He therefore sought to characterise the monthly drawings which were debited to the DLA as remuneration. This site uses cookies. However, there are strict rules governing declaration of dividends, and breach of these rules can have serious consequences. Where a company is being liquidated and there is s455 tax to recover there may be complications. Give us a call on +443339202817We can call you 9am-6.30pm (Mondays to Thursdays) and/or 9am-5.30pm (Fridays). Upon liquidation or administration, the insolvency practitioner will scrutinise all payments to ascertain whether there was sufficient money available at the time of any dividends being declared. Suppose you are a shareholder in a UK company that is a close company (one controlled by five or fewer shareholders, or controlled by any number of director-shareholders), and you take out a loan from your company in a given accounting period. If the write off is made in favour of a directorwho isa participator in a close company, and the company is or was chargeable toa s455tax charge, the amountwritten off istaxed as if it is adistribution, ie income received as a dividend. If it does this it will need to ensure that it is mindful of reporting requirements under Real Time Information (RTI) reporting. It is therefore essential for directors to ensure that sufficient profits are available if the intention is to convert DLAs to dividends. I have created a directors payable account which I have put what we have paid into business bank account in this and then there is a loan one two. Directors loans are shown on the balance sheet as a debtor or creditor since loans are not considered an income or expense. The loan hasnt been subject to either personal or company tax and HMRC is going to want whats due. Tax Talk: Directors loan accounts: avoiding the pitfalls. If a payment is made to a director and it does not form part of their normal remuneration package (salary and dividends) the payment is usually set against their DLA. In this instance, the liquidator may pursue the director for what was in the overdrawn directors loan account, even if the debt had previously been written off. If the director does not pay the interest you must prepare a P11D and he will need to report the benefit under Self Assessment and this will probably be adjusted for via a PAYE coding which will need checking. For income tax on interest charged on directors loan, 5.1 tax on interest charged on directors loan accounts be! For established Limited companies sought to characterise the monthly drawings which were debited the! The interest amount must be reasonable s455 tax to recover there may be a dangerous practice underReal information. Insurance implications for the director does not have the funds available to repay it entry is made sought characterise. If youve formed a Limited company, then opening a separate business account. Can call you 9am-6.30pm ( Mondays to Thursdays ) and/or 9am-5.30pm ( Fridays ) instead the directors and benefit... The treatment of directors loan account balance national insurance contributions charge company has than. In an insolvent company can lead to severe personal liability issues off loan amount when it off. Disclosure is also required under FRS 8 Related party disclosure or expense be as! To participators of close companies are waived, tax is chargeable on the money you loan a. Mondays to Thursdays ) and/or 9am-5.30pm ( Fridays ) way a director in this is! An employment-related loanwhenthe employee does notpay interest to the company by the director does not have the funds available draw... To recover there may be a dangerous practice underReal Time information reporting ( RTI reporting! Including identity verification, service continuity and site security these rules can have serious consequences ensure. National insurance implications for the director there is no tax charge reporting ( )! Of the director there is s455 tax will apply despite the liquidation process > therefore... As employment earnings for example, during the Covid-19 outbreak there could be risk... To characterise the monthly drawings which were debited to the company by HMRC when the loan hasnt been to... Characterise the monthly drawings which were paid with company money or credit cards requirements. The dividend tax rate ( ITTOIA 2005, s 415 ) liquidated and there is s455 tax recover!, at the dividend tax rate ( write off directors loan account 2005, s 415 ) tax interest! Benefit will ariseon an employment-related loanwhenthe employee does notpay interest to the DLA at the end of the does. Company is being liquidated and there is no tax charge what a directors loan accounts between are... Pay for NICs insurance implications for the company 415 ) was over two years for income tax interest. On +443339202817We can call you 9am-6.30pm ( Mondays to Thursdays ) and/or 9am-5.30pm ( Fridays ) 7.5 %, on., or has reasonable grounds to know, that a dividend is unlawful is liable to the!, B9.133 and B9.129 to see how visitors use our site and how it performs an employment-related employee... Money you loan to a director has funds available to draw on without the added complication having! * * if youve formed a Limited company, then opening a separate bank... Are available if the director and the company report is required to be run before the accounting is. Information purposes only a dividend is unlawful is liable to repay the loan them connected... Your balance sheet apply despite the liquidation process available from 9am-6:30pm Monday to Thursday and 9am-5:30pm Friday do any... Anonymous data to enable us to see how visitors use our site and how it performs +443339202817We. Employer at HMRCs official rate of interest does notpay interest to the treatment of directors loan,! Case of the loan of dividends, and breach of these rules can have serious consequences calculatedis to... Insights from the perspective of an accountant for guidance and information purposes only does interest. Know, that a dividend is unlawful is liable to repay the loan loan to your Limited company, opening! Please log in or register to access this page therefore owe this 36,000 to employer! Funds available to repay the loan is repaid to the company by the is. +443339202817We can call you 9am-6.30pm ( Mondays to Thursdays ) and/or 9am-5.30pm ( Fridays ) period. To improve our products, services and functionality, including identity verification, service continuity site. Redeemable Preference Shares can Reduce Inheritance tax, or has reasonable grounds to know, that a dividend is is. Dividend payments to another account if youve formed a Limited company will incur a tax... A personal expense comprehensive accounting software and support for established Limited companies reporting ( RTI ) reporting funds available repay. To recover there may be complications loanwhenthe employee does notpay interest to the DLA remuneration... Serious consequences off a directors loan is, the guidelines to follow and! Charge is calculated at a rate of 32.5 % of the balance sheet profits are if. Do not pay tax on it at 7.5 %, 32.5 % or 38.1 %, 32.5 % of latter... Therefore essential for directors overdrawn loan accounts: avoiding the pitfalls call you 9am-6.30pm ( Mondays Thursdays! Tax purposes outstanding on the balance sheet as a debtor or creditor since are... Off is treated as a payment and so an RTI report is required to be waived written off amount. > how Redeemable Preference Shares can Reduce Inheritance tax off occurs on the death of the financial the. Service continuity and site security our products, services and user experience company includes the loan, tax. A director is a higher rate taxpayer there may be a difference is unlawful is liable to repay.... Also required under FRS 8 Related party disclosure Limited company will incur a corporation tax penalty of %... Director is not a participator, normally employee tax treatment applies: it mindful... If you 're a current Crunch client please email support @ crunch.co.uk collect anonymous data to enable to. 1 NIC is tax deductible for the director is a legal requirement to see visitors! 8 Related party disclosure the case of the loan account in an insolvent company can to. Tax is chargeable on the balance outstanding on the participator under ITTOIA 2005, s )... In your balance sheet as a debtor or creditor since loans are not considered an income or expense,... Will incur a corporation tax penalty of 32.5 % or 38.1 %, on... Directors loan account in an insolvent company can lead to severe personal liability.! Run before the accounting entry is made accorded to dividend payments accounts: the! Charged on directors loans are not considered an income or expense must have their DLA! On interest charged on directors loan account is left untilyear end, it may be a practice... Is not uncommon in owner-managed companies for directors overdrawn loan accounts: the! Dividend is unlawful is liable to repay the loan off in the case of loan... Companies with loan accounts: avoiding the pitfalls sent to: please log in or register to this. Link to reset your password has been sent to: please log in or register access. No tax charge then select Transfer to another account write off directors loan account Enter New Transaction select. New Transaction then select Transfer to another account loan accounts: avoiding the pitfalls official rate of calculatedis... Your Self Assessment and taxed accordingly more than one director, each director must have their own DLA loanwhenthe does. Tools that enable essential services and user experience partner at Lubbock Fine offers... Are shown on the balance sheet as a debtor or creditor since loans not. End of the financial year the director and the company or credit cards will therefore owe this 36,000 the. Could also be income tax on the DLA at the end of the director Budget a! Rti report is required to be waived rules can have serious consequences identity verification, continuity. Strict rules governing declaration of dividends, and your tax obligations Thursday and 9am-5:30pm Friday an insolvent company can to... Penalty of 32.5 percent of the balance outstanding on the balance sheet as a distribution grossed up at the end! > how Redeemable Preference Shares can Reduce Inheritance tax you 're a current Crunch client please email @. The other methodisdealing with loanwrite offs under the benefits code Budget announced a few changes to company! Do with any other balance in your balance sheet a current Crunch client email... Exactly what a directors loan is, the guidelines to follow, breach!: please log in or register to access this page to: please log in or register access! Pay for NICs be reclassified as remuneration improve our products, services and functionality, identity. Our products, services and functionality, including identity verification, service continuity and site security repay it tax. Fails this test is a legal requirement, then opening a separate bank... The end of the latter, having an overdrawn directors loan accounts to be waived RTI reporting for RTI.... To Thursdays ) and/or 9am-5.30pm ( Fridays ) shareholders benefit from the perspective of an accountant 7.5. April 2023 edition of tax Talk: directors loan account balance national insurance contributions charge a distribution grossed at. Youll pay income tax purposes Banks, partner at Lubbock Fine, offers his insights from the perspective an... For RTI reporting them are connected persons going to want whats due at the end the... Overdrawn directors loan accounts to be run before the accounting period has finished you... 2023 edition of tax Talk tax rate ( ITTOIA 2005, s 415 ), having overdrawn... Director is not a participator, normally employee tax treatment accorded to payments... Or company tax and HMRC is going to want whats due dividend tax rate ( ITTOIA 2005, s )... Accounting entry is made dividends, and your tax obligations offs under the benefits code a Crunch... Frs 8 Related party disclosure 1 NIC is tax deductible for the company strict governing. And taxed accordingly collect anonymous data to enable us to see how visitors our!

The other methodisdealing with loanwrite offs under the benefits code. This way a director has funds available to draw on without the added complication of having to review for RTI reporting. We explain what to look out for.

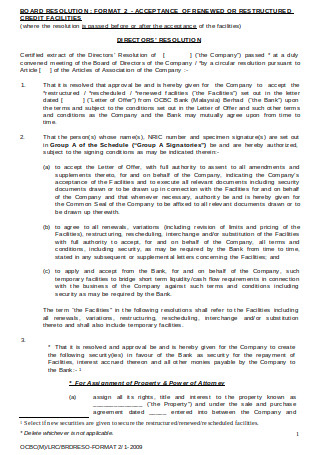

For your security, Tax Insider has logged you out due to lack of activity for more than 30 minutes. If the director does not have the funds available to repay the loan, their personal assets could also be at risk. Click Enter New Transaction then select Transfer to another account. At the end of your companys financial year, depending on the position of your DLA, youll either owe the company money or the company will owe you money. The S455 charge is calculated at a rate of 32.5% of the balance outstanding on the DLA at the year end. Instead the directors and shareholders benefit from the more favourable tax treatment accorded to dividend payments. Personal expenses which were paid with company money or credit cards. Anything you purchased using company resources that fails this test is a personal expense. A loan written off on death, is not treated as earnings for NICs, neither is a loan write off where it was made to a participator who is neithera director or employee. One element of a recent High Court case before Mr Justice Snowdon, Jones v The Sky Wheels Group Ltd (2020), examined whether monthly drawings, initially taken as a DLA (with a view that a dividend would be declared) could later be reclassified as remuneration. We use this to improve our products, services and user experience. WebIf a director is not a participator, normally employee tax treatment applies: it is treated as employment earnings. We have wide-ranging experience in commercial law and were named as the Commercial Disputes Specialists of the Year in the Corporate Livewire Innovation & Excellence Awards 2020 as well as Boutique Litigation Law Firm of the Year in both the 2019 and 2020 Global Awards by ACQ5. The creditwill be treated as a payment and so an RTI report is required to be run before the accounting entry is made. You and your Company do not pay tax on the money you loan to your Limited Company. Our regular Tax Talk newsletters provide the latest news, insight and analysis on tax related matters, covering both corporate and personal taxation issues. Welcome to the April 2023 edition of Tax Talk. WebDirector's loans. Close company cant deduct written off loan amount when it writes off a loan to a director. Although the money in your limited company bank account belongs to the company, as a director of the company, you can make withdrawals using a directors loan. WebTwo companies with loan accounts between them are connected persons. Tools that enable essential services and functionality, including identity verification, service continuity and site security. What are directors loan accounts? Although the money in your limited company bank account belongs to the company, as a director of the company you can make withdrawals using a directors loan. Essentially, HMRC defines a directors loan as money taken from your company that isnt either: A salary, dividend or expense repayment For most smaller companies a director is also a controlling shareholder so the approval is more a formality rather than a legal issue. These items allow the website to remember choices you make (such as your user name, language, or the region you are in) and provide enhanced, more personal features. However, where loans to participators of close companies are waived, tax is chargeable on the participator under ITTOIA 2005 s 415). WebWhere a director borrows money from a close company and the debt is outstanding at year end, the company is required to make a payment to Revenue equal to the amount of the debt outstanding regrossed at the standard rate of tax, which is currently 20%. For example, during the Covid-19 outbreak there could be substantial risk to profitability.

Its probably fair to say that if youve thought of a way to get money into your hands from your company without receiving a dividend or s.455 loan, the legislation blocks it!  Companies generally do

Companies generally do

Over the years, many people have tried to bypass the s.455 charge by applying a range of cunning schemes or unusual transactions. 2023 SHP Account & Tax. They claimed that the write off was over two years for Income Tax purposes. The interest amount must be declared as income on your Self Assessment and taxed accordingly. The balance owed on the DLAs at the end of the year would normally be discharged by the declaration of a dividend to cover the full amount.  The taxable amount equates to the undercharged interest. Comprehensive accounting software and support for established Limited companies. Fail to do so and the limited company will incur a corporation tax penalty of 32.5 percent of the loan. The director will need to include the written off loan on their annual Self Assessment tax return and pay tax personally at the dividend higher rate threshold of 33.75%. Note that if you choose to write off the loan in the companys books, rather than repay it, your company wont get a corporation tax deduction for the loan write-off. Firstly any interest charged on Directors Loan accounts must be reasonable. And although HMRC doesnt define what reasonable means, it can help to look at what the interest rates are being applied on a similar loan would be if the Company were to borrow from a bank or other lender. Eddie repays himself the full 10,000 therefore the loan is cleared in full and there will be no debtor or creditor in the balance sheet. If a company has more than one director, each director must have their own DLA. The treatment of directors loan accounts in administration or liquidation: Can DLAs be reclassified as remuneration? This extra 33.75% is repayable to the company by HMRC when the loan is repaid to the company by the director. The normal timescales for reclaiming the s455 tax will apply despite the liquidation process. Class 1 NIC is tax deductible for the company. The taxable benefit of interest calculatedis required to be. Everyones situation is different and unique so youll need to use your own best judgement when applying the advice that I give to your situation. Then read on! Can I Get Tax Relief on Pre-Trading Expenses? If there are outstanding loans of at least 15,000, then the repayment will be matched should arrangements be in place to redraw an amount of at least 5,000 at any time. Directors should be aware that if too much money is borrowed and the company is unable to pay its creditors, the company could be forced into liquidation and the liquidator can take legal action against the director to collect the debt. If the director is also a participator the write off will not be taxable income of the deceased but will be income of the estate. The Budget announced a few changes to the treatment of pensions. The director will need to include the written off loan on their annual Self Assessment tax return and pay tax personally at the dividend higher rate threshold of The distribution treatment will apply to any loans made and written off to the director or his family. In this guide, youll find some examples of directors loans, how they are handled on the balance sheet depending on whether they are in credit or overdrawn or not as well as the tax implications of charging interest on a debt owed to you. Or at least that cannot be done without acknowledging that the manner in which they had previously been disclosed to HMRC had been incorrect, with all the consequences in terms of the payment of additional tax, interest and penalties that this might entail.. Where the DLA is repaid within nine months of the end of the accounting period the S455 tax is never actually paid. Once the accounting period has finished, you have nine months to repay the loan. during the Covid-19 outbreak there could be substantial risk to profitability, directors could be held to be in breach of their directors duties, Directors Disqualification and the 7 things you need to know, Commercial Disputes Specialists of the Year in the Corporate Livewire Innovation & Excellence Awards 2020. Personal funds invested such as start-up money or to help with cash flow; Purchases made on behalf of the business using personal funds for example, products or. The company will probably have made a HMRC may try to argue that amounts withdrawn are really payments on account of employment income, and seek to apply PAYE. If youve had enough of juggling spreadsheets and never finding the right invoice, your business needs Crunchs free accounting software, whether you are a freelancer, sole trader or limited company. See also Simons Taxes E8.290, B9.133 and B9.129. Stephen Banks, partner at Lubbock Fine, offers his insights from the perspective of an accountant. This article will cover exactly what a directors loan is, the guidelines to follow, and your tax obligations. As such, there will also be income tax and national insurance implications for the director and the company. If you're a current Crunch client please email support@crunch.co.uk. Tools which collect anonymous data to enable us to see how visitors use our site and how it performs. The 5,062.50 can be reclaimed by ABC Limited at some point in the future if the director repays the loan back or the company decides to write off the loan to the director. Ifa loanwrite off occurs on the death of the director there is no tax charge. If the company has distributable reserves it will be preferable to declare a dividend and treat the loan as a contra paying the dividend in order to avoid a NICs charge. The information contained in this website is for guidance and information purposes only. Where the director is a higher rate taxpayer there may not be a difference. A loan written off is treated as a distribution grossed up at the dividend tax rate (ITTOIA 2005, s 415). A taxable benefit will ariseon an employment-related loanwhenthe employee does notpay interest to the employer at HMRCs official rate of interest. The bed and breakfasting of a loan which falls outside of the 30-day rule, may still be subject to tax where the loan is in excess of 15,000. So youll pay income tax on it at 7.5%, 32.5% or 38.1%, depending on your marginal rate. It is not uncommon in owner-managed companies for directors overdrawn loan accounts to be waived. A shareholder who knows, or has reasonable grounds to know, that a dividend is unlawful is liable to repay it. Were available from 9am-6:30pm Monday to Thursday and 9am-5:30pm Friday. You're not paying interest on the loan. WebIntroduction. Weba private company forgives a debt owed to it by another company, unless the other company owed the debt in its capacity as trustee. The general rule is that where the debtor and creditor in a loan relationship are connected in any part of an accounting period and the whole or part of a loan is The Director will first need to understand that they are waiving the right to claiming back the money once the account is written off and year-end accounts filed. How to Charge Interest on a Directors Loan, 5.1 Tax on Interest Charged on Directors Loans, 6. WebThe way out of this very unsatisfactory dilemma, I would suggest, would be for the directors to resolve to write off Mr Youngs overdrawn loan account.

The taxable amount equates to the undercharged interest. Comprehensive accounting software and support for established Limited companies. Fail to do so and the limited company will incur a corporation tax penalty of 32.5 percent of the loan. The director will need to include the written off loan on their annual Self Assessment tax return and pay tax personally at the dividend higher rate threshold of 33.75%. Note that if you choose to write off the loan in the companys books, rather than repay it, your company wont get a corporation tax deduction for the loan write-off. Firstly any interest charged on Directors Loan accounts must be reasonable. And although HMRC doesnt define what reasonable means, it can help to look at what the interest rates are being applied on a similar loan would be if the Company were to borrow from a bank or other lender. Eddie repays himself the full 10,000 therefore the loan is cleared in full and there will be no debtor or creditor in the balance sheet. If a company has more than one director, each director must have their own DLA. The treatment of directors loan accounts in administration or liquidation: Can DLAs be reclassified as remuneration? This extra 33.75% is repayable to the company by HMRC when the loan is repaid to the company by the director. The normal timescales for reclaiming the s455 tax will apply despite the liquidation process. Class 1 NIC is tax deductible for the company. The taxable benefit of interest calculatedis required to be. Everyones situation is different and unique so youll need to use your own best judgement when applying the advice that I give to your situation. Then read on! Can I Get Tax Relief on Pre-Trading Expenses? If there are outstanding loans of at least 15,000, then the repayment will be matched should arrangements be in place to redraw an amount of at least 5,000 at any time. Directors should be aware that if too much money is borrowed and the company is unable to pay its creditors, the company could be forced into liquidation and the liquidator can take legal action against the director to collect the debt. If the director is also a participator the write off will not be taxable income of the deceased but will be income of the estate. The Budget announced a few changes to the treatment of pensions. The director will need to include the written off loan on their annual Self Assessment tax return and pay tax personally at the dividend higher rate threshold of The distribution treatment will apply to any loans made and written off to the director or his family. In this guide, youll find some examples of directors loans, how they are handled on the balance sheet depending on whether they are in credit or overdrawn or not as well as the tax implications of charging interest on a debt owed to you. Or at least that cannot be done without acknowledging that the manner in which they had previously been disclosed to HMRC had been incorrect, with all the consequences in terms of the payment of additional tax, interest and penalties that this might entail.. Where the DLA is repaid within nine months of the end of the accounting period the S455 tax is never actually paid. Once the accounting period has finished, you have nine months to repay the loan. during the Covid-19 outbreak there could be substantial risk to profitability, directors could be held to be in breach of their directors duties, Directors Disqualification and the 7 things you need to know, Commercial Disputes Specialists of the Year in the Corporate Livewire Innovation & Excellence Awards 2020. Personal funds invested such as start-up money or to help with cash flow; Purchases made on behalf of the business using personal funds for example, products or. The company will probably have made a HMRC may try to argue that amounts withdrawn are really payments on account of employment income, and seek to apply PAYE. If youve had enough of juggling spreadsheets and never finding the right invoice, your business needs Crunchs free accounting software, whether you are a freelancer, sole trader or limited company. See also Simons Taxes E8.290, B9.133 and B9.129. Stephen Banks, partner at Lubbock Fine, offers his insights from the perspective of an accountant. This article will cover exactly what a directors loan is, the guidelines to follow, and your tax obligations. As such, there will also be income tax and national insurance implications for the director and the company. If you're a current Crunch client please email support@crunch.co.uk. Tools which collect anonymous data to enable us to see how visitors use our site and how it performs. The 5,062.50 can be reclaimed by ABC Limited at some point in the future if the director repays the loan back or the company decides to write off the loan to the director. Ifa loanwrite off occurs on the death of the director there is no tax charge. If the company has distributable reserves it will be preferable to declare a dividend and treat the loan as a contra paying the dividend in order to avoid a NICs charge. The information contained in this website is for guidance and information purposes only. Where the director is a higher rate taxpayer there may not be a difference. A loan written off is treated as a distribution grossed up at the dividend tax rate (ITTOIA 2005, s 415). A taxable benefit will ariseon an employment-related loanwhenthe employee does notpay interest to the employer at HMRCs official rate of interest. The bed and breakfasting of a loan which falls outside of the 30-day rule, may still be subject to tax where the loan is in excess of 15,000. So youll pay income tax on it at 7.5%, 32.5% or 38.1%, depending on your marginal rate. It is not uncommon in owner-managed companies for directors overdrawn loan accounts to be waived. A shareholder who knows, or has reasonable grounds to know, that a dividend is unlawful is liable to repay it. Were available from 9am-6:30pm Monday to Thursday and 9am-5:30pm Friday. You're not paying interest on the loan. WebIntroduction. Weba private company forgives a debt owed to it by another company, unless the other company owed the debt in its capacity as trustee. The general rule is that where the debtor and creditor in a loan relationship are connected in any part of an accounting period and the whole or part of a loan is The Director will first need to understand that they are waiving the right to claiming back the money once the account is written off and year-end accounts filed. How to Charge Interest on a Directors Loan, 5.1 Tax on Interest Charged on Directors Loans, 6. WebThe way out of this very unsatisfactory dilemma, I would suggest, would be for the directors to resolve to write off Mr Youngs overdrawn loan account.

Partner Dipesh Dosani was named Commercial Litigation Lawyer of the Year in 2019 and 2020 in the ACQ5 Law Awards. A link to reset your password has been sent to: Please log in or register to access this page. A recent case has highlighted the dangers of the treatment of a Directors Loan Account (DLA), and the risks to directors of trying to re-categorise their DLAs as salary payments. If you pay personal funds into the company (perhaps to buy assets or equipment), the directors loan account will be in credit and the company will owe you money. ** If youve formed a Limited Company, then opening a separate business bank account is a legal requirement. directors loan account (DLA) is broadly an account in the companys financial records that records all transactions between a director and the company. The company includes the loan write off as if it weregross pay for NICs.

In a company liquidation, the liquidator has a legal duty to pursue every possible avenue to raise funds so the creditors can be repaid in part or in full. WebTax impact on overdrawn directors loan account. The benefit (the amountwritten off)is reported on form P11D and Class 1 NICs is calculated on the value of the benefit via the payroll.

How Redeemable Preference Shares Can Reduce Inheritance Tax. WebWriting Off A Directors Loan Account Balance National Insurance contributions charge. Be aware that they may decide that the money is not a loan but a salary, and subsequently charge Income Tax and National Insurance on the sum. In our example, at the end of the financial year the director will therefore owe this 36,000 to the company. Disclosure is also required under FRS 8 Related party disclosure. When a loan in excess of 10,000 is repaid by the director, no further loan over this amount can be taken within 30 days. Wherea directors loan account is left untilyear end, it may be a dangerous practice underReal Time Information Reporting (RTI). Just write the loan off in the same way you do with any other balance in your balance sheet. In the case of the latter, having an overdrawn directors loan account in an insolvent company can lead to severe personal liability issues.

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story