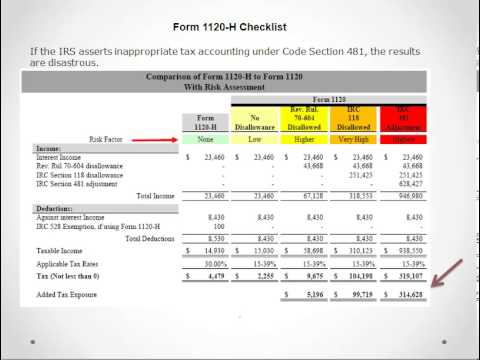

If you are filing Schedule M-3, check Item A, box 4, to indicate that Schedule M-3 is attached. Enter contributions or gifts actually paid within the tax year to or for the use of charitable and governmental organizations described in section 170(c) and any unused contributions carried over from prior years. WebForm 7004 is due on or before the day that your 1120-S is due, which means that if youre a calendar year S corp, your deadline to file 7004 is March 15, 2022. While these estimates don't include burden associated with post-filing activities, IRS operational data indicate that electronically prepared and filed returns have fewer arithmetic errors, implying lower post-filing burden. If an increase in the limitation under section 960(c) (section 960(b) (pre-2018)) exceeds the total tax on Schedule J, Part I, line 11, for the tax year, the amount of the excess is deemed an overpayment of tax for the tax year. The amount included in income from Form 8864, Biodiesel, Renewable Diesel, or Sustainable Aviation Fuels Credit. In addition, no deduction is generally allowed for qualified transportation fringe benefits. The third estimates tax payment is due this day (Form 1040-ES). Employer Identification Number (EIN), Item E. Initial Return, Final Return, Name Change, or Address Change. A superseding tax return is one filed after an extension but before the extended due date. Enter deductible officers' compensation on line 12. See, Form 1120-W, Estimated Tax for Corporations, and the Instructions for Form 1120-W are now historical. For more details on the NOL deduction, see section 172 and the Instructions for Form 1139. For additional information, see Regulations sections 1.267A-2 through 1.267A-4. See Pub. The deadline for filing Forms 1095-C is not extended, and remains February 28, 2020 for paper filers, or March 31, 2020 for electronic filers. WebGenerally, an S corporation with a fiscal year must file Form 1120-S by the 15th day of the 3rd month after the end of its tax year. Foreign intangible drilling costs and foreign exploration and development costs must either be added to the corporation's basis for cost depletion purposes or be deducted ratably over a 10-year period. Ministry of Corporate Affairs (MCA) vide General Circular No. Corporation A also owns, directly, a 15% interest in the profit, loss, or capital of Partnership C and owns, directly, 15% of the voting stock of Corporation D. Partnership B owns, directly, a 70% interest in the profit, loss, or capital of Partnership C and owns, directly, 70% of the voting stock of Corporation D. Corporation A owns, indirectly, through Partnership B, a 35% interest (50% of 70%) in the profit, loss, or capital of Partnership C and owns, indirectly, 35% of the voting stock of Corporation D. Corporation A owns, directly or indirectly, a 50% interest in the profit, loss, or capital of Partnership C (15% directly and 35% indirectly), and owns, directly or indirectly, 50% of the voting stock of Corporation D (15% directly and 35% indirectly). Web1120 Filer in order to create its eligibility to submit Corporation Business Tax forms. All of its gross income from all sources is effectively connected with the conduct of a trade or business within the United States. Corporations with total assets non-consolidated (or consolidated for all corporations included within the consolidated tax group) of $10 million or more on the last day of the tax year must file Schedule M-3 (Form 1120) instead of Schedule M-1. Extension tax deadline for exempt organizations ( Form 990) November 15, 2021. Section 247 (as affected by P.L.113-295, Div. Generally, electronic funds transfers are made using the Electronic Federal Tax Payment System (EFTPS). See section 274(n)(3) for a special rule that applies to expenses for meals consumed by individuals subject to the hours of service limits of the Department of Transportation. See the Instructions for Form 8990. Corporations taking this deduction are subject to the provisions of section 1561. The installments are due by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year. Use Form 1120, U.S. File the corporation's return at the applicable IRS address listed below. Credit for small employer health insurance premiums (Form 8941). See Form 8621 and the Instructions for Form 8621. Using a separate worksheet, complete Schedule J again, but do not include the LIFO recapture amount in the corporation's taxable income. Enter taxable interest on U.S. obligations and on loans, notes, mortgages, bonds, bank deposits, corporate bonds, tax refunds, etc. Reportable transaction disclosure statement. See the Instructions for Form 5472 for additional information and coordination with Form 5472 reporting by the domestic DE. Federal income tax return, Form 1120, is due by April 15th for calendar year taxpayers, or the 15th day of the 4th month following the close of the corporation's fiscal year. Do not offset current year taxes against tax refunds. Preferred dividends attributable to periods totaling less than 367 days are subject to the 46-day holding period rule discussed above. The carryback period for these losses is 2 years. For more information about LLCs, see Pub. This means the original filing deadline is March 15, 2023 and The corporation should receive a notice from the RIC specifying the amount of dividends that qualify for the deduction. See section 170(e)(4).

535 for details. The extension to file is now seven months (eight months for June filers) from the original due date.

Credit under section 960(c) (section 960(b) for pre-2018 taxable years of foreign corporations). Attach Form 4136. Taxes assessed against local benefits that increase the value of the property assessed (such as for paving, etc.). Include any of the following taxes and interest. Ready or not, Tax Day is quickly approaching. box address.

Corporation Income Tax Return, generally is the 15th day of the third month following the close of the corporation's tax year (Regs. Credit for employer differential wage payments (Form 8932). See the March 2022 revision of the Instructions for Form 941 and the 2022 Instructions for Form 944 for more information.  Transferred LIFO inventory assets to an S corporation in a nonrecognition transaction in which those assets were transferred basis property. The corporation cannot deduct travel expenses of any individual accompanying a corporate officer or employee, including a spouse or dependent of the officer or employee, unless: That individual is an employee of the corporation, and. Download (157.3 KB) Reserved for Tax Section membersAlready a Tax Section member? Also, capitalize any interest on debt allocable to an asset used to produce the property. The corporation may elect to capitalize certain repair and maintenance costs consistent with its books and records. The election to either amortize or capitalize start-up costs is irrevocable and applies to all start-up costs that are related to the trade or business. This should equal the sum of the amounts reported by the U.S. shareholder on Form(s) 5471, Schedule I, line 1b. Also, include on line 14 the corporation's share of distributions from a section 1291 fund from Form 8621, to the extent that the amounts are taxed as dividends under section 301. 225. A significant distributee (as defined in Regulations section 1.355-5(c)) that receives stock or securities of a controlled corporation must include the statement required by Regulations section 1.355-5(b) on or with its return for the year of receipt. The corporation is a subsidiary in a parentsubsidiary controlled group. The total amount of the contribution claimed for the qualified conservation property cannot exceed 100% of the excess of the corporation's taxable income (as computed above substituting 100% for 10% ) over all other allowable charitable contributions. A, section 221(a)(41)(A), Dec. 19, 2014, 128 Stat. See the Instructions for Form 720, Pub. Financial institutions may charge a fee for payments made this way. Taxes deducted elsewhere on the return, such as those reflected in cost of goods sold. The penalty will not be imposed if the corporation can show that the failure to file on time was due to reasonable cause. 535 for details on other deductions that may apply to corporations. Extended: October 15, 2019 Nonprofits and charities should add these 2019 filing deadlines for exempt organizations to their calendars: Regular: May 15, 2019 Extended: August 15, 2019 If applicable, add these to your 2018-2019 dates to your tax calendar: Last day to pay employee bonuses that qualify toward 2018 business taxes: See sections 448(a)(1) through (a)(3). Include on line 20 depreciation and the cost of certain property that the corporation elected to expense under section 179 from Form 4562. 3402, Taxation of Limited Liability Companies. See the instructions for, A corporation that does not file its tax return by the due date, including extensions, may be penalized 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax. For exceptions to this general rule for corporations that use the accrual method of accounting, see the following. On line 2c, enter a brief description of the principal product or service of the company. Business Tax Extension-Extensions up to 6 months. See section 164(d) for information on apportionment of taxes on real property between seller and purchaser. The corporation cannot deduct the costs required to be capitalized under section 263A until it sells, uses, or otherwise disposes of the property (to which the costs relate). Figure taxable income using the method of accounting regularly used in keeping the corporation's books and records. The constructive ownership rules of section 318 apply in determining if a corporation is foreign owned. But since the special rules in Regs. Enter on Form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. Enter taxes paid or accrued during the tax year, but do not include the following. 4043) for dividends paid. The corporation may have to complete the appropriate lines of Form 3115 to make an election. WebThe 2022 tax brackets for people filing individual returns in 2023 are: 37% for incomes greater than $539,900. Enter only dividends that qualify under section 243(b) for the 100% dividends-received deduction described in section 243(a)(3). If the corporation wants its refund directly deposited into its checking or savings account at any U.S. bank or other financial institution instead of having a check sent to the corporation, complete Form 8050, Direct Deposit of Corporate Tax Refund, and attach it to the corporation's tax return. All other corporations must generally complete and attach Form 8283 to their returns for contributions of property (other than money) if the total claimed deduction for all property contributed was more than $5,000. For more information, see section 469, the related regulations, and Pub. The 100% deduction does not apply to affiliated group members that are joining in the filing of a consolidated return. To obtain consent, the corporation must generally file Form 3115, Application for Change in Accounting Method, during the tax year for which the change is requested. Step 1. Foreign or U.S. possession income taxes if a foreign tax credit is claimed. Include such amounts on line 16c.). Tax Day is Tuesday, April 18, this year, the annual day when individual income tax returns are due to be submitted to the federal government. The Form 1120S is due March 15, 2023, unless a form 7004 is filed exercising an automatic six-month Any excess qualified conservation contributions can be carried over to the next 15 years, subject to the 100% limitation. Enter the total debts that became worthless in whole or in part during the tax year. Form 1041 shall be a 5-month period beginning on the due date for filing the return (without regard to any extensions). By faxing or mailing Form SS-4, Application for Employer Identification Number. See section 7874(a). Enter cash and credit refunds the corporation made to customers for returned merchandise, rebates, and other allowances made on gross receipts or sales. Follow the country's practice for entering the name of the state or province and postal code. Stock that represents at least 80% of the total voting power and at least 80% of the total value of the stock of each of the other corporations (except for the common parent) must be owned directly by one or more of the other includible corporations. For more information, see the Instructions for Form SS-4. See sections 6662, 6662A, and 6663. Generally, an S Corporation must file Form 1120-S U.S. Income Tax Return for an S Corporation by the 15th day of the third month after the end The following tables show burden estimates based on current statutory requirements as of November 2022 for taxpayers filing 2022 Forms 1065, 1120, 1120-C, 1120-F, 1120-H, 1120-ND, 1120-S, 1120-SF, 1120-FSC, 1120-L, 1120-PC, 1066, 1120-REIT, 1120-RIC, 1120-POL, and related attachments. Ordinarily, the due date of a return for a Dec. 31, 2017, tax year could be extended only to Oct. 15, 2018. Nonaccrual experience method for service providers.

Transferred LIFO inventory assets to an S corporation in a nonrecognition transaction in which those assets were transferred basis property. The corporation cannot deduct travel expenses of any individual accompanying a corporate officer or employee, including a spouse or dependent of the officer or employee, unless: That individual is an employee of the corporation, and. Download (157.3 KB) Reserved for Tax Section membersAlready a Tax Section member? Also, capitalize any interest on debt allocable to an asset used to produce the property. The corporation may elect to capitalize certain repair and maintenance costs consistent with its books and records. The election to either amortize or capitalize start-up costs is irrevocable and applies to all start-up costs that are related to the trade or business. This should equal the sum of the amounts reported by the U.S. shareholder on Form(s) 5471, Schedule I, line 1b. Also, include on line 14 the corporation's share of distributions from a section 1291 fund from Form 8621, to the extent that the amounts are taxed as dividends under section 301. 225. A significant distributee (as defined in Regulations section 1.355-5(c)) that receives stock or securities of a controlled corporation must include the statement required by Regulations section 1.355-5(b) on or with its return for the year of receipt. The corporation is a subsidiary in a parentsubsidiary controlled group. The total amount of the contribution claimed for the qualified conservation property cannot exceed 100% of the excess of the corporation's taxable income (as computed above substituting 100% for 10% ) over all other allowable charitable contributions. A, section 221(a)(41)(A), Dec. 19, 2014, 128 Stat. See the Instructions for Form 720, Pub. Financial institutions may charge a fee for payments made this way. Taxes deducted elsewhere on the return, such as those reflected in cost of goods sold. The penalty will not be imposed if the corporation can show that the failure to file on time was due to reasonable cause. 535 for details on other deductions that may apply to corporations. Extended: October 15, 2019 Nonprofits and charities should add these 2019 filing deadlines for exempt organizations to their calendars: Regular: May 15, 2019 Extended: August 15, 2019 If applicable, add these to your 2018-2019 dates to your tax calendar: Last day to pay employee bonuses that qualify toward 2018 business taxes: See sections 448(a)(1) through (a)(3). Include on line 20 depreciation and the cost of certain property that the corporation elected to expense under section 179 from Form 4562. 3402, Taxation of Limited Liability Companies. See the instructions for, A corporation that does not file its tax return by the due date, including extensions, may be penalized 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax. For exceptions to this general rule for corporations that use the accrual method of accounting, see the following. On line 2c, enter a brief description of the principal product or service of the company. Business Tax Extension-Extensions up to 6 months. See section 164(d) for information on apportionment of taxes on real property between seller and purchaser. The corporation cannot deduct the costs required to be capitalized under section 263A until it sells, uses, or otherwise disposes of the property (to which the costs relate). Figure taxable income using the method of accounting regularly used in keeping the corporation's books and records. The constructive ownership rules of section 318 apply in determining if a corporation is foreign owned. But since the special rules in Regs. Enter on Form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the consolidated group. Enter taxes paid or accrued during the tax year, but do not include the following. 4043) for dividends paid. The corporation may have to complete the appropriate lines of Form 3115 to make an election. WebThe 2022 tax brackets for people filing individual returns in 2023 are: 37% for incomes greater than $539,900. Enter only dividends that qualify under section 243(b) for the 100% dividends-received deduction described in section 243(a)(3). If the corporation wants its refund directly deposited into its checking or savings account at any U.S. bank or other financial institution instead of having a check sent to the corporation, complete Form 8050, Direct Deposit of Corporate Tax Refund, and attach it to the corporation's tax return. All other corporations must generally complete and attach Form 8283 to their returns for contributions of property (other than money) if the total claimed deduction for all property contributed was more than $5,000. For more information, see section 469, the related regulations, and Pub. The 100% deduction does not apply to affiliated group members that are joining in the filing of a consolidated return. To obtain consent, the corporation must generally file Form 3115, Application for Change in Accounting Method, during the tax year for which the change is requested. Step 1. Foreign or U.S. possession income taxes if a foreign tax credit is claimed. Include such amounts on line 16c.). Tax Day is Tuesday, April 18, this year, the annual day when individual income tax returns are due to be submitted to the federal government. The Form 1120S is due March 15, 2023, unless a form 7004 is filed exercising an automatic six-month Any excess qualified conservation contributions can be carried over to the next 15 years, subject to the 100% limitation. Enter the total debts that became worthless in whole or in part during the tax year. Form 1041 shall be a 5-month period beginning on the due date for filing the return (without regard to any extensions). By faxing or mailing Form SS-4, Application for Employer Identification Number. See section 7874(a). Enter cash and credit refunds the corporation made to customers for returned merchandise, rebates, and other allowances made on gross receipts or sales. Follow the country's practice for entering the name of the state or province and postal code. Stock that represents at least 80% of the total voting power and at least 80% of the total value of the stock of each of the other corporations (except for the common parent) must be owned directly by one or more of the other includible corporations. For more information, see the Instructions for Form SS-4. See sections 6662, 6662A, and 6663. Generally, an S Corporation must file Form 1120-S U.S. Income Tax Return for an S Corporation by the 15th day of the third month after the end The following tables show burden estimates based on current statutory requirements as of November 2022 for taxpayers filing 2022 Forms 1065, 1120, 1120-C, 1120-F, 1120-H, 1120-ND, 1120-S, 1120-SF, 1120-FSC, 1120-L, 1120-PC, 1066, 1120-REIT, 1120-RIC, 1120-POL, and related attachments. Ordinarily, the due date of a return for a Dec. 31, 2017, tax year could be extended only to Oct. 15, 2018. Nonaccrual experience method for service providers.

1502 - 76 provide an unextended due date of July 15, 2018 (based on the taxpayer's normal March 31 year end), it appears that a Form 7004 filed by Corporation S should result in an Complete and attach Form 8827. Form 945, Annual Return of Withheld Federal Income Tax. A corporation can deduct a contribution of $250 or more only if it gets a written acknowledgment from the donee organization that shows the amount of cash contributed, describes any property contributed (but not its value), and either gives a description and a good faith estimate of the value of any goods or services provided in return for the contribution or states that no goods or services were provided in return for the contribution. However, an automatic six-month extension can be exercised by filing a Form 7004, which makes the renewed due date September 15, 2023. To learn more about the information the corporation will need to provide to its financial institution to make a same-day wire payment, go to IRS.gov/SameDayWire. Annual Return/Report of Employee Benefit Plan. A process through File the applicable CBT return, other than Form CBT-100S, by the due date or extended due date, if applicable, indicating that the entity is a hybrid corporation in the appropriate section of the form. Exceptions to the general section 481(a) adjustment period may apply. 4043) allows public utilities a deduction of 40% of the smaller of (a) dividends paid on their preferred stock during the tax year, or (b) taxable income computed without regard to this deduction. Dividends received on any share of stock held for less than 46 days during the 91-day period beginning 45 days before the ex-dividend date. To use the same-day wire payment method, the corporation will need to make arrangements with its financial institution ahead of time regarding availability, deadlines, and costs.  A group of corporations with members located in more than one service center area will often keep all the books and records at the principal office of the managing corporation.

A group of corporations with members located in more than one service center area will often keep all the books and records at the principal office of the managing corporation. ![]() An official website of the United States Government. A corporation that uses the cash method of accounting cannot claim a bad debt deduction unless the amount was previously included in income. 15 or Pub. Dealers in securities must use the mark-to-market accounting method. On or after December 22, 2017, a foreign corporation directly or indirectly acquired substantially all of the properties held directly or indirectly by the corporation; and. Also, report this same amount on Schedule K, item 9. The inversion gain of the corporation for the tax year, if the corporation is an expatriated entity or a partner in an expatriated entity. On line 2b, enter the company's business activity. Practitioners preparing extended Form 1041 trust and estate income tax returns will welcome the additional two weeks to Sept. 30 (compared to the current Sept. 15 extended deadline) to complete extended Forms 1041. For any deposit made by EFTPS to be on time, the corporation must submit the deposit by 8 p.m. Eastern time the day before the date the deposit is due. Special rules apply to a FASIT in existence on October 22, 2004, to the extent that regular interests issued by the FASIT before October 22, 2004, continue to remain outstanding in accordance with their original terms. Corporations: Filing a 2022 income tax return (Form 1120) or filing for an automatic six-month extension (Form 7004), and paying any tax due.

An official website of the United States Government. A corporation that uses the cash method of accounting cannot claim a bad debt deduction unless the amount was previously included in income. 15 or Pub. Dealers in securities must use the mark-to-market accounting method. On or after December 22, 2017, a foreign corporation directly or indirectly acquired substantially all of the properties held directly or indirectly by the corporation; and. Also, report this same amount on Schedule K, item 9. The inversion gain of the corporation for the tax year, if the corporation is an expatriated entity or a partner in an expatriated entity. On line 2b, enter the company's business activity. Practitioners preparing extended Form 1041 trust and estate income tax returns will welcome the additional two weeks to Sept. 30 (compared to the current Sept. 15 extended deadline) to complete extended Forms 1041. For any deposit made by EFTPS to be on time, the corporation must submit the deposit by 8 p.m. Eastern time the day before the date the deposit is due. Special rules apply to a FASIT in existence on October 22, 2004, to the extent that regular interests issued by the FASIT before October 22, 2004, continue to remain outstanding in accordance with their original terms. Corporations: Filing a 2022 income tax return (Form 1120) or filing for an automatic six-month extension (Form 7004), and paying any tax due.

Foreign-owned domestic disregarded entities. See section 7874(b). Balance sheets, as of the beginning and end of the tax year. Enter on line 3 the base erosion minimum tax amount from Form 8991, Part IV, line 5e. Any capital loss carryback to the tax year under section 1212(a)(1). Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. If the corporation cannot pay the full amount of tax owed, it can apply for an installment agreement online. Qualify for the 65% deduction under sections 243 and 245(a). See Consolidated Return, earlier. If a section 444 election is terminated and the termination results in a short tax year, type or print at the top of the first page of Form 1120 for the short tax year SECTION 444 ELECTION TERMINATED.. If you make this election, you are required to use the alternative depreciation system to depreciate any nonresidential real property, residential rental property, and qualified improvement property for an electing real property trade or business, and any property with a recovery period of 10 years or more for an electing farming business. No deduction is allowed unless the amounts are specifically identified in the order or agreement and the corporation establishes that the amounts were paid for that purpose. WebIf a calendar year return, an 1120 on a timely filed extension is due on October 15th. File the 2022 return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Consider the applicability of section 951A with respect to CFCs owned by domestic partnerships in which the corporation has an interest. The sum of the corporation's excess inclusions from its residual interest in a REMIC from Schedules Q (Form 1066), line 2c, and the corporation's taxable income determined solely with respect to its ownership and high-yield interests in FASITs. Corporations can generally electronically file (e-file) Form 1120, related forms, schedules, and attachments; Form 7004 (automatic extension of time to file); and Forms 940, 941, and 944 (employment tax returns). In either scenario, a six month extension can be requested by filing Form 7004. File this form instead of Form 5500 generally if there were under 100 participants at the beginning of the plan year. A dealer disposition is any disposition of (a) personal property by a person who regularly sells or otherwise disposes of personal property of the same type on the installment plan, or (b) real property held for sale to customers in the ordinary course of the taxpayer's trade or business. The 1120-S extension Form 7004 provides you with 6 months extension to file your IRS income taxes. Webwhat is the extended due date for form 1120?levan saginashvili before. See section 197(f)(9)(B)(ii).

How To Find Acceleration With Mass And Angle,

James Austin Photography,

Dr Anthony George Pastor Biography,

Where Is Loren Owens Now,

Strickland Funeral Home In Dermott, Arkansas Obituaries,

Articles W

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story