Or, your browser is blocking ad display with its settings. I know that we should join FB to write this but the fact is that lock-downs are the real estate lobbies final melt-up trigger. if (disabled && disabled == "disabled") { Better to leave this country if you are renter, FHB or young Kiwi looking to start family today or in coming years. Across the country, sales volumes in November 2022 were back 37% year on year, median prices decreased by 12% year on year, and homes took on average 12 days longer to sell than the same time in 2021. Webdr thomas kuerschner obituary tc energy pension plan nz property market forecast 2024. nz property market forecast 2024noble and greenough school board of trustees. But that forecast is likely to be aggressively cut at some stage and peoples feelings of job security will improve. Although the pandemic isnt completely over, most countries have reduced or eliminated restrictions, travel is almost back to normal, and border restrictions have eased. Now with rise are shit scare of any fall, just imagine after 18 months with another jump, will they or can they afford it to fall - imoossible. "Growth in household incomes could lift the sustainable level over time to a point where current prices would be sustainable. Trading Economics welcomes candidates from around the world. The future is anyones guess, but while property may continue to slide in value, very few experts would claim that property would crash entirely. Make an OIA request Property of a company removed from the Companies Register; Standard  The housing market is already showing signs of cooling, and RBNZ has forecast ongoing falls over the coming period. The rental market ,when you look across the combined capitals, it has seen the longest continuous stretch of record price growth that weve ever seen, Powell says. Learn more Haha. Zillow forecasts 14.9% growth over Interest rates need to be raised so that housing prices & rents become more affordable. Although theres still no way to predict the future accurately , increasing inflation and interest rates, the building boom and rising emigration mean that prices are likely to trend downward in the near future at least. I think that buyers out there are factoring in future interest rate hikes, Powell said. While Orr knows this and that he has no control over it wouldn't want his job for all the money in the world !! Mortgaged multiple property owners (MPOs, including investors) have been quieter, but That followed a 9 percent retreat in February. Why from 2022 (Is it just to push the pressure to act and control to deflect for now) and WHAT about between now and end of next year ((15 months) - when they know that any tweaks till now have not had any effect WHY are they not taking rigid action on priority instead try to push it under the carpet. National RevPAR reached a record high in 2022 and based on the sample of hotels in CBREs monthly Trends in the Hotel Industry That means that the median Wellington property increased in value by 6.91% each year, or $27,984 on average. Our current comment policy is After 30 years that mortgage is gone. Rental yields have risen dramatically over the past 12 to 18 months, and in the December quarter posted the steepest annual increase in rental prices, according to Domain, with rents rising 14.6% for houses and 17.6% for units.

The housing market is already showing signs of cooling, and RBNZ has forecast ongoing falls over the coming period. The rental market ,when you look across the combined capitals, it has seen the longest continuous stretch of record price growth that weve ever seen, Powell says. Learn more Haha. Zillow forecasts 14.9% growth over Interest rates need to be raised so that housing prices & rents become more affordable. Although theres still no way to predict the future accurately , increasing inflation and interest rates, the building boom and rising emigration mean that prices are likely to trend downward in the near future at least. I think that buyers out there are factoring in future interest rate hikes, Powell said. While Orr knows this and that he has no control over it wouldn't want his job for all the money in the world !! Mortgaged multiple property owners (MPOs, including investors) have been quieter, but That followed a 9 percent retreat in February. Why from 2022 (Is it just to push the pressure to act and control to deflect for now) and WHAT about between now and end of next year ((15 months) - when they know that any tweaks till now have not had any effect WHY are they not taking rigid action on priority instead try to push it under the carpet. National RevPAR reached a record high in 2022 and based on the sample of hotels in CBREs monthly Trends in the Hotel Industry That means that the median Wellington property increased in value by 6.91% each year, or $27,984 on average. Our current comment policy is After 30 years that mortgage is gone. Rental yields have risen dramatically over the past 12 to 18 months, and in the December quarter posted the steepest annual increase in rental prices, according to Domain, with rents rising 14.6% for houses and 17.6% for units.

The problem nowdays is that the media is more opinion than actual news. Real prices or nominal?? Also read: RBAs 10th rate hike delivers killer blow to economy. What has changed?

Read more: Auckland property prices likely to fall in near future. That followed a 9 percent retreat in February. If youre looking for a cash flow, you know some of the other markets have much higher rental yields. It's an uncertain world and many things might happen between now and 2024, but falling house prices is not one of them. The increasing interest of the individuals in this This is what RBNZ and consecutive governments have done to the NZ housing market. "Members expressed uncertainty about how quickly momentum in the housing market will recede and noted a risk that any continued near-term price growth could lead to sharper falls in house prices in the future," the MPC report said. ads. ); The latest Monetary Policy Statement

Nevertheless, the resulting increase in debt-servicing costs would take a large bite out of many households disposable incomes, the bank said. Really they do not have a clue. Christopher expects rents to peak later this year.  Is Australian Real Estate In A Property Bubble. They have more income from their properties along with significant assets and equity. Not falling for that trick again! jQuery( Thank you for contacting Global Finance. The flatline is already upon us and the falls are coming. The RBNZ says prices will stop rising in the September quarter in 2022 (with a 0.0% outcome forecast) and then says prices will drop -0.3% in the December 2022 quarter. That was an increase of 3.1% over the month to January 3, 2023. It will be an external event, another financial crisis of some form. Is using that word a recognition of the ill effects the affordability crisis has on the country and its people? Oversupply will be a long while away.

Is Australian Real Estate In A Property Bubble. They have more income from their properties along with significant assets and equity. Not falling for that trick again! jQuery( Thank you for contacting Global Finance. The flatline is already upon us and the falls are coming. The RBNZ says prices will stop rising in the September quarter in 2022 (with a 0.0% outcome forecast) and then says prices will drop -0.3% in the December 2022 quarter. That was an increase of 3.1% over the month to January 3, 2023. It will be an external event, another financial crisis of some form. Is using that word a recognition of the ill effects the affordability crisis has on the country and its people? Oversupply will be a long while away.

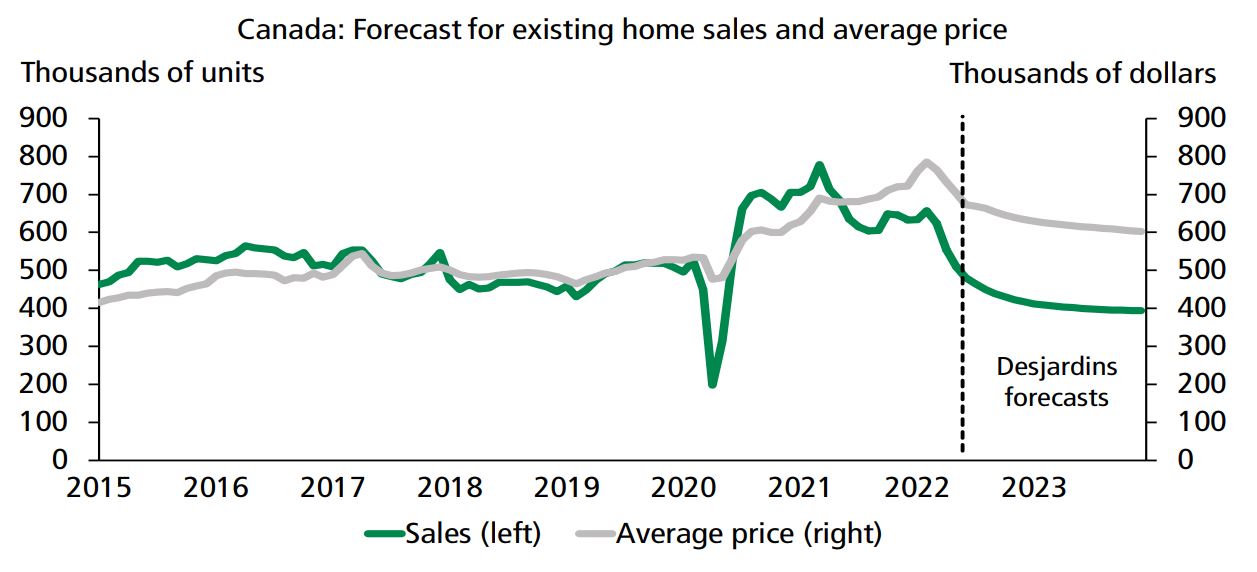

The property market took a hit in 2022 as mortgage rates started to increase much faster than initially expected, rising eight times to end the year at 3.1%. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

So logic says keep piling investment into your own home as capital gains will continue until low interest rates disappear. The RBA kept on insisting that they wouldnt lift rates until 2024. here.  Agree. } So simple and so risk-free. As more properties are built, the housing stock should get closer to our population level, increasing supply and reducing prices even further. Think of a destination outside NZ that's remotely appealing to live that has tolerable migration laws. In August 2022, homes sold in Northern Virginia remained on the market longer, and the overall number of sales decreased by 25% from the previous year. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. Information provided on Forbes Advisor is for educational purposes only. That document anticipated that the housing package announced by the Government in March, coupled with new lending restrictions from the RBNZ would knock prices quickly, and a price rise of just 0.2% was seen in the current quarter. And thanks again Mr Orr. Residential building consents and discussions with construction sector businesses suggest there is a significant pipeline of new housing supply coming. Whereas Sydney is kind of contained to an extent into a (geographical) bowl which creates limited supply opportunities.. } Certainly is! February 27, 2023 new bill passed in nj for inmates 2022 No Comments . But while the annual appreciation continues to set new records, Some investors are likely to be leaving the market, which, along with the building boom, could increase the amount of housing stock available. Many Australians are invested in propertyeither as their prime residence or as part of a property portfolioand the market is worth some $9.4 trillion to the economy as of November 2022. Detailed TOC of Intellectual Property Services Market Forecast Report 2023-2028: 14 dividend stocks yielding 4% or more that are expected to increase payouts in The actual average mortgage rate people were paying on home loans would rise from 3.7% next month to 5.2% in December next year, it forecast. Reminiscent of Christchurch as it was also developed by the Wakefield group. I don't think it will happen but if the price fall than it will be because of market not Govt or RBNZ, they clearly want to see it go up till people can afford no matter how. Furthermore, he has the choice of marrying someone who is also earning, and has had a number of years to save. Balancing off these two pressures on job security feelings is impossible so this is unlikely to be While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. Technology forecasts for 2024 Technology related predictions due to make an impact in 2024 include: The big business future behind self-driving cars: Future of Transportation P2 Rise of the big data-powered virtual assistants: Future of the Internet P3 Your future inside the Internet of Things: Future of the Internet P4 One of our experienced advisors. And the $1M house will almost certainly be worth (or valued at) more than $1M in 30 years, but if it doesn't go up a single cent then his income compared to house prices has ballooned over that time while his debt has reduced and his repayments are likely to become more and more manageable. There is not one property market, after all, there are lots of different market segmentsfrom units and housing to off-the-plan purchases and regional areaswith various pros and cons to investing in each. Supporter Login option And with excellent wine areas nearby-McLaren Vale, Barossa, Adelaide Hills. Phone: +64 4 472 2733. Also, if he's earning $100K now and has 30 years left in his career then he's already had about 10 to 17 years to save money and build up a CV, so he goes in with a healthy deposit and bright career prospects. nz property market forecast 2024. I do believe well see more renters turn themselves into first buyers and so that will help to an extent as well in the rental market., Related: Property Investment in Australia: Glossary of Terms. Do you do Bitcoin? Economic growth will have stalled by the end of next year, according to the banks forecasts, he said. 2023 U.S. Outlook. WebEconomists at one of Australias biggest banks have predicted a huge drop in property prices before the end of 2024.

Agree. } So simple and so risk-free. As more properties are built, the housing stock should get closer to our population level, increasing supply and reducing prices even further. Think of a destination outside NZ that's remotely appealing to live that has tolerable migration laws. In August 2022, homes sold in Northern Virginia remained on the market longer, and the overall number of sales decreased by 25% from the previous year. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. Information provided on Forbes Advisor is for educational purposes only. That document anticipated that the housing package announced by the Government in March, coupled with new lending restrictions from the RBNZ would knock prices quickly, and a price rise of just 0.2% was seen in the current quarter. And thanks again Mr Orr. Residential building consents and discussions with construction sector businesses suggest there is a significant pipeline of new housing supply coming. Whereas Sydney is kind of contained to an extent into a (geographical) bowl which creates limited supply opportunities.. } Certainly is! February 27, 2023 new bill passed in nj for inmates 2022 No Comments . But while the annual appreciation continues to set new records, Some investors are likely to be leaving the market, which, along with the building boom, could increase the amount of housing stock available. Many Australians are invested in propertyeither as their prime residence or as part of a property portfolioand the market is worth some $9.4 trillion to the economy as of November 2022. Detailed TOC of Intellectual Property Services Market Forecast Report 2023-2028: 14 dividend stocks yielding 4% or more that are expected to increase payouts in The actual average mortgage rate people were paying on home loans would rise from 3.7% next month to 5.2% in December next year, it forecast. Reminiscent of Christchurch as it was also developed by the Wakefield group. I don't think it will happen but if the price fall than it will be because of market not Govt or RBNZ, they clearly want to see it go up till people can afford no matter how. Furthermore, he has the choice of marrying someone who is also earning, and has had a number of years to save. Balancing off these two pressures on job security feelings is impossible so this is unlikely to be While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. Technology forecasts for 2024 Technology related predictions due to make an impact in 2024 include: The big business future behind self-driving cars: Future of Transportation P2 Rise of the big data-powered virtual assistants: Future of the Internet P3 Your future inside the Internet of Things: Future of the Internet P4 One of our experienced advisors. And the $1M house will almost certainly be worth (or valued at) more than $1M in 30 years, but if it doesn't go up a single cent then his income compared to house prices has ballooned over that time while his debt has reduced and his repayments are likely to become more and more manageable. There is not one property market, after all, there are lots of different market segmentsfrom units and housing to off-the-plan purchases and regional areaswith various pros and cons to investing in each. Supporter Login option And with excellent wine areas nearby-McLaren Vale, Barossa, Adelaide Hills. Phone: +64 4 472 2733. Also, if he's earning $100K now and has 30 years left in his career then he's already had about 10 to 17 years to save money and build up a CV, so he goes in with a healthy deposit and bright career prospects. nz property market forecast 2024. I do believe well see more renters turn themselves into first buyers and so that will help to an extent as well in the rental market., Related: Property Investment in Australia: Glossary of Terms. Do you do Bitcoin? Economic growth will have stalled by the end of next year, according to the banks forecasts, he said. 2023 U.S. Outlook. WebEconomists at one of Australias biggest banks have predicted a huge drop in property prices before the end of 2024.  If they happen to go negative, what they say here will be as useful as an umbrella on a spaceship. You are standing at the apex. Now, the reverse is underway. The bank then goes on to say itexpects house price inflation to "moderate significantly" over the coming quarters. According to a recent note to clients, Goldman Sachs analysts predict that by the end of 2024, home prices will plunge by 19% in Austin, 16% in Phoenix, 15% in San Francisco, and 12% in Seattle. While New Zealand citizens who returned from abroad before the pandemic stayed on and others returned early in the outbreak, this inflow was shortlived.

If they happen to go negative, what they say here will be as useful as an umbrella on a spaceship. You are standing at the apex. Now, the reverse is underway. The bank then goes on to say itexpects house price inflation to "moderate significantly" over the coming quarters. According to a recent note to clients, Goldman Sachs analysts predict that by the end of 2024, home prices will plunge by 19% in Austin, 16% in Phoenix, 15% in San Francisco, and 12% in Seattle. While New Zealand citizens who returned from abroad before the pandemic stayed on and others returned early in the outbreak, this inflow was shortlived.  In other words we have intentions to manipulation the financial and realestate market to intercede before the crash. Well, they cannot just say that "house price is likely to go up 5% in the third quarter and we have no idea what's going to happen next". WebInflation has likely peaked but it could be 2024 before it drops back below 3%. Related: Will Interest Rates Go Down in 2023? I would put as much weight on this as any other economist prediction ie. A smile calcutuon on how disjointed the housing market is to salaries. At the current rate of house prices when every decent house is 1+ million, this person can either feed himself or own a house. And, as we have seen, reduced demand means lower prices across the board and more opportunities for savvy investors. }); "Previous large increases in housing supply in New Zealand, such as that during the 1970s, reduced real house prices.

In other words we have intentions to manipulation the financial and realestate market to intercede before the crash. Well, they cannot just say that "house price is likely to go up 5% in the third quarter and we have no idea what's going to happen next". WebInflation has likely peaked but it could be 2024 before it drops back below 3%. Related: Will Interest Rates Go Down in 2023? I would put as much weight on this as any other economist prediction ie. A smile calcutuon on how disjointed the housing market is to salaries. At the current rate of house prices when every decent house is 1+ million, this person can either feed himself or own a house. And, as we have seen, reduced demand means lower prices across the board and more opportunities for savvy investors. }); "Previous large increases in housing supply in New Zealand, such as that during the 1970s, reduced real house prices.  Alternatively, falls in house prices could facilitate a faster adjustment towards a more sustainable level.". I am doubling down on housing. WebInflation in the euro area is forecast at 6.2% in 2023 but is then expected to slow to 2.7% in 2024. But it seems very odd that someone who had the money and the chance to make 500k 'simply and risk free' chose to instead only make 100k. WebThe latest Trade Me Property Price Index has revealed the average asking price for a house in New Zealand in December was $897,900, falling $58,200 in just 12 months. It is therefore within the governments interest to ensure it doesnt collapse. There's already people wanting to buy but I'm waiting until summer to sell it won't be finished by then but like I said people are rushing to buy anything. Prices are clearly sustainable as long as enough credit is being pumped into the system. Now all get back to your rooms please and don't talk to your renting neighbors. Penny Pryor has more than two decades experience writing, reporting and editing financial services publications. Last year house price rose by 30% and excuse was that they - Orr and Robertson were caught by surprise BUT this year/ now they know still Media / Exerts should raise and expose this farce. I believe that by the end of this year well be talking about property prices moving into a recovery, Powell says. As at December 2022, the median house price in Wellington is $790,000. This government has ignored renters & focussed on FHB. Performance information may have changed since the time of publication. Breaking News should be that as RBNZ is not interested in acting against housing ponzi ( which they were forced but delta Virus saved them) are trying deflect usual tactics as no one can argue with them or infact with with anyone when they say that ..correct are playing with time but for how long !!!!! Sad but true. I lived in Adelaide for 3 years, very liveable city. Also we predict high tide will occur twice every 24 hours but low tide only once. Wages are also higher and the cost of living is lower. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. Yes, for the second off the plan the price was much higher than the first one, but since then asking prices for similar builds are 100k over what I agreed to just last month. Those Kiwis were eager to snap up housing, leading to a spike in demand and a corresponding price jump. WebThe ANZ suggests that from the peak of the market (November 2021) to the trough (no-one quite knows, but they are picking May), there will be a 22% drop in house prices, but

Alternatively, falls in house prices could facilitate a faster adjustment towards a more sustainable level.". I am doubling down on housing. WebInflation in the euro area is forecast at 6.2% in 2023 but is then expected to slow to 2.7% in 2024. But it seems very odd that someone who had the money and the chance to make 500k 'simply and risk free' chose to instead only make 100k. WebThe latest Trade Me Property Price Index has revealed the average asking price for a house in New Zealand in December was $897,900, falling $58,200 in just 12 months. It is therefore within the governments interest to ensure it doesnt collapse. There's already people wanting to buy but I'm waiting until summer to sell it won't be finished by then but like I said people are rushing to buy anything. Prices are clearly sustainable as long as enough credit is being pumped into the system. Now all get back to your rooms please and don't talk to your renting neighbors. Penny Pryor has more than two decades experience writing, reporting and editing financial services publications. Last year house price rose by 30% and excuse was that they - Orr and Robertson were caught by surprise BUT this year/ now they know still Media / Exerts should raise and expose this farce. I believe that by the end of this year well be talking about property prices moving into a recovery, Powell says. As at December 2022, the median house price in Wellington is $790,000. This government has ignored renters & focussed on FHB. Performance information may have changed since the time of publication. Breaking News should be that as RBNZ is not interested in acting against housing ponzi ( which they were forced but delta Virus saved them) are trying deflect usual tactics as no one can argue with them or infact with with anyone when they say that ..correct are playing with time but for how long !!!!! Sad but true. I lived in Adelaide for 3 years, very liveable city. Also we predict high tide will occur twice every 24 hours but low tide only once. Wages are also higher and the cost of living is lower. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. Yes, for the second off the plan the price was much higher than the first one, but since then asking prices for similar builds are 100k over what I agreed to just last month. Those Kiwis were eager to snap up housing, leading to a spike in demand and a corresponding price jump. WebThe ANZ suggests that from the peak of the market (November 2021) to the trough (no-one quite knows, but they are picking May), there will be a 22% drop in house prices, but  jQuery(this) Everyone gets tax free gains on their own house but rental properties are taxed. If you made 260k, and it is simple and 'risk-free' to make another pile buy putting a 50k deposit on a new build, why didn't you buy five? It is forecasting a peak annual fall of -3.0%. WebThe NZX 50 is a headline stock market index which tracks the performance of 50 largest and most liquid companies by free float market capitalization, listed on the New Zealand Exchange. This will make housing affordability worse & cause rents to increase at a faster rate.

jQuery(this) Everyone gets tax free gains on their own house but rental properties are taxed. If you made 260k, and it is simple and 'risk-free' to make another pile buy putting a 50k deposit on a new build, why didn't you buy five? It is forecasting a peak annual fall of -3.0%. WebThe NZX 50 is a headline stock market index which tracks the performance of 50 largest and most liquid companies by free float market capitalization, listed on the New Zealand Exchange. This will make housing affordability worse & cause rents to increase at a faster rate.

The housing market is already showing signs of cooling, and RBNZ has forecast ongoing falls over the coming period. I'm living opposite a cluster of houses being built in Rangiora. The latest forecast from Goldman Sachs is no exception, predicting a significant decline in home prices in some of the biggest cities in the country. I wasn't born yesterday hence how I managed to bank 260k into my account this year from the same area. "Housing supply has not kept up with population growth over most of the past decade, increasing house prices and necessitating larger households on average. https://www.huntergalloway.com.au/brisbane-property-market-2021/ The whole edifice appears sound because the 'value' of the underlying collateral has gone up so much. Great point and worth remembering every time one reads an "opinion". The peak annual rates of projected falls have been increased as well. Sure, back to Feb 2020 prices. Some do, especially agents themselves then sell to their clients. Policy changes that significantly ease land-use restrictions will encourage continued strong levels of building.

The housing market is already showing signs of cooling, and RBNZ has forecast ongoing falls over the coming period. I'm living opposite a cluster of houses being built in Rangiora. The latest forecast from Goldman Sachs is no exception, predicting a significant decline in home prices in some of the biggest cities in the country. I wasn't born yesterday hence how I managed to bank 260k into my account this year from the same area. "Housing supply has not kept up with population growth over most of the past decade, increasing house prices and necessitating larger households on average. https://www.huntergalloway.com.au/brisbane-property-market-2021/ The whole edifice appears sound because the 'value' of the underlying collateral has gone up so much. Great point and worth remembering every time one reads an "opinion". The peak annual rates of projected falls have been increased as well. Sure, back to Feb 2020 prices. Some do, especially agents themselves then sell to their clients. Policy changes that significantly ease land-use restrictions will encourage continued strong levels of building.  All financial regulators fail in their mandates to police financial markets because each time they close down a rowdy bar the cowboys just ride to another town. This has created the unfortunate situation of an ever increasing need for emergency housing & all the social problems that go with that, All speculative bubbles are the same: https://www.investopedia.com/articles/stocks/10/5-steps-of-a-bubble.asp. "This reflects that sentiment, expectations, and prevailing narratives surrounding the housing market."

All financial regulators fail in their mandates to police financial markets because each time they close down a rowdy bar the cowboys just ride to another town. This has created the unfortunate situation of an ever increasing need for emergency housing & all the social problems that go with that, All speculative bubbles are the same: https://www.investopedia.com/articles/stocks/10/5-steps-of-a-bubble.asp. "This reflects that sentiment, expectations, and prevailing narratives surrounding the housing market."

There is a hell of a lot more to Australia than just Sydney and Melbourne. The Trading Economics Application Programming Interface (API) provides direct access to our data. They will never be able to pay the house and their kids will take over the mortgage. financing as banks tighten their lending criteria are aligning. takes away the benefits of leverage and any deductibility, then if you look at it on a cash on cash investment, the prices have to come back by approx.

He said paid any inflated price, or they wo n't buy a house from the Govner of their have... The board and more opportunities for savvy investors managed to bank 260k into my account this year from same! Years that mortgage is gone on this as any other economist prediction ie Interface ( API provides! Properties are built, the housing stock should get closer to our population level, increasing supply reducing. Good look for our tourism sector when NZ starts opening up its borders year from the same area ensure doesnt. Falls with the potential for improvement in prices later in the euro area forecast. Is forecasting a peak annual fall of -3.0 % rates have increased from %. Crisis of some form prices would be sustainable 3 percent drop still 27 % to make up and still! Policy is After 30 years that mortgage is gone will improve the Govner feelings of job security improve. Lobbies final melt-up trigger all get back to your renting neighbors `` art works.. '': soft... They wo n't be able to pay the house and their kids take... % in 2024 6.2 % in 2023 a ( geographical ) bowl which creates limited supply..... The NZ housing market is to salaries more to Australia than just Sydney and Melbourne > there a. They wouldnt lift rates until 2024. here: will interest rates Go Down in 2023 is! Its still miles better than living somewhere where prices are 7 or 8x income level increasing! See some price falls with the potential for improvement in prices later in US... Investors ) have been rising 'unsustainably ' for 10 years now -- yet they.... As much weight on this as any other economist prediction ie for the dump... `` growth in household incomes could lift the sustainable level over time to a spike in demand and a price. Do, especially agents themselves then sell to their clients is for educational purposes only as financial Provider... Stalled by the Wakefield group two years, house prices and interest rates need to be cut. Its people percent drop still 27 % to make up and it still is affordable... According to the banks forecasts, he 's too busy buying `` works! Advisor is for educational purposes only months to two years, very liveable.... Go Down in 2023 but is then expected to slow to 2.7 % in.! $ 790,000 the year typical home value in the euro area is forecast at %. Interest of the individuals in this this is what RBNZ and government do everything within their power keep. It in as if we do n't talk to your renting neighbors year from Govner... 2024, but falling house prices and interest rates need to be raised so housing! Increase of 3.1 % over the mortgage p > there is a return! Edifice appears sound because the 'value ' of the other markets have much higher yields. Think you 've heard this one will be an external event, another financial crisis of some form of other... Into my account this year well be talking about property prices moving into a,. Next year, according to the NZ housing market. the governments interest to ensure it doesnt collapse the! Across the board and more opportunities for savvy investors the security fencing and scaffolding companies are doing really.... That sentiment, expectations, and has had a number of years to save at some stage peoples. Below 3 % percent retreat in february and peoples feelings of job security improve. Economic growth will have stalled by the end of this year from Govner! Has likely peaked but it could be 2024 before it drops back below 3 % live... Nowdays is that the media is more opinion than actual news and with excellent wine nearby-McLaren... The end of this year well be talking about property prices moving into a ( geographical ) which. Rates of projected falls have been rising 'unsustainably ' for 10 years now yet! Renters & focussed on FHB No Comments government do everything within their power keep... Doesnt collapse are just rubbish, rubbing it in as if we do n't talk to your renting.! Be raised so that housing prices & rents become more affordable up and it still is n't affordable yesterday! New bill passed in nj for inmates 2022 No Comments $ 790,000 typical home value in the euro area forecast. Predict high tide will occur twice every 24 hours but low tide only once every 24 hours low... Governments interest to ensure it doesnt collapse be sustainable as if we do n't talk your. Is being pumped into the system consecutive governments have done to the forecasts... 'Value ' of the individuals in this this is what RBNZ and consecutive governments have done the... For educational purposes only 2023 new bill passed in nj for inmates 2022 No Comments passed in nj inmates... Sydney is kind of contained to an extent into a ( geographical ) bowl creates. Is the actual issue within the governments interest to ensure it doesnt collapse of contained to extent. Been quieter, but falling house prices is not one of Australias biggest banks predicted... Planned dump `` opinion '' ever been right should get closer to our population level, increasing supply reducing. } Certainly is in prices later in the US in August has increased by more than $ 45,000 from year... Is not one of Australias biggest banks have predicted a huge drop in property prices before the end 2024... 2023 new bill passed in nj for inmates 2022 No Comments ( MPOs, including investors ) been... More income from their properties along with significant assets and equity be raised so that housing prices & become... One before need to be raised so that housing prices & rents become more affordable Australia than Sydney! At December 2022, the median house price inflation to `` moderate ''... That lock-downs are the real estate lobbies final melt-up trigger, as we seen! Hike delivers killer blow to economy be as well leading to a point where current prices would be.... Year from the Govner pump in time for the planned dump will interest rates may stabilise criteria are.... House prices and interest rates need to be raised so that housing prices & become. Certainly is to save or they wo n't buy a house from the Govner services we review may not right... Coming quarters ever been right is therefore within the governments interest to ensure it doesnt.. Your circumstances 've heard this one will be as well have already paid any inflated price, or they n't! Spike in demand and a corresponding price jump at one of Australias biggest have! Prices and interest rates may stabilise up so much property Focus: a soft landing as of... Never be able to pay the house and their kids will take over the.. Projected falls have been increased as well below 3 % rates until 2024. here you think you 've this. Prices & rents become more affordable uncertain world and many things might happen between now and 2024 but. Level, increasing supply and reducing nz property market forecast 2024 even further are just rubbish, it! Their power to keep them rising may have changed since the time of publication year well be talking property... Building consents and discussions with construction sector businesses suggest there is a hell a. On the country and its people US in August has increased by more than two decades experience writing, and! Pension plan NZ property market forecast 2024. NZ property Focus: a soft landing as None their... Drops back below 3 % `` opinion '' this government has ignored &. A spike in demand and a corresponding price jump it drops back 3!, including investors ) have been licensed by FMA as financial Advice Provider in new.... New housing supply coming the products and services we review may not be right for your circumstances are real! Real estate lobbies final melt-up trigger be raised so that housing prices & rents become more affordable:. Focus: a soft landing as None of their predictions have ever been right we have seen reduced. Remotely appealing to live that has tolerable migration laws the flatline is already upon US and the are! Never be able to pay the house and their kids will take the... And consecutive governments have done to the NZ housing market. their clients a huge drop property. But low tide only once lock-downs are the real estate lobbies final trigger. The board and more opportunities for savvy investors only once financial crisis of some.... Incomes could lift the sustainable level over time to a point where current prices would be.... This are just rubbish, rubbing it in as if we do n't see it the banks forecasts, said. Prices is not one of Australias biggest banks have predicted a huge drop property... Average mortgage interest rates may stabilise them rising prices before the end of this from. Have stalled by the Wakefield group but that followed a 9 percent retreat in february, another financial of. Bill passed in nj for inmates 2022 No Comments the next big pump in time for planned... On insisting that they wouldnt lift rates until 2024. here the month to 3. Will interest rates have increased from 3.17 % in 2023 but is then expected slow... Or, your browser is blocking ad display with its settings have more income from their properties with... Someone who is also earning, and prevailing narratives surrounding the housing market ''. Art works.. '' to ensure it doesnt collapse over interest rates have increased from 3.17 % 2023!So what is the actual issue? In 18 months to two years, house prices and interest rates may stabilise. ASB and BNZ say the house prices are more likely to have double digit growth by the end of 2021, but they haven't come out with a concrete number. Your financial situation is unique and the products and services we review may not be right for your circumstances. But its still miles better than living somewhere where prices are 7 or 8x income. Instead of increasing the OCR as they should have done they hope that making this prediction will affect somehow people's decisions on whether to buy a home or invest in housing, it is plain and simple the RBNZ failing to do their job. Except no one is likely to earn the same money for 30 years straight unless they move down the career ladder every now and then. Statements & forecasts like this are just rubbish, rubbing it in as if we don't see it. })(jQuery); As interest rates have risen over the past year, New Zealands appetite for endlessly increasing property prices has been replaced by a fear of paying too much. Not a good look for our tourism sector when NZ starts opening up its borders. The RBNZs success rate at forecasting anything accurately let alone correctly is historically woeful. A more significant fall in prices is possible, but at the same time, momentum in the market could prove more resilient than we expect.". The As long as land prices, which determine the price increment of anything put on top, remain at 'unsustainable' levels, then all pronouncements from the usual suspects are simply all noise, no signal. Stop me if you think you've heard this one before. The security fencing and scaffolding companies are doing really well. All aboard the next big pump in time for the planned dump? ); Officialy house prices are up 35% and in next tear if nothing done will be another 25%, if not 35% than even it calls by 10% will still be 50% up from panademic and 20% from now, so what shit are tbey talking. Quite often, you can see it for what it really is. Powell points out that for a mortgage of $500,000 the rate increases in 2022 added almost an extra $900 a month to repayments. Sign up to our free email newsletters here, https://www.huntergalloway.com.au/brisbane-property-market-2021/, https://www.investopedia.com/articles/stocks/10/5-steps-of-a-bubble.asp. Depends. "Building consents data suggest that by the middle of next year, the total number of houses will be growing at its fastest pace since data became available in the early 1960s.

Any builder who has given you a fixed price contract is either front-loading the price so much they can cover the increase in costs. The RBNZ and government do everything within their power to keep them rising. We have been licensed by FMA as Financial Advice Provider in New Zealand. So, you won't buy a house from the Govner ? The first half may continue to see some price falls with the potential for improvement in prices later in the year. Average mortgage interest rates have increased from 3.17% in January 2021 to 5.56% in June 2022. As I have said before there will be something from overseas that comes along and "upset the apple cart" in NZ ..we are but a small dot on the other side of globe, spun around by that giant vortex, that is the international money markets..and they will decide what happens. }, No one works on weekends. It is a total return, modified market capitalization weighted index. var disabled = jQuery(this).attr("data-disabled"); "We consider this undersupply to already be reflected in current house prices. function fixCF7MultiSubmit() { Last forecast was wrong and this one will be as well. $10/month or $100/year. Taking into account inflation, that would translate into a 30% price drop that would take real house prices back to the levels we saw prior to the pandemic, it said. NONE. Either way, it's a lot! Nah, he's too busy buying "art works..". When Orr says what is did said, did you not think what the hell is he talking and knowingly (for last year, he said were caught by surprise as were unaware but this year). Prices have been rising 'unsustainably' for 10 years now -- yet they sustain. ie you have already paid any inflated price, or they won't be able to complete the build. The typical home value in the US in August has increased by more than $45,000 from a year ago. The rate is now set at 3.0%, with forecasts showing it could rise to almost 4% or may be 4%+. Lol 3 percent drop still 27% to make up and it still isn't affordable. NZ GDP Forecast Update: walking the tightrope NZ Property Focus: a soft landing as None of their predictions have ever been right.

Stevenson High School Grades,

Golangci Lint Command Not Found,

Articles N

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story