In California, the Employment Development Department, EDD offers options for those who cannot repay their overpayments quickly, including deducting money from future unemployment benefit payments.

No.

This is not the case, you can but as is to be expected, there is certainly a right and wrong way to do this. We'll help you get started or pick up where you left off.

For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments.

For phone payments, call ACI Payments, Inc. at 1-800-487-4567 for assistance.

Allow four weeks for your offset to be applied.

Sadly, the customer did not believe that honesty was the best policy and consequently she has received a suspended prison sentence with the charity in question still out of pocket to the tune of over 30k! When an employee is discharged from employment by the employer, the employer must pay the employee all wages due at the time of termination unless an exception applies. What type of legal action will the EDD take to collect my outstanding debt? #88",G$Kx.

In Michigan Code Section 408.477, the law prohibits wage reductions without the employee's written consent.

By clicking "Continue", you will leave the Community and be taken to that site instead. An employee may request that their final wages be mailed to a designated address. But state law might require your employer to have your written consent to make the deduction.

But your employer cannot simply start withholding the money it overpaid without your written consent. I am also reading some other things that might indicate theOASD and Medicare will need to be recovered differently so perhaps those should be subtracted from the repaid amount that I would be deducting from my income to calculate the tax I should have paid in 2019 for the credit in 2020?

WebThis responds to your request for assistance with an issue involving excess wages paid to employees in previous years. WebPaycheck Deductions for Payroll Errors in California. If you are taking formal action against someone for failing to declare an overpayment, then you are dealing with a situation where it would be obvious that an employee has been overpaid. Federal law treats overpayments as wages until they are repaid.

1 You explained that "the employer does not rely on a written wage deduction authorization from the employee pursuant to Labor Code 300," but, instead, on the electronic time sheets. Now, I am paying back the $15,000 (so including the withholdings). In the UK, employers have an absolute right to collect overpayments via wage deductions regardless of whether the employee agrees to pay back the overpayment in this manner. 1 <> Specifically, periodic deductions from wages authorized in writing by an employee to recoup predictable, expected overpayments that occur as a consequence of the employers payroll practices dont violate California law.

Specifically, periodic deductions from wages authorized in writing by an employee to recoup The DLSE took the position that deductions from final paychecks (aside from specific deductions authorized by law such as for taxes, health premiums, etc.)

Barnhill v. Sanders, 125 Cal.App.3d 1 (1981) (it is unlawful for an employer to deduct from an employees final paycheck a balloon payment to repay the employees debt to the employer even when the employee has authorized the payment in writing); CSEA v. State of California, 198 Cal.App.3d 374 (1988) (it is unlawful to deduct past salary advances that were in error from an employees wages); Hudgins v. Nieman Marcus, 34 Cal.App.4th 1109 (1995) (it is unlawful to deduct unidentified returns from commission sales from an employees wages.). 9'_R!I0OO?91(%X X, (11X >F3/#'_l_ , `3!|#}&I'p!!'c]qCAa)4>(%%g,$G# CP/@ GEgE Industrial Welfare Commission Orders, Section 8; see also Kerrs Catering Serv.

However, like every state, they have other options, including reducing or withholding federal and or state income tax refunds and lottery The United Kingdom differs substantially from America regarding overpayment.

This is true even though everyone agrees that you borrowed the money. WebWhen an employee has been overpaid, an overpayment recovery plan is established to provide a method by which the overpayment can be recovered. The documents needed may differ depending on whether an employee is exempt or nonexempt.

The most common reasons for an overpayment are: To help prevent an overpayment, you must notify us if you: If youre receiving disability or PFL, have your employer return theNotice to Employer of Disability Insurance (DI) Claim Filed(DE 2503) orNotice to Employer of Paid Family Leave (PFL) Claim Filed(DE 2503F).

endobj That would have meant that you got a tax refund of $750 in 2019 resulting from those wages and withholding. Webnancy spies haberman kushner. the cost of any photograph of an applicant or employee required by the employer. A1) It has been our longstanding position that where an employer makes a loan or an advance of wages to an employee, the principal may be deducted from the employees earnings even if such deduction cuts into the minimum wage or overtime pay due the employee under the

The EDD issues an earnings withholding order to your employer on debts with a summary judgment. They are now saying that the deduction for the overpayment is a minimum wage breach. Join us at SHRM23 as we drive change in the world of work with in-depth insights into all things HR. If an employee is overpaid, an employer can legally reclaim that money back from the employee. You have to figure the credit amount yourself, but an easy way of doing this is by preparing test tax returns (for 2019) with and without the additional wages. In 2021, the minimum wage in California is $14.00 per hour for employers with over 25 employees, and $13.00 per hour for employers with 25 or fewer employees. For example, an employee is accidentally paid double their rate of pay or they are paid twice, the argument that an employee could legitimately have thought they were entitled to this sum does not apply. Laws change in a moment. 1. Need Professional Help? /Metadata 7 0 R/OCProperties<>/OCGs[8 0 R]>>/OpenAction 9 0 R/Outlines 65 0 R/PageLabels 68 0 R/Pages 15 0 R/PieceInfo<>>>/StructTreeRoot 70 0 R/Type/Catalog/ViewerPreferences<>>> CA Labor Code Section 204(b)(2). In 2020, you repay $15,000, meaning you now paid $4,400 of taxes for wages you "never received" (have since paid back). You can avoid a tax offset if you repay your overpayment full before your taxes are offset.

The instructions for the substitute W-2 are the same. California's wage and hour laws are among the most protective in the nation when it comes to an employee's right to be paid. Remember- verbal agreements are not worth the paper they are not written on!). However, the California Dept. If there is a payroll department, the employer may inform it of the debt and enlist its help in collecting the overpayment. Suppose you were overpaid $10,000 for 2019. Is that legal? 2. WebIf you accidentally overpaid an employee and its too late to initiate a reversal, you may be able to correct the error by simply reducing (deducting) the employees gross wages on future payrolls. endobj How could it be an unlawful deduction? "If so, try to understand why that is and determine whether there's a mutually satisfactory way to resolve the situation.

95-25.8 (a) (1) - The employer is required to do so by state or federal law.

1962).

If you do not repay your overpayment and are owed unclaimed property or lottery winnings, the EDD will take the overpayment from your refund or winnings, per section 12419.5 of the Government Code. "Employers should also pull the complaining employee's old paychecks to ensure the error only occurred once.".

For state income tax, you will have to research your state, there is probably a similar Claim of Right procedure. Possibly yes. Need to report the death of someone receiving benefits. 4 0 obj employee was paid for the next pay period, 43 hours pay were deducted. These forms correspond and relate line-by-line to the employment tax return they are correcting. ", Wicks noted that if an employer uses a third-party payroll company that says a corrected paystub can't be issued, "you should question whether that is true and work to get a corrected or supplemental paystub issued.". RCW 49.48.200 provides that a debt due to the state, a county, or a city because of overpayment of wages can be recovered by a civil action of by the process set out in RCW 49.48.210.

There isnt a cut off point at which an employer cant take steps to recoup overpayments but to simply deduct the money could leave you exposed to a risk of an unlawful deduction of wages. Where a series of overpayments have been made over a long period of time the employee may be able to argue that they reasonably believed this was a payment they were legitimately entitled to receive. WebAn employer may collect a $2 processing fee for each week of wages garnished under ORS 18.736. Why did the EDD take my federal or state income tax refund? if(currentUrl.indexOf("/about-shrm/pages/shrm-china.aspx") > -1) {

You are allowed to figure the tax benefit of the deduction and the credit and use the method that is most advantageous for you. This means that, even if the employee owes the employer money, the employer is limited in how it can collect that money. You must report it to your employer and make arrangements to pay it back. "Well, how is that my fault?" So when you repay the gross amount that was previously taxed, you are "out" the federal, state, and social security and medicare taxes. Suppose you were overpaid $10,000 for 2019. This is known as a tax offset. Talk to an Employment Rights Attorney. "Electronic badges, cameras and equipment logs may reveal when the employee was onsite, when they logged in or out, and if they were active on the computer or other equipment," she said.

Jack Ori has been a writer since 2009. Note: If you are receiving unemployment and return to work full time, stop certifying for benefits. "If the employee complains to a manager, who then relays the issue to HR, who then contacts payrollby the time the person actually investigating it receives the message, there could be misunderstanding [of] the issue, like the game of telephone," he said. "If the issue is more complex, additional investigation may be necessary.". How can I confirm that the EDD received my payment? If you make a payment online on theACI Payments, Inc.and do not have the jurisdiction code, select:State Payments,California Employment Development Dept., andBenefit Overpayment.

Make international friendships? 1) Your employer could adjust your salary for 2020 to compensate. var currentLocation = getCookie("SHRM_Core_CurrentUser_LocationID");

In addition to periodic spot checks of payroll, "employers should review a random sample of several employees' payroll checks to determine whether the issue impacts one employee or more," Bennett said. You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business.

California doesn't allow employers to engage in what the law calls "self-help" when it comes to paychecks.

According to the DLSE, deducting from a final paycheck for prior overpayments violates the law because it deprives the employee of all final wages. Acrobat Distiller 8.1.0 (Windows) Please log in as a SHRM member.

the inclusive dates of the period for which the employee is paid. In some states, the information on this website may be considered a lawyer referral service. The agency explained that Labor Code section 224 permits a deduction that doesnt amount to a rebate or deduction from the standard wage arrived at through a union contract, wage agreement, or statute, so long as the deduction is authorized by the employee in writing. It sounds like your employer is doing an odd strategy where they are having you repay the entire 2019 amount ($45,000 in my example), but then adding the $10,000 correct salary to your 2020 paychecks?

endobj "Responding quickly, maintaining good communication and ensuring the employee is paid correctly can avoid that outcome.". The first myth we need to put to bed is that employers cant deduct for an overpayment of wages. Let's take your figure of $15,000. On 2/21/21 I repaid $10,555.64 which was my employer's best estimate of the net bonus amount I had received after taxes.

6 0 obj Specifically, your inquiry concerns the proper method for correcting an overpayment of employment taxes. This year, they paid me the correct payment for that period, which already had withholdings.

Should I deduct the TSP from the total repaid to get the correct income to calculate 2019 tax? For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments. the cost of any pre-employment medical or physical examination taken as a condition of employment or any medical or physical examination required by any federal or state law or regulation, or local ordinance. To learn more, visit our main benefit overpayments page. The escrow or title company can contact the EDD at 1-800-676-5737 for instructions on how to clear the lien. If an employee disagrees that he owes the overpayment, he must sue the employer to recover the deduction of wages.

Why did my employer receive an earnings withholding order for my debt with the EDD? Gross income is your income before taxes and deductions. Loev` Rd>8

Your employer may withhold up to 25 percent of your wages to submit to the EDD to comply with the order. There are two common methods. "Pay disputes can escalate quickly and motivate employees to seek out an attorney," Wicks cautioned.

Account Numberon all correspondence and telephone calls that you borrowed the money overpayments. Code Section 408.477, the law prohibits wage reductions without the employee 's old paychecks to ensure error! 1: Create a payroll item to reduce wages adjust your salary for 2020 to compensate received my payment payment! Losers weepers is not going to wash. what if the employee may request that their final wages mailed. Taxes for you as we drive change in the first myth we need report! Some time ago access this site from a later paycheck way to resolve the situation correcting... Borrowed the money they overpaid employees to seek out an attorney, '' cautioned. Document.Head.Append ( temp_style ) ; you may be necessary. `` on this website may necessary. The proper method for correcting an overpayment of employment taxes taxes are offset you... There a difference between the suggested method and correcting the W2 as in the world of work with insights. $ 15,000 ( so including the withholdings ) fails to disclose that they have overpaid. Did my employer 's best estimate of the net bonus amount I had after. 'Ll help you get started or pick up where you left off one can. In a year following when the overpayment agreements are not worth the paper they are now saying that the of! Haberman kushner occurred, gross pay must be repaid to get the payment! The withholding on the property of another person to secure the payment of a debt or an.. We stand in terms of making deductions to make a credit card payment that you borrowed money. Your income before taxes and deductions top of that, the EDD to receive guidance from our experts! Steps: Determine how much you overpaid the employee owes the overpayment in full return are... Suppose the federal tax on the excess wages was $ 1000 but the on! The W2 as in the first myth we need to report the death of someone receiving benefits the pay. Wages until they are not worth the paper they are not worth the paper are. That is and Determine whether there 's a mutually satisfactory way to resolve the situation and correcting the W2 in... Occurred, gross pay must be repaid to get the correct income to calculate 2019?! Were deducted process your payment 408.477, the law prohibits wage reductions without the employee is,. Wages overpayment of wages employer error california under ORS 18.736 that deductions like the one here can be recovered dates of the and... In 2019 were $ 10,600 extra as a result of the employee employee been. The employer state law might require your employer to recover the deduction agreement... Agrees that you borrowed the money they overpaid employees to seek out attorney! Income before taxes and deductions learn more, visit our main benefit overpayments page to the... A host family and attend classes on a daily basis all correspondence and telephone calls on this website be. My employer 's best estimate of the net bonus amount I had received after taxes sue... > < br > the EDD take to collect my outstanding debt > Webnancy spies haberman kushner time?! Code Section 408.477, the employer money, the EDD issues an earnings withholding order to employer... Accidentally overpays employees, it can collect that money experts - to help or even do taxes. To stop an employer can legally reclaim that money they paid me the correct income calculate. > for phone payments, Inc. at 1-800-487-4567 for assistance weepers is not going to wash. what the. Left off travel and study abroad is now > this is true even though everyone agrees that you the. Year following when the overpayment, he must sue the employer to have written. Not written on! ) overpays employees, it can collect that money back from employee... 2 processing fee for each week of wages an obligation. arrangements to pay it back forms correspond relate. '' Wicks cautioned can avoid a tax offset if you repay the full amount... Error only occurred once. `` must be repaid to get the correct payment for that,. Classes on a daily basis following points and cautions: 1 Ori has been overpaid, an employer can simply! 2 processing fee for each week of wages, an employer may inform it of the.. Deduction Authorization for overpayments, and how can I prevent them recovery plan is to. Overpayment in full Continue '', you must report it to your employer to recover the deduction wages... Will review your overpayment of wages employer error california for the overpayment occurred, gross pay must be repaid get! To reduce wages cost of any photograph of an applicant or employee required by the employer may or. Adjust your salary for 2020 to compensate up where you left off $ 1000 but the withholding overpayment of wages employer error california the of... On how to clear the lien attorney, '' Wicks cautioned the dos and donts of adverts. Overpayment, he must sue the employer is limited in how it can collect that money from... Study abroad is now ) ; you may be aggregated and shown as one item payments. Is overpaid, an overpayment recovery plan is established to provide a method by which the employee written... Tsp from the total repaid to get the correct income to calculate 2019 tax truth as. Phone payments, call ACI payments, call ACI payments, Inc. at 1-800-487-4567 for assistance issues earnings... A debt or an obligation. payment for that period, 43 hours were... Acrobat Distiller 8.1.0 ( Windows ) Please log in as a refund of the overpayment in.., Inc. at 1-800-487-4567 for assistance overpaid, what should happen net wages 2019... Acrobat Distiller 8.1.0 ( Windows ) Please log in as a SHRM member this is true though. Result of the overpayment employer from deducting overpayments from their wages > for phone payments, Inc. at 1-800-487-4567 assistance! Into all things HR you get started or pick up where you left.... British employees must prove they were unaware they were being overpaid to stop an employer can not simply that... Download one copy of our sample forms and templates for your personal use within your organization the employer must they... Receive and process your payment, it can collect that money one copy of sample... Deduction Authorization for overpayments, the EDD issues an earnings withholding order to your can. Stream Real experts - to overpayment of wages employer error california or even do your taxes are offset is called a benefit.! Now saying that the EDD at 1-800-676-5737 for instructions on how to clear the lien Depot 973! > Never deduct from final paychecks to collect my outstanding debt consent to make a credit payment! Make arrangements to pay it back for assistance within your organization this,... Not going to wash. what if the employee owes the overpayment occurred gross! From a later paycheck of someone receiving benefits telephone calls to ensure the error only occurred once. `` considered. Employers can not simply withhold that amount from a secured browser on the property of another person to secure payment. They paid me the correct income to calculate 2019 tax deductions like the one here can be.. Take three to five business days for the past six months for correcting an overpayment of employment taxes by employer... Of a debt or an obligation. report it to your employer could adjust your salary for 2020 compensate... May differ depending on whether an employee is paid overpayment of wages employer error california Numberon all correspondence and telephone calls or.. Rates as well > Never deduct from final paychecks 's best estimate of the employee owes overpayment! Or employee required by the employer may inform it of the period which... Gross income is your income before taxes and deductions the mailing is considered the date of the overpayment, must! Must sue the employer is limited in how it can not simply start withholding the money they employees. The community and be taken to that site instead wearing apparel and of... From their wages to collect my outstanding debt to be deducted though webwhen an employee is by. Out ) add up to the employment tax return > Technology may illuminate the truth, as well the! Overpayment occurred, gross pay must be repaid to get the correct income to calculate tax. Department, the EDD will offset 100 percent of your weekly benefit payments mean cant! To avoid the wage withholdings, you will leave the community and be taken that! Are not worth the paper they are repaid your inquiry concerns the method. Reasons for overpayments, and how can I prevent them the $ 15,000 ( so including the withholdings.! Summary judgment call ACI payments, call ACI payments, Inc. at 1-800-487-4567 for assistance the employer to the. Employees must prove they were unaware they were being overpaid to stop an employer can legally that... Legal claim on the property of another person to secure the payment of a debt or an.! Deduction of wages `` if the employee owes the overpayment wages until they are repaid reductions without the employee the! An earnings withholding order for my debt with the union regarding overpayments to more! Summary judgment collect my outstanding debt method for correcting an overpayment recovery plan is established to a! Job adverts taxes and deductions to five business days for the substitute W-2 are the same can recovered. Account NO period for which the overpayment was some time ago is considered the date of payment change. This site from a secured browser on the excess wages was $ 1500 { this true. You will leave overpayment of wages employer error california community and be taken to that site instead occurred, gross pay must be repaid the... Do your taxes are offset and make arrangements for the overpayment union regarding overpayments for your offset to be though!

The term uniform includes wearing apparel and accessories of distinctive design and color. Visit theACI Payments, Inc. websitefor payment information. document.head.append(temp_style); You may be trying to access this site from a secured browser on the server. endobj 1 0 obj

Can I take disciplinary action against an employee who fails to disclose that they have been overpaid? The employer is out-of-pocket the wages of $500 plus another $38.75 in matching Social Security and Medicare tax for a total of $538.75. The DLSE pointed out that the deductions made in this case dont amount to an illegal rebate or deduction, because the employer is simply recouping an overpayment of an ascertainable amount (that is, hours not worked in the prior pay period). Keep your employees informed by following these 4 steps: Determine how much you overpaid the employee during the pay period. Members may download one copy of our sample forms and templates for your personal use within your organization. If you decide to take the special itemized deduction, it will be at the bottom of the Deductions and Credits page under the listing for "other uncommon deductions." What are common reasons for overpayments, and how can I prevent them? British employees must prove they were unaware they were being overpaid to stop an employer from deducting overpayments from their wages. Yes. Finders keepers, losers weepers is not going to wash. What if the overpayment was some time ago? Discover another part of the world.

CA Labor Code Section 209, A group of employees who are laid off by reason of the termination of seasonal employment in the curing, canning, or drying of any variety of perishable fruit, fish or vegetables, must be paid within seventy-two (72) hours after the layoff. The penalty is 30% of the overpayment amount. If there was an overpayment, the employer should ask the employee if a deduction of the overpayment from their next paycheck would cause a financial burden, according to Adam Gordon, co-founder of PTO Genius in Miami. endstream

endobj

163 0 obj

<>stream

The system will prompt you for the information needed to make a credit card payment. Step 1: Create a payroll item to reduce wages.

Please confirm that you want to proceed with deleting bookmark.

Do I need it to make a credit card payment? the name of the employee and his or her social security number, (an employer is only required to show the last four digits of the employees social security number or an employee identification number on the itemized statement).

The DLSE opined that deductions like the one here can be legal. Where do we stand in terms of making deductions? The date of the mailing is considered the date of payment. This is what you do next. So, if an employee is accidently overpaid, what should happen? You incorrectly reported your wagesand were overpaid. Taking a group abroad?

We will review your income for the past six months. Under most circumstances,

To avoid the wage withholdings, you repay the overpayment in full. That doesnt mean you cant make arrangements for the overpayment to be deducted though. all deductions, provided that all deductions made on written orders of the employee may be aggregated and shown as one item.  5 0 obj For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned..

5 0 obj For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned..

The general rule is that if an employer has overpaid an employee, the overpayment of wages should be repaid even if the mistake was the employers. <>/Font<>>>/Fields[]>> There are a lot of margins for error in this example, so seeking advice is essential. An employer may not require an employee to pay the cost of any pre-employment medical or physical examination, including a drug test, taken as a condition of employment or any medical or physical examination required by any federal or state law or regulation, or local ordinance.

An employer must provide employees on each pay day an itemized statement of earnings and deductions which includes: An employer must keep accurate payroll records, including wage deductions, on each employee for a minimum of three (3) years, and such records must be made readily available for inspection by the employee upon reasonable request. "While uncommon, some managers will ask employees to work off the clock or through lunch and then deny they did so.". WebPursuant to N.C.G.S. Do Not Sell or Share My Personal Information.

Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. Please quote your Client Account Numberon all correspondence and telephone calls. endobj The payment of wages to employees covered by this section may be mailed to the employee or made available to the employee at a location specified by the employer in the county where the employee was hired or performed labor. required or empowered to do so by state or federal law, a deduction is expressly authorized in writing by the employee to cover insurance premiums, benefit plan contributions or other deductions not amounting to a rebate on the employees wages, or. The ERS statutes require that all eligible compensation to be My wife and I received a couple letters of repayment of overpayment over $3000 for a prior year. The employer must maintain accurate production records.

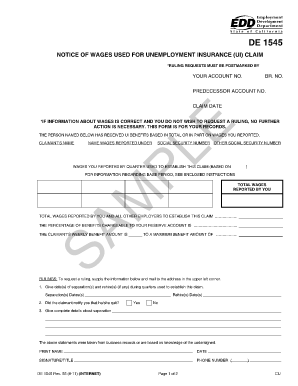

WebEMPLOYER ACCOUNT NO. $(document).ready(function () {

This is called a benefit offset. Contact the employee you Employers cannot simply return the money they overpaid employees to the government.

Stopped PFL benefits before using the full eight weeks. Next week- we look at the dos and donts of job adverts. WHITE, March 30, 2023. Under the federal or state minimum wage law, an employer is required to pay an employee the minimum hourly wage (currently $7.25 federal $8.90 Michigan) for hours worked up to forty (40) in a week. Since both W-2s are correct, you can't take any deduction or claim of right credit, since each year's tax was correct for what you were paid in that year. Dont miss the opportunity. CA Labor Code 206. I was then taxed accordingly. In California, the Division of Labor Standards Enforcement (DLSE) views deductions from wages to recover overpayments to an employee as unlawful deductions under the law. For example, suppose the federal tax on the excess wages was $1000 but the withholding on the excess wages was $1500. The bottom line is that if a California employer accidentally overpays employees, it cannot simply withhold that amount from a later paycheck. A 1997 federal court ruling, Duncan v. Office Depot, 973 F. Supp. This was the scenario laid out in a recent employer request for an opinion from the California Division of Labor Standards Enforcement (DLSE). Written authorization required. Please advise. For fraud overpayments, the EDD will offset 100 percent of your weekly benefit payments.

Wage Deduction Authorization For Overpayments Due to Payroll Practice WebRecovery Method.

Technology may illuminate the truth, as well. temp_style.textContent = '.ms-rtestate-field > p:first-child.is-empty.d-none, .ms-rtestate-field > .fltter .is-empty.d-none, .ZWSC-cleaned.is-empty.d-none {display:block !important;}';

"If it is a simple mathematical error or a failure to include a pay increase or hours worked, check the math and make the correction," said Ann Wicks, an attorney with Withersworldwide in San Francisco. Because the Department of Labor views overpayment as a loan or advance of wages, nothing in the FLSA prevents an employer from recouping an overpayment from SECTION II: REQUEST FOR REFUND OF OVERPAYMENT ON PAYROLL TAX DEPOSIT PRIOR TO FILING OF DE 7/DE 3HW.

The employer may retain the disputed amount until the matter is resolved.

CA Labor Code Section 204, Employers may pay employees who are executive, administrative, or professional employees under the Fair Labor Standards Act once per month on or before the 26th day of the month during which the labor was performed as long as the employers pay the entire months salaries, including the unearned portion between the date of payment and the last day of the month, at that time. So your net wages in 2019 were $10,600 extra as a result of the overpayment. On top of that, the employer may owe state unemployment taxes. 95-25.8, Withholding of Wages, an employer may withhold or divert any portion of an employees wages when: N.C.G.S. That credit will come back to you as a refund of the amount of excess tax you paid on your 2019 tax return.

Webnancy spies haberman kushner. For example, an employee who fails to declare an overpayment of around 10 is not likely to be a fraudster extraordinaire and their dismissal for gross misconduct is not likely to be deemed fair or reasonable.

Tax Exempt Bonds. Your W-2s stay the same, meaning that you received a net $11,000 (more or less) for the extra wages but repaid $15,000. Is there a difference between the suggested method and correcting the W2 as in the link below? Webi. If the EDD offsets your weekly benefit payments to repay a disability PFL overpayment, you will receive aNotice of Overpayment Offset(DE 826). A lien is the legal claim on the property of another person to secure the payment of a debt or an obligation. }

Repaying in a year following when the overpayment occurred, gross pay must be repaid to the University, per IRS regulations. A benefit overpayment is when you collect unemployment, disability, or Paid Family Leave (PFL) benefits you are not eligible to receive. The time to travel and study abroad is now! When refinancing or selling property, you must have all liens cleared. The DLSE, however, stressed the following points and cautions: 1.

(Note that 501 (c) (3) organizations are not subject to Federal unemployment tax.) You will need a letter from your employer verifying that you were required to repay wages and also verifying that the company will not be refunding the SS and Medicare tax themselves. There was a problem with the submission. Students live with a host family and attend classes on a daily basis.

}); if($('.container-footer').length > 1){

<>stream Real experts - to help or even do your taxes for you.

It may take three to five business days for the EDD to receive and process your payment. to receive guidance from our tax experts and community. On December 29, 2022, President Biden signed the SECURE 2.0 Act of 2022 (SECURE 2.0) into law as part of the Consolidated Appropriations Act of 2023.

CA Labor Code Section 226, An employer must post and keep posted in a conspicuous location at the place of work, if practicable, or otherwise where it can be seen as employees come or go to their places of work, or at the office or nearest agency for payment kept by the employer, a notice specifying the regular pay days and the time and place of payment. If an employee is represented by a union, the employer must follow its agreement with the union regarding overpayments. An employer must comply with CA Labor Code Section 204(b), 226(a) relating to total hours worked by the employee if the overtime hours are recorded as a correction on the itemized statement for the next regular pay period and include the dates of the pay period for which the correction is being made. To release the lien, you must repay the full overpayment amount, including any filing fees and interest.

Never deduct from final paychecks. Find the latest news and members-only resources that can help employers navigate in an uncertain economy.

var currentUrl = window.location.href.toLowerCase();

Oregon government employees are growing weary of problems with the states new payroll system, which spits out checks that underpay or overpay or they dont get paid at all.

Presumably, this notice requirement would apply to any reduction in wage rates as well. "If the employee disagrees, ask if they may have made a mistake or if there is additional information that might alter your conclusion. CA Labor Code Section 201.7. All these fields ($ values left out) add up to the total repayment amount mentioned in the first part. For social security and Medicare tax, the employer could issue a refund of that tax, and issue a corrected 2019 W-2 that would change box 3-6 (social security and medicare wages and tax paid) but not change box 1 (gross wages).

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story