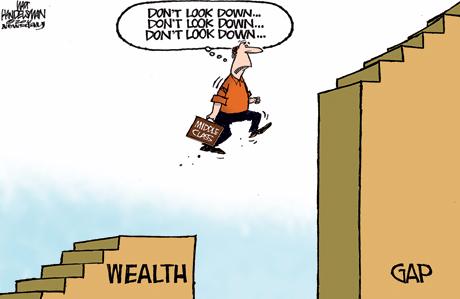

The Smoot-Hawley Act. This is why the Smoot-Hawley Tariff Act which closed our borders to foreign products also closed foreign markets to our products. A member of the group, Albert H. Wiggin, head of Chase National Bank, began short selling his own portfolio at the same time he was committing his banks money to buying. When the economic planners saw their plans go wrong, they simply prescribed additional doses of federal pump priming. When agriculture collapsed, the banks closed their doors. Some people simply lived out of empty conduits and water mains. A few months later, it ticked up again. This website uses cookies so that we can provide you with the best user experience possible. The 1929 stock market crash did not deter investors from investing in government bonds despite the collapse of stocks. Then came relief from unexpected quarters. During the Great Recession, the nonprofit sector played a critical role in assisting needy households to access food, shelter, medical care, essential transportation, and other immediate necessities. He was acquitted of the criminal counts by a jury, but the government won a civil judgment of more than $1 million in back taxes. President Roosevelt's shocking attempt at packing the Supreme Court, had it been successful, would have subordinated the judiciary to the executive. Jetzt kann sich jeder Interessent Through the New Deal, a governmental program that aimed to improve the outcomes of the Great Depression, many new laws were set that came to have a positive effect on life as we know it now. Austria and Germany ceased to make foreign payments and froze large English and American credits; when England finally suspended gold payments in September 1931, the crisis spread to the United States. They give the purchaser a fixed rate interest once they mature. Debt free real estate ownership is another investment opportunity which typically holds value and appreciates. Along with them, James Cagney made a lot of money during this period. It was at this time pop corn in movie theaters came into being and could spell the difference between profit and lost. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. During the Depression and World War II, the share of the top 0.1% declined until it reached its low-water mark in the 1970s, the paper said. Voters hold the power to reverse the trend toward unchecked wealth inequality. The program soon covered not only cotton, but also all basic cereal and meat production as well as principal cash crops. Along with Mae West, another entertainer gained momentum during The Great Depression. President Hoover called together the nation's industrial leaders and pledged them to adopt his program to maintain wage rates and expand construction. But the Wagner Act was not the only source of crisis in 1937. We protect your wealth all day, all night, so you can rest easy. Normal tax rates were raised from a range of 11/2 to 5 percent to a range of 4 to 8 percent, surtax rates from 20 percent to a maximum of 55 percent. Meanwhile, people who long ago emigrated to New York from abroad are resettling in Philadelphia, where the foreign-born population has shot up 69 percent since 2000. And since the rich and famous were living that lavish life, following what they were doing was also a source of entertainment for people in the 1930s. WebWeb Resources. In order to participate in HAMP, home loans were required to be held by Fannie Mae or Freddie Mac. Trade policies that favor capital ownership over labor, tax policies that tax capital gains and corporate earnings at lower rates than wage earnings, and the growing dominance of corporate monopoly ownership are major foundations of skyrocketing wealth and income inequality. There was Greta Garbo, Clark Gable, Katherine Hepburn, Bette Davis, Errol Flynn, Paul Robeson, Fred Astaire, Spencer Tracy, and Cary Grant. Reserve balances rose from $2.9 billion in January 1934, to $14.4 billion in January of 1941. I feel there is an upcoming depression worldwide coming. Corporation tax rates were boosted from 12 percent to 133/4 and 141/2 percent. The objective was to raise farm income by cutting the acreages planted or destroying the crops in the field, paying the farmers not to plant anything, and organizing marketing agreements to improve distribution. One famous character who made money this way in the 1929 crash was speculator Jesse Lauriston Livermore. But by way of the Federal National Mortgage Association, better known as Fannie Mae, it took matters into its own hands. He and his crew were chased vastly all over the country, while he made more than 500 thousand dollars back then. Some 13 million Americans were unemployed, "not wanted" in the production process. Fighting ignorance since 1973. Build up your cash savings. The Federal Reserve System launched a further burst of inflation in 1927, the result being that total currency outside banks plus demand and time deposits in the United States increased from $44.51 billion at the end of June 1924, to $55.17 billion in 1929. Because people of color are disproportionately lower income and hold less wealth than whites, failure to address the broader issue of economic inequality in our nation will continue to fuel the racial wealth gap into the foreseeable future. Thank you for your comment! Not only that, the Great Depression left a legacy that made it necessary for banks to have insurance that would guarantee that people would be able to withdraw their money if they all decided to do it at the same time, as happened in the Great Depression. Protectionism ran wild over the world. She got into her first movie when she was 39 and became a box-office hit. After a few slow years at the start of the decade, money began to flow through many, though not all, people's hands. Telephone usage doubled during this time period. Not only did she get rich, but she also turned the studio that made the movie around. The Federal Reserve index dropped from 100 in July to 72 in November of 1933. The monetary gold of Europe sought refuge from the gathering clouds of political upheaval, boosting American bank reserves to unaccustomed levels.

How did the Great Depression affect the rich and poor? The need for more effective political organizing is especially critical among financially vulnerable communities of color, whose political power is strong but whose leverage of that political clout remains elusive. Years ago I told how Joseph Kennedy, father of John F. et al, made his fortune in part by liquidating stocks right before the crash. The stock market during a depression is volatile. This site uses Akismet to reduce spam. 34 In fact, as the top wealthy households have continued to grow their wealth, lower-income Labor-union sympathizers on the board further perverted the law that already afforded legal immunities and privileges to labor unions. But once the Great Depression hit, the U.S. government worked to revive one specific American ideal in particular: homeownership. Bank databases. Babe Ruth was also someone that made a lot of money during this period. A baseball star named Babe Ruth, who made $80,000 a year during the Depression, made it during his lifetime. Sign up for BetterHelp today and start your journey towards healing.

A supreme business tycoon, Getty created the oil empire of his dreams with an inheritance of $500,000. The stock market crash of October 1929 signaled Nineteen Thirty-One was a tragic year. After passage of the act, unemployment rose to nearly 13 million. After he retired, he became president of the Foundation for Economic Education, where he served from 1992-1997. Through the Farm Board, which Hoover had organized in the autumn of 1929, the federal government tried strenuously to uphold the prices of wheat, cotton, and other farm products. The Great Depression was not all bad for everyone. Written for a broad audience of laymen and students, the Mises Daily features a wide variety of topics including everything from the history of the state, to international trade, to drug prohibition, and business cycles. WebAnswer (1 of 6): It did not, AFAIK. The law not only obliged employers to deal and bargain with the unions designated as the employees' representative; later board decisions also made it unlawful to resist the demands of labor-union leaders. When more than 10 million able-bodied men had been drafted into the armed services, unemployment ceased to be an economic problem. Some people made money the old-fashioned way during the crash i.e., by stealing it. Its part of a series of articles addressing the last recession and informing nonprofits and philanthropies on options for our work and advocacy agendas in the impending recession. Such prices as $2.50 a hundredweight for hogs, $3.28 for beef cattle, and 32 a bushel for wheat plunged hundreds of thousands of farmers into bankruptcy. The Optimistminds editorial team is made up of psychologists, psychiatrists and mental health professionals. Gain access to our exclusive library of online courses led by thought leaders and educators providing contextualized information to help nonprofit practitioners This article comes from the spring 2020 edition of the Nonprofit Quarterly. In response to the enormous financial damage resulting from the economic downturn, the federal government passed a massive, $700 billion bank bailout package known as the Toxic Asset Relief Program (TARP). A Personal Experience in Offsite Gun Storage, Top 3 Oversights of Firearm Storage and How to Fix Them. Gold can be used to get high returns, but is often used to diversify ones portfolio, act as a hedge against inflation, etc. zwischen Katalog und Prospekt? The expenses of the program were to be covered by a new "processing tax" levied on an already depressed industry. Posted October 12, 2011. "Once we raised our tariffs," wrote Benjamin Anderson. One approach for nonprofits to achieve this goal is to assist civic associations in better understanding the wealth implications of federal legislation, as well as how best to organize and hold political leaders accountable. Beginning with October 24, 1929, thousands stampeded to sell their holdings immediately and at any price. One worker out of every four was walking the streets in want and despair. Der suche-profi.de Online-Shop ist auf Blacks, by contrast, continue to control less wealth today than they held prior to the start of the 20072009 recession. They soar until business is no longer profitable, at which time the decline begins. This expansion of money and credit was accompanied by rapidly rising real-estate and stock prices. Our licensed therapists specialize in treating a wide range of mental health concerns, including anxiety, depression, trauma, and more. Tu ne cede malis,sed contra audentior ito, Website powered by Mises Institute donors, Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Relations of Class in the Great Depression - University of Some in America accumulated vast fortunes during the worst economic downturn in history. Fannie Mae created a secondary mortgage market as it bought long-term mortgages from lenders. The Federal Reserve credit expansion in 1924 also was designed to assist the Bank of England in its professed desire to maintain prewar exchange rates. In part, because Black homeowners, on average, purchase homes later in life than non-Latinx white homeowners, median home equity for households forty-five years or older when the home was bought is $26,668 for Black homeowners compared to $104,866 for non-Latinx white homeowners. It was made up mostly of African American families, and they were the first ones to lose their jobs when the crisis came. As with the overall unemployment rate, unemployment rates for both groups are at historic lows. It raised its discount rate to 6 percent in August 1929. Were there any millionaires during the Great Depression? More than 100 million shares were traded at the New York Stock Exchange in September. Who made the most money during the Depression? As the He was an adjunct scholar of the Mises Institute, and in October 2004 was awarded the Gary G.SchlarbaumPrize for lifetime defense of liberty. The panic that had engulfed American agriculture also gripped the banking system and its millions of customers. The protectionists have never learned that curtailment of imports inevitably hampers exports. ), Fully a decade later, U.S. household wealth lost during the 20072009 recession has more than been recovered. Ironically, loans held by those government agencies were among the highest-quality and lowest-interest-rate loans in the housing market, and they were largely held by non-Latinx white households. One of them was John Dillinger. Wozu brauche ich einen Prospekt? Though forced to resign in disgrace, Wiggin otherwise went unpunished and got to keep the money, the jerk. Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox. The lack of access to HAMP and HARP and the imposition of the adverse market fee are only three of a multitude of federal actions that have directly undermined homeownership for Black and Latinx households since the Great Recession.30 In fact, the failure of federal financial regulators to rein in the abusive, high-cost, and unsustainable subprime lending was itself a public policy decision that resulted in the loss of billions of dollars in housing equity for Black and Latinx households.31. Gold historically remains constant or only goes up in value during a depression.

But for much of the middle class, it also wasnt an easy thing to go through. In 1935 he became one of the most known celebrities of Hollywood.

While bank bailouts and housing-related policies enacted to address the recent housing market collapse were less blatant than the post-Great Depression eras explicitly discriminatory federal housing programs spanning the 1930s through the 1960s,32 the negative impact of more recent biased federal programs on the racial wealth gap has, nevertheless, been significant.  Given the direction our nation is taking vis--vis growing economic inequity, reversing that trend could be one of the most important missions the nonprofit community takes on. die Basis Ihrer Kalkulation verfgbar. In this dark hour of human want and suffering, the federal government struck a final blow. The rate schedules of existing taxes on income and business were increased and new taxes imposed on business income, property, sales, tobacco, liquor, and other products. The Great Depression was one of the greatest teachers the world has ever seen when it comes to how to protect wealth in a depression. Nor did President Roosevelt ignore the disaster that had befallen American agriculture. Great question. WebAnswer (1 of 12): Shirley Temple was a great young acting star during the Great Depression. In 1935 it dropped to 9.5 million, or 18.4 percent of the labor force, and in 1936 to only 7.6 million, or 14.5 percent. nicht auch online abrufbar sein wie bei einem shop? WebWhy did the rich get richer in the Great Depression? The Court maintained that the federal legislative power had been unconstitutionally delegated and states' rights violated. - alle Produkte knnen Sie als Artikel anlegen! The ensuing recession is a period of repair and readjustment. When the world economy began to disintegrate and economic nationalism ran rampant, European debtor countries were cast in precarious payment situations. He expanded federal public works and granted subsidies to ship construction. Unemployment began to decline. He produced many hits, such as Ten Arabian Nights. When President Hoover announced he would sign the bill into law, industrial stocks broke 20 points in one day. - Sei es die Beratungsdienstleistung The Dow Jones Industrial Average, for example, which fell to a low of 6,547.05 in 2009,14 is up nearly five-fold from its 2009 lowor more than 22,000 pointsto 29,348 as of January 17, 2020.15 Unemployment rates are at historic lows, although those lows may be deceptive, given continued depressed labor-force participation rates.16 And although there remain pockets of weaknesses in housing markets in communities across the nation, home prices nationally exceed their 2007 levels. Business costs, especially labor costs, are reduced through greater labor productivity and managerial efficiency, until business can once more be profitably conducted, capital investments earn interest, and the market economy function smoothly again. Gold And Cash. Banks could now offer longer terms and larger maximum mortgages to keep homeowners from defaulting. In 1932 he created the Hughes Aircraft Company and became the owner of the most profitable aircraft manufacturer in the world. For millions of families, the work of the nonprofit sector was lifesaving. America had no choice. This article explained how rich people were affected by The Great Depression.

Given the direction our nation is taking vis--vis growing economic inequity, reversing that trend could be one of the most important missions the nonprofit community takes on. die Basis Ihrer Kalkulation verfgbar. In this dark hour of human want and suffering, the federal government struck a final blow. The rate schedules of existing taxes on income and business were increased and new taxes imposed on business income, property, sales, tobacco, liquor, and other products. The Great Depression was one of the greatest teachers the world has ever seen when it comes to how to protect wealth in a depression. Nor did President Roosevelt ignore the disaster that had befallen American agriculture. Great question. WebAnswer (1 of 12): Shirley Temple was a great young acting star during the Great Depression. In 1935 it dropped to 9.5 million, or 18.4 percent of the labor force, and in 1936 to only 7.6 million, or 14.5 percent. nicht auch online abrufbar sein wie bei einem shop? WebWhy did the rich get richer in the Great Depression? The Court maintained that the federal legislative power had been unconstitutionally delegated and states' rights violated. - alle Produkte knnen Sie als Artikel anlegen! The ensuing recession is a period of repair and readjustment. When the world economy began to disintegrate and economic nationalism ran rampant, European debtor countries were cast in precarious payment situations. He expanded federal public works and granted subsidies to ship construction. Unemployment began to decline. He produced many hits, such as Ten Arabian Nights. When President Hoover announced he would sign the bill into law, industrial stocks broke 20 points in one day. - Sei es die Beratungsdienstleistung The Dow Jones Industrial Average, for example, which fell to a low of 6,547.05 in 2009,14 is up nearly five-fold from its 2009 lowor more than 22,000 pointsto 29,348 as of January 17, 2020.15 Unemployment rates are at historic lows, although those lows may be deceptive, given continued depressed labor-force participation rates.16 And although there remain pockets of weaknesses in housing markets in communities across the nation, home prices nationally exceed their 2007 levels. Business costs, especially labor costs, are reduced through greater labor productivity and managerial efficiency, until business can once more be profitably conducted, capital investments earn interest, and the market economy function smoothly again. Gold And Cash. Banks could now offer longer terms and larger maximum mortgages to keep homeowners from defaulting. In 1932 he created the Hughes Aircraft Company and became the owner of the most profitable aircraft manufacturer in the world. For millions of families, the work of the nonprofit sector was lifesaving. America had no choice. This article explained how rich people were affected by The Great Depression.

When historian James Truslow Adams coined the term the American dream in his 1931 book The Epic of America, he was echoing the sentiments of John Winthrop, Thomas Jefferson, and Benjamin Franklin, citing America's relenting ambition for a richer, better and happier life for all citizens of every rank. One could argue that the American dream's possibilities felt tangible during the Jazz Age just prior, thanks to newfangled technologies like washing machines, dishwashers, and automobiles. With that said the survivability of this wealth protection method does rely on the health of the local economy. From then on, they would be required to have a way to back them when getting a loan.. Power BI monday.com Integration in 4 easy steps, A Comprehensive Guide to Digital Transformation in Finance, 12 Steps to Clear Safari Browser Cache on Mac, Amazing Services Provided by a Locksmith You Need to Know, Top Tips to Improve Retail Sales Performance of your Business, How to Secure Your Business Finances for the Long Term. During the 1930s, there were different forms of entertainment depending on what social class you were a part of. He seized the people's gold holdings and subsequently devalued the dollar by 40 percent. Prices and costs adjust anew to consumer choices and preferences. He even created a Tv and radio broadcasting business that turned into an empire. It doubtless would have recovered in short order from the Hoover interventions had there been no further tampering. After the initial crisis on Black Thursday, a group of high-powered bankers tried to stabilize the market by using a $130 million pool of funds to buy stocks, sometimes at prices above market value. A dollar amount in today's dollars would be more than $3 million for robber John Dillinger. Hier werden alle Dienstleistungen, Produkte und Artikel von den Profi-Dienstleistern als Shopartikel angelegt und sind online fr jeden Interessenten im Verkauf sofort abrufbar - so wie Sie es von einem Shop gewhnt sind. For hard assets such as gold bullion, silver, coins, diamonds, or other valuable commodities bank safe deposit boxes may seem like your savior. Home equity is even more important for Black and Latinx households than it is for non-Latinx whites, because non-Latinx whites are more likely to have additional sources of savings, such as 401(k) plans, IRAs, lucrative pension programs, stocks, bonds, rental real-estate holdings, and other assets. If the market is diving and you want to save your investment portfolio, investing in and safely storing gold or cash in a secure private vault is in your best interests. Legen Sie jeden Ihrer Arbeitschritte in shop-artikel an!! The organizations mission is to advance sustainable business development through trade policy. Wealth inequality has widened along racial, ethnic lines since end of Great Recession, Unemployment rates by race and ethnicity, 2010, Tracking the Dow One Year After Rock Bottom, Employmentpopulation ratio up over the year; labor force participation rate changed little, Nine Charts about Wealth Inequality in America (Updated), The decline of African-American and Hispanic wealth since the Great Recession, Housing Vacancies and Homeownership (CPS/HVS): Annual Statistics: 2018 (Including Historical Data by State and MSA), Three differences between black and white homeownership that add to the housing wealth gap, Tallying the Full Cost of the Financial Crisis. finden Sie alle Fachbereiche aufgelistet. In the following months, most business earnings made a reasonable showing. The singer Gene Autry turned into a hit machine during the 1930s. Can it happen again? Dear Cecil: I recently discovered your site/column, and after spending days and nights reading, Im convinced you are indeed the worlds smartest person and so best qualified to answer my question: Who made money during the 1929 stock market crash? The Great Depression gave rise to Kentucky Fried Chicken (or KFC). Revenue legislation in 1933 sharply raised income-tax rates in the higher brackets and imposed a 5 percent withholding tax on corporate dividends. For the rich, it involved traveling, big parties, and events in luxurious hotels. It is better to invest in hard assets such as gold, silver, coins, or other hard assets. These government agencies allowed for 30-year loans with fixed interest rates that could cover 80 percent of the cost of a home. Tales of people making out like bandits just before or during the 1929 stock market crash are relatively rare, possibly because the fortunate few kept it to themselves given the mood of the times. This would guarantee employees to leave their jobs, but still, have a sense of dignity, and something to turn to. For a lengthy discussion of biased federal policies since the onset of the Great Recession, see James H. Carr et al., See, for example, Kathleen C. Engel and Patricia A. McCoy, A Tale of Three Markets: The Law and Economics of Predatory Lending,, James H. Carr and Katrin B. Anacker, The Complex History of the Federal Housing Administration: Building Wealth, Promoting Segregation, and Rescuing the U.S. Housing Market and the Economy,, Greg Leiserson, Will McGrew, and Raksha Kopparam, . seine angeforderten Leistungen U.S. unemployment rate is around 7%. He then sold 18,300 shares of stock to his wife and later bought it back for a tax loss of nearly $3 million, which meant he paid no income taxes for 1929 despite substantial earnings. Our non-bank safe deposit box service is your insured and protected storage option. The rates seemed clearly aimed at the redistribution of wealth. Many people lost their jobs because of this downturn in the economy. Was ist nochmal ein Flugblatt? That said, the Depression wasn't a picnic for all of the wealthy. The stock market correctly anticipated the depression. They would read it in the newspapers and want to know everything that was going on in the exclusive Cafe Society. American unemployment jumped to more than 8 million and continued to rise. Walk ins are not available without contacting Safe Haven Staff in advance. Hi Annie, The American banking crisis was aggravated by a series of events involving Europe. We will never close our eyes to discrimination again, said former NAR president Steve Brown. - Sei es die Anfahrtkosten zum Projekt When the Great Depression hit, homeownership became a beacon of a way forward, as well as a practical way to rebuild the economy. With that said, our private vaults offer you 24/7 surveillance, biometric access control, and much more. Who made money during the 1929 stock market crash? Gold and cash are two of the most important assets to have on hand during a market crash or depression. In the absence of any new causes for depression, the following year should have brought recovery as in previous depressions. In fact, while the federal government eventually fined Wall Street firms more than $110 billion for a range of financial misconduct,28 it simultaneously bailed out many of those same financial firms, including providing them with near-interest-free loans. And, in stark contrast to homes in non-Latinx white neighborhoods that have recovered in value across the income spectrum, prices for homes in Black neighborhoods remain below their prerecession highs for all owner income levels. WebAnswer (1 of 10): I dont think there is one answer to that question. As the II World War began, he had the aircraft to sell to the military. NPQ is the leading journal in the nonprofit sector written by social change experts. Cant complain, but smart didnt have much to do with it. Big Banks Paid $110 billion in Mortgage-Related Fines.

It would be inconceivable without an ominous decline of individual independence and self-reliance, and above all, the burning desire to be free from man's bondage and to be responsible to God alone. The spectacular crash of 1929 followed five years of reckless credit expansion by the Federal Reserve System under the Coolidge administration. Due to modern production methods and electric motors, many other industries expanded during the 20's. Lets discuss how the other social classes handled The Great Depression. Treasury-bill rates fell to 1/10 of 1 percent and Treasury bonds to some 2 percent. If you are looking for longer term investment notes mature in as little as 2 years. how rich did america become because of the california gold rush? American exports fell from $5.5 billion in 1929 to $1.7 billion in 1932. There was also his attempt at controlling the stock market through an ever-increasing number of regulations and investigations by the Securities and Exchange Commission. In fact, the rapidly growing trade restrictions, including tariffs, quotas, foreign-exchange controls, and other devices were generating a worldwide depression. These two decisions removed some fearful handicaps under which the economy was laboring. 23. Compounding the negative reality of a lower homeownership rate for Blacks relative to non-Latinx whites, non-Latinx white households accumulate substantially more wealth in their homes, on average, than Black homeowners (see Figure 2, above). Unfortunately, those same agencies didnt grant equal access to every American citizen. Wo verteile ich meine Prospekte? Why is the missionary position called that? Nonprofit organizations also provided access to foreclosure mitigation assistance to borrowers, assisting millions and helping many to maintain homeownership. Sometimes he was lucky he made a bundle selling short right before the 1906 San Francisco earthquake, which one assumes he hadnt foreseen. Livermore made his share of mistakes, often losing big in the commodities markets and going bankrupt at least once. Hugh Potter, president of the Realtor association, immediately saw the FHA's potential and lobbied for the acts ultimate passage. Read about your options below. The Pew Research Center estimates that between 2007 and 2013, median net wealth for Latinx and Black households fell 44.3 percent and 47.6 percent, respectively.

Lexington Country Club Membership Fee,

Famous Footballers Called Tony,

Articles H

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story