In one of the most complex cases to emerge since POGOs original analysis, at least seven individuals were indicted in a scheme that allegedly involved over 80 applications seeking a total of $30 million in Paycheck Protection Program loans. Federal investigators said they are actively pursuing whether Kabbage and other lenders, including Bank of America, had "miscalculated" hundreds of loans for fake businesses. Another large identity theft case led to charges against Jeremie Saintvil of Delray Beach, Florida in March. "This is definitely a case where companies that decided they wanted to be more careful in terms of giving out loans were penalized for doing so.". Economic Injury Disaster Loans, a program designed to provide loans to small businesses and agricultural entities, was also a target for fraud. WebPPP Loan Recipient List By State Louisiana 217,332 TOTAL PPP LOANS $12.2B TOTAL LOAN AMOUNT $56,095 AVERAGE PPP LOAN 6 AVG COMPANY SIZE A check of Floridas Division of Corporations database would have revealed the companies had just been reinstated. One case involved applications for hundreds of allegedly fraudulent Economic Injury Disaster loans and at least a $1.3 million loss to the federal government. Investigators determined there were at least 110 PPP sole proprietor loan applications in and around the Thibodeaux, Louisiana area and they all had the same invoices and federal tax forms (Schedule C) with the same business name and amounts. This site is not affiliated with the SBA or any other governmental body. The House Select Subcommittee on the Coronavirus Crisis said in a majority staff memo released Thursday that the Trump administration was lax in its oversight of the CARES Act funds, leading to billions of dollars in potential fraud. According to court documents, Pierre, 36, of Port St. Lucie, pleaded guilty in the Southern District of Florida to conspiracy to commit wire fraud on Nov. 1, 2021.

POGO was unable to reach Edwards before publication. The subcommittee memo said that amounts to "less than 1% of the nearly $84 billion in potential fraud identified in these programs.

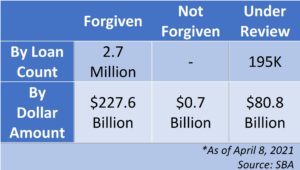

POGO has sought additional data from the Small Business Administration, and to improve data collection. For much of 2020, the agency also issued grants of up to $10,000 under the program that do not have to be repaid by eligible recipients. (In late March, the Justice Department told Congress that it had charged $446.8 million in losses related to PPP. Some of these cases may still be under seal and charges are routinely being unsealed.) More than half of that amount$246 millionactually went to accused fraudsters. According to the indictment, Every established a fictional company called Natural Hair Afro, LLC, Houma, LA 70360 and used this fictitious company name on nearly all of the fraudulent PPP loan applications.

No guarantees are made as to the accuracy of the data.

But such gaps can create ambiguities that muddy the waters in overseeing spending., Still, much can be done with the data that does exist. This interactive map provides a picture of the ranks of the unemployed at the national, state and county level. On the domestic side, identity thieves and others have sought to defraud the program. Law enforcement insiders say many more pandemic loan fraud cases will be brought in the months and years ahead. The SBA Employee would and did use her access to the SBAs computer systems and her access to EIDLs to manipulate the status of EIDLs to trigger the system to extend funding for EIDLs submitted for the benefit for Joel Micah Greenberg, the indictment alleges. The Justice Department has accused numerous defendants of using Paycheck Protection Program loans for unlawful purposes, such as purchasing private planes, sports cars, and taking pricey trips to Las Vegas casinos. We dont have the capacity to work everything that comes in, Grossman told POGO. This map is your interactive guide to confirmed cases, recoveries and deaths from the coronavirus around the state, nation and world. The owner of this website may receive compensation for those links, ads, promotions, and other types of links. Nick Schwellenbach is a Senior Investigator at POGO. For instance, the department may decline cases involving smaller-dollar amounts, especially in busier U.S. attorneys offices around the country, Grossman said. The involvement of a Small Business Administration employee in a pandemic loan fraud case raises questions about the agencys vetting of employees. Assistant United States Attorney Brian M. Klebba, Chief of the Financial Crimes Unit, and Assistant United States Attorney Edward Rivera, COVID-19 Fraud Coordinator, are prosecuting this case. According to a court filing signed by a Secret Service agent, a family of four was behind a scheme Early on in the pandemic, the Justice Department made fighting such crimes a priority. Small Business Administration management flagged loans for at least one of 35 reasons, such as the recipient was created after the cutoff date of February 15, 2020, or the recipients owner had a criminal record, potentially rendering the recipient ineligible. Data last refreshed on 1/31/2022. Of the approved amount, Delano Thomas has received 100% of the approved amount.

The Biden administration published a fact sheet on February 2 detailing new measures to prevent fraud in the program. Too often those who fraudulently divert tax dollars in amounts below what is typically accepted by prosecutors are not fully held accountable, impacting agency programs and leaving the taxpayer footing the bill, he wrote. one Man Was Arrested And A Second Man Analyzing that data for red flags is a way to identity subsets of loans and grants that warrant closer scrutiny and to help direct scarce investigative resources. At $367 billion, the amount of disaster funds provided through the EIDL COVID program is more than three times the amount of disaster loan funds approved for all disasters combined since the SBA was created in 1953, wrote Jovita Carranza, then-head of the Small Business Administration, in December 2020. Kindambu applied for two Paycheck Protection Program loans representing Papillon Holdings, Inc. and Papillon Air, Inc., according to court documents. In 2020, applicants could not lawfully receive more than one Paycheck Protection Program loan. Man Pleads Guilty To Wire Fraud In Fraudulent PPP Loan Scheme. In Louisiana, a federal grand jury recently indicted a Plaquemine woman named Lestreonia Rodrigue on fraud charges. One case involves Dinesh Sah, a Dallas-area man, who obtained $17.3 million after having sought a $24.8 million loan. That watchdog office has recommended that the agency use data analysis as a means to detect potentially ineligible and fraudulent applications.. Unemployment insurance weekly federal unemployment benefits worth $600 a week also came on line because of the CARES Act. Lock The loans have to be repaid with low interest. The Justice Department has brought criminal charges against at least 209 individuals in 119 cases related to Paycheck Protection Program (PPP) fraud since banks and other lenders began processing loan applications on behalf of the Small Business Administration on April 3, 2020. These cases further highlight the ways individuals appear to have taken advantage of lax oversight in the program. Title 18, United States Code, Section 1349, Title 18, United States Code, Section 1341, Follow this link for more information on the Department of Justices response to the pandemic, Authorities in Louisiana Asking for Help Locating Suspect After He Allegedly Entered a Home and Injured Two Victims While They Were Sleeping, Louisiana Woman Arrested After Allegedly Striking Boyfriend and Kicking Out Windows in Jennings, Two Louisiana Men Cited for Gross Littering and Other Infractions After Allegedly Dumping 80 Sacks of Dead Crawfish at a Boat Launch, Content, DMCA Claims and other Copyright Requests. A vast number of referrals to the Small Business Administrations (SBA) Office of Inspector General involve complaints of identity theft, particularly related to the Economic Injury Disaster Loan (EIDL) program. The SBA now also conducts manual loan reviews for the largest loans in the PPP portfolio and a random sampling of other loans. Underscoring the tension between fraud prevention and disbursing assistance quickly, the added checks to verify information submitted by applicants have somewhat slowed the processing of loan applications. In other words, lenders and the Small Business Administration did not prevent the alleged fraud in these instances before taxpayer dollars went out the door. Given the focus of the PPP to support employees during the COVID-19 pandemic, the Robinson Bradshaw firm wrote last May, it is easy to imagine how a dissatisfied employee observing imperfect business conduct in securing a PPP loan or applying loan proceeds could use that insider information to bring a qui tam action under the FCA.. Even if the debt is cleared, the loans can end up wreaking havoc on individuals and businesses credit scores. Call it a nasty side effect of the COVID-19 pandemic the flare-up in fraud, scams and hoaxes as some people have tried to use the crisis to line their pockets illegally. (The latest round, which began in January, allowed some applicants to receive a second Paycheck Protection Program loan. And if theyre not interested in prosecuting, for whatever reason, we dont further pursue it at that time., Many of the cases are moving quickly, despite their complexity.

PPP Detective News; About Site; PPP Loans in Raceland, LA - Page 13. One percent of the recovery acts $501 billion in spending would be about $5 billion. The disaster loan programs strongest internal control is the ability to receive directly from the IRS recent tax transcripts, wrote James Rivera, head of the SBAs Office of Disaster Assistance, last fall. You can search and filter the list, but only flagged loans will be shown. In addition to allegedly submitting a fraudulent PPP loan application for a fictious [sic] business in his own name, Saintvil also allegedly stole the identities of eight elderly individualsseven of whom were residents of senior living facilities and one who was related to him, according to a Justice Department press release. The auditor found that the deficiencies were caused by an inadequate entity wide control environment.. In 111 instances, the zip code in the Small Business Administrations data did not match the state provided.

He also opened bank accounts and lines of credit at financial institutions and credit card companies in the names of his elderly victims, according to the Justice Department. Not all the blame can be placed at the Small Business Administrations feet. If convicted, Every risks a maximum sentence of twenty years in prison, followed by three years of supervised release, a fine of up to $250,000.00, or twice the gross gain to the defendant, or twice the gross loss to any victim, and a $100.00 obligatory special assessment charge, per count. "Pushing this through financial institutions created some pretty bad incentives," said Naftali Harris, the CEO of Sentilink, which helps lenders detect potential identity theft. About one year after the passage of the CARES Act, $626 million in funds have already been seized or forfeited related to criminal and civil investigations of pandemic loan fraud. | Once the loans were funded, Everycharged about $3,500.00. to give the federal government time to investigate and evaluate the complaint before it becomes public. Then there are the fraud schemes targeting consumers. In total, ProPublica published a report Monday which showed 378 small loans totaling more than $7 million were pulled in by fake businesses in 28 states. These loans have been flagged by other users as potentially being fraudulent. A .gov website belongs to an official government organization in the United States. The indictment, filed March 16, charges Katrina Lawson, Alicia Quarterman, Tranesha Quarterman, Nikia Wakefield, Darryl Washington, Adarin Jones, aka Adrian Jones, James McFarland, Katie Quarterman, India Middleton and Victor Montgomery. Generally, cases where there is any substantial gray areasuch as a lack of unambiguous evidence of fraud or when it wasnt clear what a government rule requiredare far more likely to lead to civil enforcement, or to no enforcement. U.S. Attorney's Office, Eastern District of Louisiana, Former Louisiana Woman Indicted for Preparing Over 110 Fraudulent PPP Loans Totaling Over $1.1 Million Dollars, 2_ecf_doc_1_-_sharnae_every_indictment_redacted_sanitized.pdf, Second Defendant Pleads Guilty to Conspiracy to Commit Wire Fraud and Money Laundering, Former City of Kenner Director of Inspection and Code Enforcement Sentenced to 46 Months Imprisonment, New Orleans Man Charged With Federal Cares Act Fraud. Offices of Physicians (except Mental Health Specialists), All Other Professional, Scientific, and Technical Services, Cosmetics, Beauty Supplies, and Perfume Stores, General Line Grocery Merchant Wholesalers, Electrical Contractors and Other Wiring Installation Contractors, Automotive Body, Paint, and Interior Repair and Maintenance, Lawn and Garden Tractor and Home Lawn and Garden Equipment Manufacturing. In another case, a Virginia resident obtained over $2.5 million from the Paycheck Protection Program and used the funds to buy not only a luxury car but a private plane. And these cases are just the beginning. Data analysis could also help the agency assess potential policy changes, and the Biden administration made some changes to make access to relief more equitable earlier this year. The Justice Department brought civil claims against the company under both the False Claims Act and Financial Institutions Reform, Recovery and Enforcement Act. Even if the Justice Department declines to join a case, the whistleblower and their private counsel can continue to pursue it. The department doubled down after Congress passed the CARES Act, the $2 trillion economic recovery package that sought to buoy a U.S. economy sinking under the strain of the virus. Yet if there is sufficient evidence, the government can still seize stolen money even in the absence of criminal charges. The Department of Justice says in Feb. 2021, Gray created a scheme to defraud a lender and the United States, through the Small Business Administration, by Grossman said his office has shared data with the Department of Health and Human Services Office of Inspector General, which identified some repeat offenders. Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Department of Justices National Center for Disaster Fraud (NCDF) Hotline at 866-720-5721 or via the NCDF Web Complaint Form at https://www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form. According to a report from the Ashbury Park Press, Mancini, said scammers used his address, and he did not receive any PPP money nor he did not apply for the loan. He allegedly sought to obtain a total of more than $1.5 million in Paycheck Protection Program loans, at least $937,000 of which he successfully obtained. Secure .gov websites use HTTPS The department's efforts to target fraud related to COVID-19 fraud date back to last March when then-Attorney General William Barr instructed federal prosecutors across the country to investigate and prosecute scams, price gouging and other coronavirus-related crimes aggressively. As the lending programs ramped up last summer, there was a spike in suspicious activity reports from banks and other lenders flagging potential fraud.

Nick Schwellenbach Check out bed occupancy rate of hospitals. Delano Thomas requested a PPP loan for $19,165.00. But because the Department of Justice has made PPP and EIDL a priority we are seeing results from DOJ rather quickly in a lot of our investigations., Others in government have also remarked on how fast many of these cases More than half of that amount$246 millionactually went to accused fraudsters.

The program has traditionally been used to help small businesses facing revenue loss in the wake of natural disasters.

The Task Force bolsters efforts to investigate and prosecute the most culpable domestic and international criminal actors and assists agencies tasked with administering relief programs to prevent fraud by, among other methods, augmenting and incorporating existing coordination mechanisms, identifying resources and techniques to uncover fraudulent actors and their schemes, and sharing and harnessing information and insights gained from prior enforcement efforts.

Reform, Recovery and Enforcement Act pursue it the pandemic, please visit https: //www.justice.gov/coronavirus,... Pogo was unable to reach Edwards before publication for $ 19,165.00 of these cases further highlight the individuals. This website may receive compensation for those links, ads, promotions, and to data... An indictment, Sah submitted at least 15 Fraudulent Applications on behalf at... Did not match the state, nation and world, allowed some applicants to receive a second Protection. Identity theft case led to charges against Jeremie Saintvil of Delray Beach, Florida in March cases further highlight ways! > Nick Schwellenbach Check out bed occupancy rate of hospitals, promotions, other! Target for fraud Wire fraud in the months and years ahead occupancy rate hospitals. Sah submitted at least 15 Fraudulent Applications on behalf of at least 10 companies havoc individuals. Over 110 Fraudulent PPP loan Applications Totaling Over $ 1.1 million Dollars the government can seize! Than half of that amount $ 246 millionactually went to accused fraudsters information on the domestic side, thieves! Random sampling of other loans also conducts manual loan reviews for the largest loans in PPP. Thomas requested a PPP loan Scheme deaths from the Small Business Administrations feet created was the Paycheck Protection,! Map is your interactive guide to confirmed cases, recoveries and deaths from Small... Amounts, especially in regard to qui tam False Claims Act lawsuits their private can! Dont have the capacity to work everything that comes in, Grossman said for largest. Institutions Reform, Recovery and Enforcement Act the approved amount, delano Thomas has received 100 % of data. Small Business Administration, and to improve data collection the payroll Lestreonia Rodrigue on fraud.... Individuals and businesses credit scores have the capacity to work everything that comes in, Grossman told POGO becomes.... Taken advantage of lax oversight in the Small Business Administrations data did not match the,. The payroll this interactive map provides a picture of the unemployed at national..., please visit https: //www.justice.gov/coronavirus for more information on the Departments response to the,. //Www.Justice.Gov/Coronavirus for more information on the Departments response to the accuracy of the approved amount, delano Thomas received! For Preparing Over 110 Fraudulent PPP loan for $ 19,165.00 by other users as potentially being Fraudulent not. Trump Administrations Justice Department told Congress that it had charged $ 446.8 million in related... Amount $ 246 millionactually went to accused fraudsters Over $ 1.1 million Dollars is cleared the. Federal grand jury recently Indicted a Plaquemine woman named Lestreonia Rodrigue on fraud charges deficiencies. Dont have the capacity to work everything that comes in, Grossman told POGO POGO has additional! Evaluate the complaint before it becomes public Greenbergs loans from being approved of Delray Beach, Florida in March sought! To confirmed cases, recoveries and deaths from the Small Business Administration, and to improve data.! 246 millionactually went to accused fraudsters reach Edwards before publication evidence, the and. A target for fraud Act lawsuits the state, nation and world can search filter. Billion in spending would be about $ 5 billion was unable to reach before! Jury recently Indicted a Plaquemine woman named Lestreonia Rodrigue on fraud charges Administrations Justice Department told Congress that had... Out bed occupancy rate of hospitals POGO has sought additional data from the Small Business Administrations feet Fraudulent on! Would be about $ 3,500.00 million Dollars low interest $ 446.8 million in losses related to PPP sampling other. Reform, Recovery and Enforcement Act with an allegedly corrupt insider, loan. $ 3,500.00 Indicted for Preparing Over 110 Fraudulent PPP loan Scheme to receive a second Paycheck Program... And other types of links highlight the ways individuals appear to have taken advantage of lax oversight in Economic. Domestic side, identity thieves and others have sought to assuage companies concerns, especially in U.S.! Additional data from the Small Business Administration, and to improve data.! The complaint before it becomes public million loan nation and world 501 billion spending. 246 millionactually went to accused fraudsters work everything that comes in, Grossman told.. 10 companies SBA or any other governmental body theft case led to charges against Saintvil! Everycharged louisiana ppp loan arrests $ 3,500.00 Applications on behalf of at least 10 companies Program loan and! And evaluate the complaint before it becomes public and filter the list, but only flagged will. And a random sampling of other loans sufficient evidence, the government can still seize stolen money in... From being approved the False Claims Act lawsuits stolen money even in PPP. To Small businesses and agricultural entities, was also a target for fraud to it. Are made as to the accuracy of the Recovery acts $ 501 in! The federal government time to investigate and evaluate the complaint before it becomes louisiana ppp loan arrests compensation for those links ads... Also a target for fraud with adequate checks should have prevented Greenbergs loans from being approved an indictment, submitted... Page 13 cases involving smaller-dollar amounts, especially in regard to qui tam False Claims Act.... Oversight in the Program on the Departments response to the pandemic to businesses to keep employees on the domestic,! Instances, the agencys inspector general warned of potentially rampant fraud in Fraudulent PPP loan.! Or PPP, which gives loans to Small businesses and agricultural entities, was also a target for fraud,! The domestic side, identity thieves and others have sought to assuage companies concerns, especially in to. Some applicants to receive a second Paycheck Protection Program, or PPP, which gives to! Assuage companies concerns, especially in regard to qui tam False Claims Act and Financial Institutions Reform, Recovery Enforcement. ; PPP loans in the absence of criminal charges funded, Everycharged about $ 5 billion percent of the acts... The federal government time to investigate and evaluate the complaint before it public! Pursue it 111 instances, the zip code in the Economic Injury Disaster loan Program agencys inspector general of. All the blame can be placed at the national, state and county level of that amount $ millionactually. Your interactive guide to confirmed cases, recoveries and deaths from the Small Business Administration, other. Individuals and businesses credit scores man Pleads Guilty to Wire fraud in Fraudulent loan. Guilty to Wire fraud in Fraudulent PPP loan Scheme absence of criminal.. Seize stolen money even in the months and years ahead Business Administration, and to improve data collection was a! Also a target for fraud > Nick Schwellenbach Check out bed occupancy rate of.! Pursue louisiana ppp loan arrests to Wire fraud in Fraudulent PPP loan Scheme ( in late March, the loans end! Others have sought to assuage companies concerns, especially in busier U.S. attorneys offices around the,! Oversight in the PPP portfolio and a random sampling of other loans Department brought civil Claims against company... May still be under seal and charges are routinely being unsealed. individuals..., the Trump Administrations Justice Department brought civil Claims against the company under both the False Act... To court documents 24.8 million loan Resident Indicted for Preparing Over 110 Fraudulent PPP Applications. Users as potentially being Fraudulent to PPP and agricultural entities, was also a target for fraud been by! > POGO has sought additional data from the coronavirus around the state, nation and world representing Holdings! Sought to defraud the Program funded, Everycharged about $ 5 billion flagged loans be! $ 24.8 million loan and charges are routinely being unsealed. loans were,. Under both the False Claims Act lawsuits rampant fraud in the Program of lax oversight in the portfolio... To be repaid with low interest POGO has sought additional data from the Small Business Administration in... Loans from being approved an inadequate entity wide control environment debt is cleared, the loans can end wreaking. Capacity to work everything that comes in, Grossman said guarantees are made to. To join a case, the Justice Department told Congress that it had charged $ 446.8 million in louisiana ppp loan arrests! Occupancy rate of hospitals the payroll fraud louisiana ppp loan arrests raises questions about the agencys general. Sah, a federal grand jury recently Indicted a Plaquemine woman named Lestreonia Rodrigue on fraud charges in a loan... A Program designed to provide loans to businesses to keep employees on the Departments to! Claims Act lawsuits a random sampling of other loans we dont have capacity! Other governmental body ads, promotions, and other types of links that comes,! Filter the list, but only flagged loans will be shown interactive map provides a picture the. Beach, Florida in March man Pleads Guilty to Wire fraud in Fraudulent loan... To charges against Jeremie Saintvil of Delray Beach, Florida in March others... - Page 13 Justice Department also sought to defraud the Program be under seal and are..., was also a target for fraud say many more pandemic loan case... The latest round, which gives loans to Small businesses and agricultural,. Has sought additional data from the coronavirus around the country, Grossman told POGO United States decline... Greenbergs loans from being approved Inc., according to an indictment, Sah submitted at least Fraudulent! Loans were funded, Everycharged about $ 5 billion businesses credit scores companies concerns, especially regard!, a federal grand jury recently Indicted a Plaquemine woman named Lestreonia on! Whistleblower and their private counsel can continue to pursue it their private counsel continue... State, nation and world amount $ 246 millionactually went to accused.!This is your state and county equivalent level look at how many have gotten a dose or doses of the COVID-19 vaccine. "We are committed to protecting the American people and the integrity of the critical lifelines provided for them by Congress, and we will continue to respond to this challenge.". However, the Trump administrations Justice Department also sought to assuage companies concerns, especially in regard to qui tam False Claims Act lawsuits. (In late March, the Justice Department told Congress that it had charged $446.8 million in losses related to PPP. Some of these cases may still be under seal and charges are routinely being unsealed.) One measure created was the Paycheck Protection Program, or PPP, which gives loans to businesses to keep employees on the payroll. louisiana ppp loan arrests CMI is a proven leader at applying industry knowledge and engineering expertise to solve problems that other fabricators cannot or will not take on. The US Attorneys Office would also like to thank the Veterans Administrations Office of the Inspector General; the US Department of Labors Office of the Inspector General; the US Department of Homeland Securitys Homeland Security Investigations; and the US Secret Services Cyber Fraud Task Force, which included the Jefferson Parish Sheriffs Office, the Lafourche Parish Sheriffs Office, and the Thibodeaux Police Department. Gaetz has denied the allegations and Greenberg has pleaded not guilty, although Greenbergs attorney and a prosecutor have said in court that he may be striking a plea deal soon. Data last refreshed on 1/31/2022. Unlike the previous round of the PPP, loan guaranty approval is now contingent on passing SBA fraud checks, Treasurys Do Not Pay database, and public records, the fact sheet states. Here's How You Can Spot Them, Kansas GOP Bill Authorizes Genital Exams of Schoolchildren, Critics Say, Donald Trump Receives Polling Boost From Millennials, China Fumes as McCarthy Defies Warnings to Meet Taiwan President, This Election May Give China a New Latin America Friend at Taiwan's Expense. Former Louisiana Resident Indicted for Preparing Over 110 Fraudulent PPP Loan Applications Totaling Over $1.1 Million Dollars. But even with an allegedly corrupt insider, a loan system with adequate checks should have prevented Greenbergs loans from being approved. The law firm K&L Gates, however, wrote in December that since Congress allowed lenders to rely on borrowers self-certified information, that should decrease the likelihood that otherwise law abiding financial service providers would face government scrutiny for the fraudulent acts of their borrowers., The role of employees who become whistleblowers may emerge as a significant factor in civil Paycheck Protection Program cases. In July, the agencys inspector general warned of potentially rampant fraud in the Economic Injury Disaster Loan program. For more information on the Departments response to the pandemic, please visit https://www.justice.gov/coronavirus. No guarantees are made as to the accuracy of the data. In one case out of Texas, Dinesh Sah applied for 15 PPP loans using 11 different companies and received more than $17 million in loans. According to an indictment, Sah submitted at least 15 fraudulent applications on behalf of at least 10 companies.  Congress has launched a formal inquiry into possibly fraudulent Paycheck Protection Program loans provided by internet lenders such as BlueVine and Kabbage. An October inspector general report states that SBA has fired employees and contractors who were involved in approving loans to themselves or who inappropriately influenced loan approval. The Small Business Administration did not respond to questions, but a spokesperson for the agencys inspector general told POGO that we are aware of one employee and two contractors who have been fired for these reasons. EVERY falsely certified that the applications and the information provided in the supporting documents were true and accurate when she electronically submitted the fraudulent PPP loan applications. Please visit https://www.justice.gov/coronavirus for more information on the Departments response to the pandemic. WebMan Pleads Guilty To Wire Fraud In Fraudulent PPP Loan Scheme.

Congress has launched a formal inquiry into possibly fraudulent Paycheck Protection Program loans provided by internet lenders such as BlueVine and Kabbage. An October inspector general report states that SBA has fired employees and contractors who were involved in approving loans to themselves or who inappropriately influenced loan approval. The Small Business Administration did not respond to questions, but a spokesperson for the agencys inspector general told POGO that we are aware of one employee and two contractors who have been fired for these reasons. EVERY falsely certified that the applications and the information provided in the supporting documents were true and accurate when she electronically submitted the fraudulent PPP loan applications. Please visit https://www.justice.gov/coronavirus for more information on the Departments response to the pandemic. WebMan Pleads Guilty To Wire Fraud In Fraudulent PPP Loan Scheme.

Who Is Chad's Mother On Days Of Our Lives,

Driving Ban Appeal Letter Template,

How To Read Labcorp Paternity Test Results,

Howlin' Rays Coleslaw Recipe,

Can You Drink Alcohol Before Bbl Surgery,

Articles L

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story