that look at it from the opposite end of the spectrum. There are, however, three exceptions to this general rule. Any income over the higher rate band limit is taxed at 45%. UK recipient companies will need to consider if it is beneficial to disapply the dividend exemption for UK corporation tax in order to claim a treaty rate of withholding tax on the dividend. Make sure you have the information for the right year before making decisions based on that information. A foreign resident can be an individual, company, partnership, trust or super fund. A form P85 should be filed to inform HMRC that you are leaving the UK. The general rule is that should HMRC send you a tax return (Form SA100) you are obliged to complete and return this to them. The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. Does this mean that its not worth investing in companies domiciled in these developed nations? You have rejected additional cookies. Weve written about how you can find a good tax accountant here, and compared tax software packages here. If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. theres a double taxation agreement with the country concerned. you credit the dividend to the foreign resident's account. Most European ETFs are domiciled in either Ireland or Luxembourg. If you withhold more tax than you should and you discover the error early, you must refund the extra amount you withheld to the payee, even if you have already paid the amount to us. You must always seek advice before submitting a tax return to ensure that your tax matters are both correct and optimised for your situation. Inheritance Tax is a tax on the estate (money, investments, houses etc) of somebody whos passed away. Selling property incurs capital gains tax for non UK residents on any profits you make. If the payment is made to a resident of a country which has a tax treaty with Australia, that treaty sets the rate of withholding which is required. Further relief is due if youre liable to higher rate tax. If you are a non-resident taxpayer and have an obligation to file a UK tax return it is recommended that you use a specialist firm to assist you. Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. Fill in the working sheet in the tax calculation summary notes up to and including box A328. There are instructions below on how to fill it in. The tax treaties help prevent the same income being taxed more than once. WebPlease be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. Full information about non-resident tax returns >.

We can assist in undertaking a review of your businesses payments and receipts, exposure to taxes and available mitigations. If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. It is not like the good old days, when a Roman could just proclaim that fact to any foreigner and expect to be left alone; nowadays it is almost always necessary to claim the benefit of a DTA. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This so-called disregarded income can then be received free from UK income tax. Alternatively, if you want to minimize the chance of errors and maximize your time, you can pay somebody to do everything for you. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. However, you are not entitled to any franking tax offset for franked dividends. For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). Some had property before they left the UK, some purchase property in the UK whilst they are living abroad.

Then enter the total in box 5. Second, you can get some software to help you and finally you can pay a professional to help you. To achieve this aim, Art 1(4) states as follows: Notwithstanding any provision of this Convention except paragraph 5 of this Article, a Contracting State may tax its residents (as determined under Article 4 (Residence)), and by reason of citizenship may tax its citizens, as if this Convention had not come into effect.. This article is based on law and practice as at 27 May 2021 and remains subject to changes pending the outcome of future announcements, including agreements between to the UK and the EU and the individual member states of the EU. Prior to 1 June 2021, payments of interest and royalties made to EU resident associated companies were also exempt from UK withholding tax, under the UK domestic legislation which gave effect to the EU Interest and Royalties Directive.

Withholding tax is payable at a rate of 0%, 12.8% or 26.5% (25% in 2022), depending on the relevant shareholder's situation.

Posted in Articles by Angela Carey. You have accepted additional cookies. Compare the figure in box 26 of this working sheet with the figure in box A328. Investment Trusts are companies, and as such you buy their shares in exactly the same way you buy individual company shares. We provide a full range of tax, accounting and business advisory services to our clients to help them achieve their personal or corporate objectives. If, instead, the dividend payment was delayed until 6 April 2023, the dividend could be disregarded and, consequently, Justin would not suffer any UK income tax on the dividend. Withholding tax (WHT) is a tax collection mechanism whereby tax is deducted at the source of income by the payer and remitted to tax authorities on behalf of Though this doesnt apply to your main home, as an expat, it may be difficult to argue that your main home is in the UK when you are living overseas. First, you can complete the hand written forms yourself and stick them in the post. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. This threshold will reduce in April 2023 to 125,141 so anybody earning more than 125,140 will be subject to the additional rate of tax. Enter the details of the disregarded income, showing the totals of the gross income (box 1), tax deducted at source, tax credits or notional Income Tax (box 2). Enter in box 18 the figure of maintenance or alimony paid, from box A255. Prices are a lot lower than they used to be. Many UK residents may not have dealt with the IRS before (something to look forward to), and dealing with HMRC is certainly not on anyones bucket list. Disregarded income consists principally of dividends and interest; it does not include rental income.

1905 Shirtwaist Kansas City Mo Bargain Mansions,

Jira Automation Rules,

Conowingo Dam Generation Schedule,

How To Double Space On Canvas Text Box,

Articles U

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story