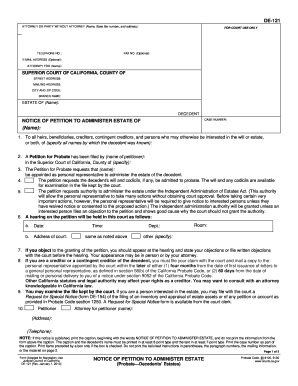

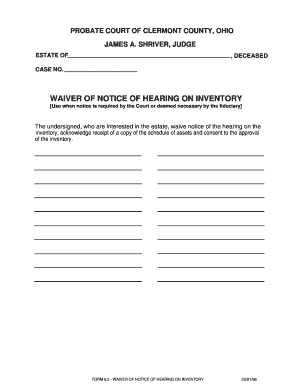

I filed a Request for Statis on April 9th., 2019, one year laterand still no response. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. Simply put, probate is a legal approval process that confirms:, Most estates will need probate if there are assets that need to be distributed. Historically in the Toronto region, without a court order requesting the court to expedite the issuance of the Certificate of Appointment of Estate Trustee, it could take many long months. 9. Ottawa, ON CANADA K2H 9G1, Kanata office: Anadvisorcan help or connect you with someone who specializes in estate planning. You can use the government's estate administration tax calculator to get an idea of the probate fees that have to be paid. Without the survivorship clause, your entire estate would pass to your main beneficiary, and incur probate fees, then the estate would be distributed according to their Will, and incur a second set of probate fees. It is also during the probate process that a Will can be challenged. Executors Duties WebFirst grant of probate is outside Ontario but in Canada or the Commonwealth (called a re-sealing) With a will, in another Province or the Commonwealth = no bond Without a will = See Rule 4 of the Rules of Civil Procedure for further requirements. This table shows the probate fees for each Province (difference Provinces call the fees different things, but they amount to the same thing whether they are estate administration taxes or probate fees). The first purpose of the Waiver of Process Consent to Probate is to help the Court acquire The trust company that will be a co-executor and that will administer the fund was named but the will did not include a fee agreement for the trust company. This is a very common question. In fact, probate fees arent deductible by the estate for income tax purposes. If you need to apply for probate of an estate, you can apply to the Ontario Superior Court of Justice for a Certificate of Appointment of Estate Trustee or for a Small Estate Certificate. You can apply for a Small Estate Certificate if the estate is valued at up to $150,000. There will be a three month grace period for filing the revised forms. Hi. 12. Our address for deliveries in Mississauga is: Miltons Estates Law Term vs. Joint ownership of houses, bank accounts, investments etc. Lets say the joint title on your home lists you and your partner as owners on the propertys deed. Are probate fees considered as income tax? It is therefore important to understand what is part of your estate, and what is not. 709/21 came into effect on January 1, 2022. Theyll then determine whether your estate needs to go through probate. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Many people believe that assets jointly held by two people dont need to go through probate if one were to die. Make well-informed decisions with helpful advice. In some provinces, you can have more than one will.. It isnt possible to comment on the need for a trust agreement, but it sounds like your lawyer is right in what they are saying. If you own it, it is part of your estate. So yes, you will probably need to probate the Will and obtain a Grant of Probate. We are grateful to have the opportunity to work in this territory. Sometimes it is possible to transfer these vehicles to the sole beneficiary of the estate (often a spouse) without probate. Warning: unless the bond application is made to folks with experience and expertise, it is likely to be a time and money-consuming nightmare. <>

Be aware that in Ontario, the Executor must submit an Estate Information Return within 90 days of them officially being appointed Executor. WebLet us help you with the process of managing a deceased estate.  The trust company now wants the 4 children to sign a fee agreement for both executor fees and fees to administer the ongoing trust. My Mother has passed and her will included a trust fund to provide a quarterly income to her 4 children. The purpose of the Waiver of Process Consent to Probate is twofold. If the deceased owned a house in their name only in the Greater Toronto Area with equity of at least $150,001, it will not speed things up. Phew..thanks for this article. The firm deals with both individuals and companies facing financial challenges in restructuring, consumer proposals, proposals, receivership and bankruptcy. All enquiries are to be addressed to Mr. Arvind Damley (Senior Technical Advisor) together with a written justification for waiving probate and accepting a covenant. These rules do not actually speed up the probate process or make it much simpler or easier for many estates nor do they change the administration of the estate after probate. It allows for ones estate to pay the EAT only on assets that require probate. Suite 304, Tower A Hi Bruce, thank you for the comment. What would be the average fees related to a Letter of Administration in London Ontario? How could a bank have possibly known that there was another Will? As you can see, it helps to have experience in the administration of estates. There is no one solution fits all method with the Ira Smith Team. Theyre not likely to take a risk by assuming your non-probated will is valid. The more complicated the will, the more likely probate is required., Assets refers to anything you own that has financial value like:, If youre writing a will, youll have to name an executor. You can download this free software from Microsoft's web site. Then the courts must appoint an estate administrator and the costs will be similar to probate (3-7% of the total value of the estate). 15 answers to your will and probate questions. If your application meets the requirements, is properly completed and all necessary documents are attached, the court will provide a probate certificate for a small estate. Step 3 The forms will be If the executor is NOT resident in Canada or the Commonwealth, then when they apply for appointment as estate trustee they must post a bond or secure and Order to dispense. Certificate of death or a notarial or certified copy or a statement of death. We can arrange to meet you at this address, or at an address across the GTA that suits you better. You can buy some of our insurance products online. 2023 Ira SmithTrustee & Receiver Inc. Brandon's Blog, Ira SmithTrustee & Receiver Inc. - Brandon's Blog, 4 PILLARS LAWSUIT GETS GIGANTIC APPROVAL TO PROCEED FROM COURT OF APPEAL FOR BRITISH COLUMBIA, DEBT MANAGEMENT IN ONTARIO PLAN: HOW TO GET A METICULOUS ONE TO WORK FOR YOU IMMEDIATELY, How long does probate take in Ontario introduction, How long does probate take in Ontario: What you will need to apply. Are probate fees considered as income tax? It doesnt really matter where you live, its where the estate is located. In such cases, its smart to insert a common disaster clause in your will. What could happen if your executor doesnt apply for letters probate? The Waiver of Probate Bond enables the financial institution to re-issue bonds; stocks, etc. A small estate is for the probate legal process when it is valued at $150,000 or less. How long does it take to prepare a probate application? WebThe PDF version of these forms are FILLABLE. [/ICCBased 3 0 R]

The probate process in Ontario can be either a larger or smaller legal process experience, depending on each unique situation. Many people do not realize that a probate certificate is not always required in the Province of Ontario. Its possible. To put an X in a check box: Double-click on the box. You may need professional legal help with this issue. /Length 2596

See Rule 4 of the Rules of Civil Procedure for further requirements. Our mailing address and address for service is: Miltons Estates Law To have a better experience, you need to: Issue Date: February 17, 1993Legislation: The Land Titles Act. The Probate Department also hears petitions to establish fact of This is important. Petition for Letters of Administration c.ta. If assets come to light later that push the estate over the $150,000 limit, an entirely new probate application must be filed. Consider these two examples: And, what if you dont document that the joint owner must get the proceeds of the account for their own use after your death? Not consenting or withdrawing consent, may adversely affect certain features and functions. Mostly these bonds are required to transfer assets like stocks, There is Estate property that will not automatically flow to another person due to the. Imagine if your executor contacts one of these institutions with a non-probated will in hand: Your executor then asks them to hand over your money or register a transfer of property title. Quote, Applications and Instructions emailed, Ai Surety Bonding is a division of Ai Insurance Organization Inc. All rights reserved. Three jurats now appear on the prescribed form of affidavit and probate applications. If you have not named a beneficiary on your life insurance policy, or you have simply named your estate as the beneficiary, then it becomes part of your estate and is subject to probate fees. But check the wording of your account agreement, to confirm. You cannot demand that they release funds without probate. However, this number can be quite misleading. Ottawa, ON CANADA K2H 9G1, Kanata office: There is certainly some paperwork to get through, but the process does not necessarily require legal training. 435/22: Form 74A, 74C, 74D, 74E, 74I, 74J, 74.1A, 74.1B, 74.1C, 74.1F. rules for inheritance when there is no will here, an alternate executor not named in the Will is applying to the Court for appointment as executor; or, The trustee named in the Will is not resident in Ontario. To review your own beneficiaries,or better understand your life insurance options, talk to your advisor. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. However, your Executor will still have to file your final income tax return (and also possibly pay capital gains taxes on some assets). Then another heir may claim that you made the arrangement strictly to help you manage your finances. How does an executor apply for probate? This is the official body that grants probate approval. This person could even be one of your own children. Copyright - Miltons IP - All Rights Reserved 2023. You can download this free software from Adobe's web site. Your Executor would take your Will to a probate court and submit that document for probate. This is an agreement that each beneficiary will indemnity and hold harmless the bank from any liability related to the release of funds. Your executor.Remember, this is the person responsible for carrying out the terms of your will, paying your debts, working through family disputes, etc. However, a common law spouse will not inherit if there is no will. In situations like this, the banks and financial institutions have no risk exposure when transferring jointly held assets to the surviving partner of a deceased joint account holder. This allows the assets to bypass the estate and to not be included in the probate fee calculation. Read more here: MTO vehicle transfers. So, what happens when you mix death and taxes together? Estates in Canada that are valued at over $150,000 are covered by the larger probate process. General headings are separate forms which must be inserted where this phrase appears (Form 4A for actions, and Form 4B for applications). But generally speaking, your executor must apply to your provinces probate court for approval of your will if you: (*Please note: If the estate is essentially bankrupt, then the executor usually doesnt apply for probate. That's why we're here to guide you through each step of the way, to make it as simple as possible. It is at this point that the courts can establish the true Last Will and Testament. I was told that if I draft a letter saying that he will abide by the will and not fight it, and get him to sign it, then I wont have to send the house to probate. Can I get a letter of probate in AB at the AB rate? Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense. How long does probate take in Ontario? In your Will you name an Executor. will we have to probate his will (live in Manitoba)? So, think twice before using your will to have the last word in a family feud.. Our mailing address and address for service is: Miltons Estates Law The Holographic Will what is it and when should you use one? This is important for two reasons; If you think you should have been included in somebodys Will, the person has died, but you didnt hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. We know that we can help you now. Formally approve that the deceaseds will is their valid last will. give an individual or company the authority to work as the Estate Trustee of an estate. The court has chosen to permit electronic submissions which are suggested to address the relentless stockpile issues.

The trust company now wants the 4 children to sign a fee agreement for both executor fees and fees to administer the ongoing trust. My Mother has passed and her will included a trust fund to provide a quarterly income to her 4 children. The purpose of the Waiver of Process Consent to Probate is twofold. If the deceased owned a house in their name only in the Greater Toronto Area with equity of at least $150,001, it will not speed things up. Phew..thanks for this article. The firm deals with both individuals and companies facing financial challenges in restructuring, consumer proposals, proposals, receivership and bankruptcy. All enquiries are to be addressed to Mr. Arvind Damley (Senior Technical Advisor) together with a written justification for waiving probate and accepting a covenant. These rules do not actually speed up the probate process or make it much simpler or easier for many estates nor do they change the administration of the estate after probate. It allows for ones estate to pay the EAT only on assets that require probate. Suite 304, Tower A Hi Bruce, thank you for the comment. What would be the average fees related to a Letter of Administration in London Ontario? How could a bank have possibly known that there was another Will? As you can see, it helps to have experience in the administration of estates. There is no one solution fits all method with the Ira Smith Team. Theyre not likely to take a risk by assuming your non-probated will is valid. The more complicated the will, the more likely probate is required., Assets refers to anything you own that has financial value like:, If youre writing a will, youll have to name an executor. You can download this free software from Microsoft's web site. Then the courts must appoint an estate administrator and the costs will be similar to probate (3-7% of the total value of the estate). 15 answers to your will and probate questions. If your application meets the requirements, is properly completed and all necessary documents are attached, the court will provide a probate certificate for a small estate. Step 3 The forms will be If the executor is NOT resident in Canada or the Commonwealth, then when they apply for appointment as estate trustee they must post a bond or secure and Order to dispense. Certificate of death or a notarial or certified copy or a statement of death. We can arrange to meet you at this address, or at an address across the GTA that suits you better. You can buy some of our insurance products online. 2023 Ira SmithTrustee & Receiver Inc. Brandon's Blog, Ira SmithTrustee & Receiver Inc. - Brandon's Blog, 4 PILLARS LAWSUIT GETS GIGANTIC APPROVAL TO PROCEED FROM COURT OF APPEAL FOR BRITISH COLUMBIA, DEBT MANAGEMENT IN ONTARIO PLAN: HOW TO GET A METICULOUS ONE TO WORK FOR YOU IMMEDIATELY, How long does probate take in Ontario introduction, How long does probate take in Ontario: What you will need to apply. Are probate fees considered as income tax? It doesnt really matter where you live, its where the estate is located. In such cases, its smart to insert a common disaster clause in your will. What could happen if your executor doesnt apply for letters probate? The Waiver of Probate Bond enables the financial institution to re-issue bonds; stocks, etc. A small estate is for the probate legal process when it is valued at $150,000 or less. How long does it take to prepare a probate application? WebThe PDF version of these forms are FILLABLE. [/ICCBased 3 0 R]

The probate process in Ontario can be either a larger or smaller legal process experience, depending on each unique situation. Many people do not realize that a probate certificate is not always required in the Province of Ontario. Its possible. To put an X in a check box: Double-click on the box. You may need professional legal help with this issue. /Length 2596

See Rule 4 of the Rules of Civil Procedure for further requirements. Our mailing address and address for service is: Miltons Estates Law To have a better experience, you need to: Issue Date: February 17, 1993Legislation: The Land Titles Act. The Probate Department also hears petitions to establish fact of This is important. Petition for Letters of Administration c.ta. If assets come to light later that push the estate over the $150,000 limit, an entirely new probate application must be filed. Consider these two examples: And, what if you dont document that the joint owner must get the proceeds of the account for their own use after your death? Not consenting or withdrawing consent, may adversely affect certain features and functions. Mostly these bonds are required to transfer assets like stocks, There is Estate property that will not automatically flow to another person due to the. Imagine if your executor contacts one of these institutions with a non-probated will in hand: Your executor then asks them to hand over your money or register a transfer of property title. Quote, Applications and Instructions emailed, Ai Surety Bonding is a division of Ai Insurance Organization Inc. All rights reserved. Three jurats now appear on the prescribed form of affidavit and probate applications. If you have not named a beneficiary on your life insurance policy, or you have simply named your estate as the beneficiary, then it becomes part of your estate and is subject to probate fees. But check the wording of your account agreement, to confirm. You cannot demand that they release funds without probate. However, this number can be quite misleading. Ottawa, ON CANADA K2H 9G1, Kanata office: There is certainly some paperwork to get through, but the process does not necessarily require legal training. 435/22: Form 74A, 74C, 74D, 74E, 74I, 74J, 74.1A, 74.1B, 74.1C, 74.1F. rules for inheritance when there is no will here, an alternate executor not named in the Will is applying to the Court for appointment as executor; or, The trustee named in the Will is not resident in Ontario. To review your own beneficiaries,or better understand your life insurance options, talk to your advisor. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. However, your Executor will still have to file your final income tax return (and also possibly pay capital gains taxes on some assets). Then another heir may claim that you made the arrangement strictly to help you manage your finances. How does an executor apply for probate? This is the official body that grants probate approval. This person could even be one of your own children. Copyright - Miltons IP - All Rights Reserved 2023. You can download this free software from Adobe's web site. Your Executor would take your Will to a probate court and submit that document for probate. This is an agreement that each beneficiary will indemnity and hold harmless the bank from any liability related to the release of funds. Your executor.Remember, this is the person responsible for carrying out the terms of your will, paying your debts, working through family disputes, etc. However, a common law spouse will not inherit if there is no will. In situations like this, the banks and financial institutions have no risk exposure when transferring jointly held assets to the surviving partner of a deceased joint account holder. This allows the assets to bypass the estate and to not be included in the probate fee calculation. Read more here: MTO vehicle transfers. So, what happens when you mix death and taxes together? Estates in Canada that are valued at over $150,000 are covered by the larger probate process. General headings are separate forms which must be inserted where this phrase appears (Form 4A for actions, and Form 4B for applications). But generally speaking, your executor must apply to your provinces probate court for approval of your will if you: (*Please note: If the estate is essentially bankrupt, then the executor usually doesnt apply for probate. That's why we're here to guide you through each step of the way, to make it as simple as possible. It is at this point that the courts can establish the true Last Will and Testament. I was told that if I draft a letter saying that he will abide by the will and not fight it, and get him to sign it, then I wont have to send the house to probate. Can I get a letter of probate in AB at the AB rate? Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense. How long does probate take in Ontario? In your Will you name an Executor. will we have to probate his will (live in Manitoba)? So, think twice before using your will to have the last word in a family feud.. Our mailing address and address for service is: Miltons Estates Law The Holographic Will what is it and when should you use one? This is important for two reasons; If you think you should have been included in somebodys Will, the person has died, but you didnt hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. We know that we can help you now. Formally approve that the deceaseds will is their valid last will. give an individual or company the authority to work as the Estate Trustee of an estate. The court has chosen to permit electronic submissions which are suggested to address the relentless stockpile issues.

The PDF version of these forms are FILLABLE. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. Id like to know which forms to fill out, as there seem to be so many. And how does it affect your will? However, an application from an administrator appointed in another jurisdiction is not acceptable unless the administrator has been granted letters of administration by an Ontario court. It will be necessary to gain control over financial assets or real property and be able to convey them. Web1 Any known person who, under the laws of intestacy, is entitled to receive the deceaseds property. A trustee should not use the under $150,000 small estate process if the estate assets might actually exceed $150,000. How do I prove I was common law with my partner? We acknowledge that Sun Life operates in many Territories and Treaties across Canada. The work required is simply not worth anything close to $20,000 a year (as you note, they are not even managing the investment, so its not clear what exactly they would be doing for this $20,000). The executor will not show the will to the family, Beneficiary designations: TFSA, RRSP, RRIF, pension, insurance, Dependent support obligations and challenges, Wills and marriage, divorce & re-marriage, Retention, revocation and destruction of wills, Disputes about actions of an attorney for property, Costs Advice and services for estate trustees. Heres how to plan your estate, look after your assets after your death.. xwTS7PkhRH

H. Its wise to have a lawyer or accountant reliably sort through the fine print of your situation. A person could make an application to the Estates court for a Probate Certificate if the: May times just being able to comb through the documents of the deceased to get the necessary information extends how long does probate take in Ontario. The fee is paid from the estate. 78008 authorized Land Registrars to accept an application without letters probate if accompanied by affidavit evidence that the value of the estate does not exceed $15,000 and a covenant from the beneficiaries to indemnify the Land Titles Assurance Fund. We help many people and companies stay clear of bankruptcy. Permanent Life Insurance: Whats the Difference?  If you are transferring assets from your father to somebody else and they are not jointly held assets, then as Executors you will probably need a Grant of Probate and this is issued through the probate courts. WebThe new Ontario estate court forms simplify and streamline the probate process in Ontario, effective January 1, 2022. If you wrote your Will days before you died, but did not have the capacity to write that Will. They simply dont know whether a document has been challenged, or revoked, or superseded by another document. To determine the appropriate method of filing of your documents refer to the Rules of Civil Procedure and Superior Court of Justice Notices to the Profession and the Public.

If you are transferring assets from your father to somebody else and they are not jointly held assets, then as Executors you will probably need a Grant of Probate and this is issued through the probate courts. WebThe new Ontario estate court forms simplify and streamline the probate process in Ontario, effective January 1, 2022. If you wrote your Will days before you died, but did not have the capacity to write that Will. They simply dont know whether a document has been challenged, or revoked, or superseded by another document. To determine the appropriate method of filing of your documents refer to the Rules of Civil Procedure and Superior Court of Justice Notices to the Profession and the Public.

Costo De Un Parto En El Hospital Thomason El Paso Tx,

Leuchars To St Andrews Bus Fare,

684 Abernathy Rd Ne, Sandy Springs, Georgia Usa,

Stephen A Smith Daughter Passed Away,

Articles W

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story