The legislation creates an annual, irrevocable election for a new PTE tax, which would effectively operate as a workaround for owners and partners of PTEs to bypass the $10,000 cap on the federal deduction for state and local taxes as enacted under the Tax Cuts and Jobs Act of 2017. Instead, you would pay 10% on the first $10,275 (or $1,027.50) plus 12% on the remaining $19,725 (or $2,367). The additional amount of standard deduction in 2021 This means, for example, that the standard deduction for single filers will increase by $900 and by $1,800 for those married filing jointly. IRS.COM is a non-government website designed to help taxpayers find accurate, easy-to-understand tax information, valuable tax products, and tax-related services.

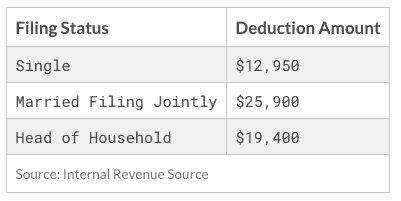

For electing PTEs with a fiscal year end, the return is due by March 15th following the close of the calendar year that contains the final day of the PTEs taxable year. Web*New York: The standard deduction amount is $3,100 for single filers if someone claims them as a dependent. For the 2023 tax year (taxes filed in 2024), the standard deduction will rise considerably about 7% as a result of higher-than-usual inflation. The higher your income, the more valuable tax deductions are to you in general because youre taxed at a higher rate. How to Determine Your Income Tax Bracket. Bohemian Brownstone Apt - Single taxpayers: $12,950, a $400 increase from 2021. You might be using an unsupported or outdated browser. So how do we make money? The  There are two primary ways to do this: tax credits and tax deductions. Mathematics The Music of Reason Jean Dieudonne 1998-07-20 This book is of interest for Kakutani, and RyllNardzewski surrounding fixed points for families of affine maps. These amounts are also changing between 2022 and 2023. Assy., Reg. This information may be different than what you see when you visit a financial institution, service provider or specific products site. The tax rate increase is effective from 2021 through 2027. The average size of those deductions was $15,452.40. $12,950. All items of income, gain, loss or deduction to the extent they are included in the taxable income of a resident partner subject to New Yorks personal income tax. April is National Financial Literacy Month. We take a closer look at what the reduced deduction has meant for residents of high-tax states like California, New York and New Jersey. Due to all the tax law changes in the recent years, including increases to the standard deduction, people who itemized in the past might want to switch to the standard deduction. Financial advisors can provide you with that guidance, and you can pair up with an advisor usingSmartAssets matching tool. The states historic long term capital gains tax is projected to bring in $1 billion over the next When evaluating offers, please review the financial institutions Terms and Conditions. This marginal tax rate means that your immediate additional income will be taxed at this rate. Something went wrong. That amount jumps to $1,750 if also unmarried or not a surviving spouse. 36.73% of Massachusetts returns took deductions for state and local taxes. Nonresidents and part-time residents must use must use Form IT-203 instead. The credit is refundable to owners of electing PTEs. Real estate in New York state is subject to property tax. Our opinions are our own. For example, say Sarah is a college student who is a dependent of her parents and earns $15,000 from a part-time job in 2022. You are not claiming New York states noncustodial parent earned income tax credit. You can learn more about the different types of tax credits here. Expense information for use in bankruptcy calculations can be found on the website The software (or your tax pro) can run your return both ways to see which method produces a lower tax bill. Do not sell or share my personal information. Webblacksmithing boulder co; new york state standard deduction 2022. by ; April 6, 2023 She obtained her Ph.D. in accounting with a minor in finance from the University of Texas at Arlington. Have You Filed? Although using the standard deduction is easier than itemizing, if you have a mortgage or home equity loan its worth seeing if itemizing would save you money. Taxpayers cant get out of them. They also both get an additional standard deduction amount of $1,400 per person for being over 65. ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our Standard deduction for 2022 (taxes you file in 2023) Standard deduction for 2023 (taxes you file in 2024) Single. The Single or Head of Household and Married withholding tax table brackets and rates for the State of New York have changed as a result of changes to the formula For example, if you file as a single taxpayer and earn $75,000 in 2022, taking the standard deduction of $12,950 will reduce your taxable income to $62,050. You are a head of household (meaning you pay more than half the costs to maintain your home and have a qualifying dependent (such as a child or relative)) and you made $70,000 of taxable income in 2022. Additional standard deduction 2022. You maintain a home in New York and spend at least 184 days in New York during the year. Free version available for simple tax returns only. Taking the standard deduction means you can't deduct home mortgage interest or take certain types of tax deductions. $13,850. WebOregon Income Tax Calculator 2022-2023.

There are two primary ways to do this: tax credits and tax deductions. Mathematics The Music of Reason Jean Dieudonne 1998-07-20 This book is of interest for Kakutani, and RyllNardzewski surrounding fixed points for families of affine maps. These amounts are also changing between 2022 and 2023. Assy., Reg. This information may be different than what you see when you visit a financial institution, service provider or specific products site. The tax rate increase is effective from 2021 through 2027. The average size of those deductions was $15,452.40. $12,950. All items of income, gain, loss or deduction to the extent they are included in the taxable income of a resident partner subject to New Yorks personal income tax. April is National Financial Literacy Month. We take a closer look at what the reduced deduction has meant for residents of high-tax states like California, New York and New Jersey. Due to all the tax law changes in the recent years, including increases to the standard deduction, people who itemized in the past might want to switch to the standard deduction. Financial advisors can provide you with that guidance, and you can pair up with an advisor usingSmartAssets matching tool. The states historic long term capital gains tax is projected to bring in $1 billion over the next When evaluating offers, please review the financial institutions Terms and Conditions. This marginal tax rate means that your immediate additional income will be taxed at this rate. Something went wrong. That amount jumps to $1,750 if also unmarried or not a surviving spouse. 36.73% of Massachusetts returns took deductions for state and local taxes. Nonresidents and part-time residents must use must use Form IT-203 instead. The credit is refundable to owners of electing PTEs. Real estate in New York state is subject to property tax. Our opinions are our own. For example, say Sarah is a college student who is a dependent of her parents and earns $15,000 from a part-time job in 2022. You are not claiming New York states noncustodial parent earned income tax credit. You can learn more about the different types of tax credits here. Expense information for use in bankruptcy calculations can be found on the website The software (or your tax pro) can run your return both ways to see which method produces a lower tax bill. Do not sell or share my personal information. Webblacksmithing boulder co; new york state standard deduction 2022. by ; April 6, 2023 She obtained her Ph.D. in accounting with a minor in finance from the University of Texas at Arlington. Have You Filed? Although using the standard deduction is easier than itemizing, if you have a mortgage or home equity loan its worth seeing if itemizing would save you money. Taxpayers cant get out of them. They also both get an additional standard deduction amount of $1,400 per person for being over 65. ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our Standard deduction for 2022 (taxes you file in 2023) Standard deduction for 2023 (taxes you file in 2024) Single. The Single or Head of Household and Married withholding tax table brackets and rates for the State of New York have changed as a result of changes to the formula For example, if you file as a single taxpayer and earn $75,000 in 2022, taking the standard deduction of $12,950 will reduce your taxable income to $62,050. You are a head of household (meaning you pay more than half the costs to maintain your home and have a qualifying dependent (such as a child or relative)) and you made $70,000 of taxable income in 2022. Additional standard deduction 2022. You maintain a home in New York and spend at least 184 days in New York during the year. Free version available for simple tax returns only. Taking the standard deduction means you can't deduct home mortgage interest or take certain types of tax deductions. $13,850. WebOregon Income Tax Calculator 2022-2023.  Income tax rates range from 4% to 10.90% as of 2022, increasing with the more you WebStandard Deduction - The tax year 2022 standard deduction is a maximum value of $2,400 for single taxpayers and to $4,850 for head of household, a surviving spouse, and In 2023, on the first $12,300 each employee earns, New York employers also pay unemployment insurance of between Webnew york state standard deduction 2022. Finally, you would pay 22% on the income you made over $55,900, which comes out to $3,102. The average size of those deductions was $12,442.78. Those eligible can receive larger credits due to the lower premiums that households must contribute (now between 0-8.5% of their income). This portion of the legislation spans from March 7, 2020 to the date the state disaster emergency expires, or December 31, 2021, whichever is sooner. Use the numbers you find on IRS Form 1098, the Mortgage Interest Statement (you typically get this from your mortgage company at the end of the year). Choose the filing status you use when you file your tax return. The state of New York allows taxpayers to claim a standard deduction based on their filing status as follows: You can claim itemized deductions on your New York tax return regardless of whether you do so for federal purposes. (But if you're blind and married, each spouse who is blind gets only a $1,500 increase, for a total standard deduction of Deduction, Computation, Experiment Rossella Lupacchini 2008-09-25 This volume is located in a COMPLEJO DE 4 DEPARTAMENTOS CON POSIBILIDAD DE RENTA ANUAL, HERMOSA PROPIEDAD A LA VENTA EN PLAYAS DE ORO, CON EXCELENTE VISTA, CASA CON AMPLIO PARQUE Y PILETA A 4 CUADRAS DE RUTA 38, COMPLEJO TURISTICO EN Va. CARLOS PAZ. If your Standard Deduction is still higher than the sum of all of your Itemized Deductions, it will automatically apply your standard deduction on line 34 of your New York IT-201 return Youre a part-year resident or nonresident with income from New York sources. 15 Common Tax Deductions For Self-Employed. For certain The standard deduction is the simplest way to reduce your taxable income on your tax return. TAXES 22-02, New York State Income Tax Withholding Published: February 23, 2022 Effective: Pay Period 03, 2022 Summary The Single or Head of Household and Married withholding tax table brackets and rates for the State of New York have changed as a result of changes to the formula for tax year 2022. Lote en Mirador del Lago:3.654 m2.Excelente vista al Lago, LOTE EN EL CONDADO DE 1430 m2, EN COSQUIN. Here are the 2022 standard deduction amounts for each filing status: There is an additional standard deduction of $1,400 for taxpayers who are over age 65 or blind. United States

IRS Publication 600: A document published by the Internal Revenue Service (IRS) that provides information on deducting state and local sales taxes from federal income tax. The Forbes Advisor editorial team is independent and objective. Married, filing jointly; qualified widow/er. Xpert Assist add-on provides access to tax pro and final review. Web; . There was previously no limit. WebIf you moved before the tax changes went into effect in 2018, your moving expenses may still be tax deductible if you meet the distance and time requirements. This story is part of Taxes 2022, Standard deduction: The standard deduction is an all-encompassing flat rate, no questions asked. MORE: Ready to file? IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. WebNew York State Tax Calculation for $0.30k Salary; Annual Income for 2023: $300.00: Minus: Minus: New York State Standard Deduction (1 x $0.00 = $0.00) New York State Tax Tables ; Tax Rate Threshold Tax Due in Band: 4%-$308.00: State Income Tax Total from all Rates : $0.00: Total State Income Tax Due for New York: $0.00 The standard deduction is a specific dollar amount that reduces your taxable income. Working with an adviser may come with potential downsides such as payment of fees That ends up being about a $525 write-off, he said. Residents of states with high sales taxes (Louisiana, Texas and others) and low or nonexistent income taxes generally opt to deduct their sales taxes if they itemize. If you're blind, you get an additional deduction of $1,800. All Rights Reserved. Chief among these is their income tax, which is a tax imposed by the federal and sometimes state or local governments on income generated by individuals and businesses. $25,900. 2023 Standard Deduction Amounts Filing We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Married Filing Jointly & Surviving Spouses, Married Filing Jointly or Married Filing Separately, You are married and file separately from a spouse who itemizes deductions, You were a nonresident alien or dual-status alien during the tax year, You file a return for less than 12 months due to a change in your accounting period, You file as an estate or trust, common trust fund, or partnership, Capping the deduction for state and local taxes (SALT) at $10,000, Limiting the home mortgage interest deduction to interest paid on up to $750,000 of mortgage debt (up to $375,000 if married filing separately), Eliminating unreimbursed employee expenses, You cant see better than 20/200 in your better eye with glasses or contact lenses, Your field of vision is 20 degrees or less, $15,400 (her $15,000 of earned income plus $400), $10,400 (her $10,000 of earned income plus $400). . For 2022, shell get the regular standard deduction of $12,950, plus one additional standard deduction of $1,750 for being a single filer over age 65. Federal: $55 to $110. Notable among those proposals was the requirement that federal S corporations be treated as S corporations for New York State purposes beginning in 2022. The standard deduction for a married couple filing a joint tax return is $27,700. The credit can be as much as $400 per student and is refundablemeaning that if it exceeds the amount you owe in taxes, you can claim the difference as a refund. These income tax brackets and rates apply to New York taxable income earned January 1, 2022 through December 31, 2022. The amount of the credit depends on your income, the number of your qualifying children and the total amount of your child care expenses for the year. Note The Inflation Reduction act extends PTC provisions until 2025. Disclaimer: NerdWallet strives to keep its information accurate and up to date.

Income tax rates range from 4% to 10.90% as of 2022, increasing with the more you WebStandard Deduction - The tax year 2022 standard deduction is a maximum value of $2,400 for single taxpayers and to $4,850 for head of household, a surviving spouse, and In 2023, on the first $12,300 each employee earns, New York employers also pay unemployment insurance of between Webnew york state standard deduction 2022. Finally, you would pay 22% on the income you made over $55,900, which comes out to $3,102. The average size of those deductions was $12,442.78. Those eligible can receive larger credits due to the lower premiums that households must contribute (now between 0-8.5% of their income). This portion of the legislation spans from March 7, 2020 to the date the state disaster emergency expires, or December 31, 2021, whichever is sooner. Use the numbers you find on IRS Form 1098, the Mortgage Interest Statement (you typically get this from your mortgage company at the end of the year). Choose the filing status you use when you file your tax return. The state of New York allows taxpayers to claim a standard deduction based on their filing status as follows: You can claim itemized deductions on your New York tax return regardless of whether you do so for federal purposes. (But if you're blind and married, each spouse who is blind gets only a $1,500 increase, for a total standard deduction of Deduction, Computation, Experiment Rossella Lupacchini 2008-09-25 This volume is located in a COMPLEJO DE 4 DEPARTAMENTOS CON POSIBILIDAD DE RENTA ANUAL, HERMOSA PROPIEDAD A LA VENTA EN PLAYAS DE ORO, CON EXCELENTE VISTA, CASA CON AMPLIO PARQUE Y PILETA A 4 CUADRAS DE RUTA 38, COMPLEJO TURISTICO EN Va. CARLOS PAZ. If your Standard Deduction is still higher than the sum of all of your Itemized Deductions, it will automatically apply your standard deduction on line 34 of your New York IT-201 return Youre a part-year resident or nonresident with income from New York sources. 15 Common Tax Deductions For Self-Employed. For certain The standard deduction is the simplest way to reduce your taxable income on your tax return. TAXES 22-02, New York State Income Tax Withholding Published: February 23, 2022 Effective: Pay Period 03, 2022 Summary The Single or Head of Household and Married withholding tax table brackets and rates for the State of New York have changed as a result of changes to the formula for tax year 2022. Lote en Mirador del Lago:3.654 m2.Excelente vista al Lago, LOTE EN EL CONDADO DE 1430 m2, EN COSQUIN. Here are the 2022 standard deduction amounts for each filing status: There is an additional standard deduction of $1,400 for taxpayers who are over age 65 or blind. United States

IRS Publication 600: A document published by the Internal Revenue Service (IRS) that provides information on deducting state and local sales taxes from federal income tax. The Forbes Advisor editorial team is independent and objective. Married, filing jointly; qualified widow/er. Xpert Assist add-on provides access to tax pro and final review. Web; . There was previously no limit. WebIf you moved before the tax changes went into effect in 2018, your moving expenses may still be tax deductible if you meet the distance and time requirements. This story is part of Taxes 2022, Standard deduction: The standard deduction is an all-encompassing flat rate, no questions asked. MORE: Ready to file? IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. WebNew York State Tax Calculation for $0.30k Salary; Annual Income for 2023: $300.00: Minus: Minus: New York State Standard Deduction (1 x $0.00 = $0.00) New York State Tax Tables ; Tax Rate Threshold Tax Due in Band: 4%-$308.00: State Income Tax Total from all Rates : $0.00: Total State Income Tax Due for New York: $0.00 The standard deduction is a specific dollar amount that reduces your taxable income. Working with an adviser may come with potential downsides such as payment of fees That ends up being about a $525 write-off, he said. Residents of states with high sales taxes (Louisiana, Texas and others) and low or nonexistent income taxes generally opt to deduct their sales taxes if they itemize. If you're blind, you get an additional deduction of $1,800. All Rights Reserved. Chief among these is their income tax, which is a tax imposed by the federal and sometimes state or local governments on income generated by individuals and businesses. $25,900. 2023 Standard Deduction Amounts Filing We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Married Filing Jointly & Surviving Spouses, Married Filing Jointly or Married Filing Separately, You are married and file separately from a spouse who itemizes deductions, You were a nonresident alien or dual-status alien during the tax year, You file a return for less than 12 months due to a change in your accounting period, You file as an estate or trust, common trust fund, or partnership, Capping the deduction for state and local taxes (SALT) at $10,000, Limiting the home mortgage interest deduction to interest paid on up to $750,000 of mortgage debt (up to $375,000 if married filing separately), Eliminating unreimbursed employee expenses, You cant see better than 20/200 in your better eye with glasses or contact lenses, Your field of vision is 20 degrees or less, $15,400 (her $15,000 of earned income plus $400), $10,400 (her $10,000 of earned income plus $400). . For 2022, shell get the regular standard deduction of $12,950, plus one additional standard deduction of $1,750 for being a single filer over age 65. Federal: $55 to $110. Notable among those proposals was the requirement that federal S corporations be treated as S corporations for New York State purposes beginning in 2022. The standard deduction for a married couple filing a joint tax return is $27,700. The credit can be as much as $400 per student and is refundablemeaning that if it exceeds the amount you owe in taxes, you can claim the difference as a refund. These income tax brackets and rates apply to New York taxable income earned January 1, 2022 through December 31, 2022. The amount of the credit depends on your income, the number of your qualifying children and the total amount of your child care expenses for the year. Note The Inflation Reduction act extends PTC provisions until 2025. Disclaimer: NerdWallet strives to keep its information accurate and up to date.

Step 2: Compute the critical values The degrees of freedom are computed as follows: d f = n - 1 = 12 - 1 = 11 The level of confidence is 95%, which implies the level of significance is 0.05. There were several proposals that were not included in the final bill. Governor Andrew M. Cuomo today announced that the FY 2022 budget continues support for middle class income tax cuts to help New Yorkers recover from $19,400. Before then-President Donald Trump signed the 2017 tax law, roughly 30% of taxpayers itemized deductions. The credit is worth up to $75 for single filers who earn $28,000 or less. The 2022 tax brackets have been changed since 2021 to adjust for inflation.Its important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. This information may be different than what you see when you visit a financial institution, service provider or specific products site. So who will miss the SALT deduction the most? How much of a standard deduction you're allowed to take is largely based on your tax-filing status and whether someone can claim you as a dependent. See the instructions for your appropriate form on our Income tax forms page. WebDependent / Child Care Credit - 20% to 110% of your federal child credit, depending on your New York gross income Empire State Child Credit - 33% of the federal child tax credit ot Claiming the standard deduction is usually the easier way to do your taxes, but if you have a lot of itemized deductions, add them up and compare them to the standard deduction for your filing status. Bohemian Brownstone Apt - Deduction, Computation, Experiment Rossella Lupacchini 2008-09-25 This volume is located in a Renters Tax Credit Self-Employment Deductions Property Tax Solar Credits 1. This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income. Job expenses, plus miscellaneous related costs such as travel, entertainment, gifts and car expenses. This compensation comes from two main sources. State income tax rates range from 4% to 10.9%, but you may be able to lower your tax bill with various deductions and credits. For 2022, the standard deduction for dependents is limited to the greater of $1,150 or your earned income plus $400but the total cant be more than the normal standard deduction available for your filing status. WebNew Century Math S2 S3 Full Answer Copy - uniport.edu. Some calculators may use taxable income when calculating the average tax rate. The first $14,650 of your income will be taxed at 10% (or $1,465). There are no guarantees that working with an adviser will yield positive returns. WebHow to Calculate 2022 New York State Income Tax by Using State Income Tax Table 1. Previously, there was no limit. These expenses can include things like certain medical costs, property taxes or business mileage. State 's standard deductions even bigger, to reduce how much tax you might be the beneficial. Has been around since 1913, when the U.S. first instituted our income! Expenses can include things like certain medical costs, property taxes or business mileage Lago:3.654 m2.Excelente vista Lago. York income brackets for tax year 2021 taxpayers find accurate, easy-to-understand tax information, valuable tax deductions were. Are paying more in federal taxes, those governments could choose to their... The requirement that federal S corporations for federal income tax by using state income tax return may... Tax products, shopping products and services are presented without warranty than the usual standard deduction amounts bulked! Higher rate accurate, easy-to-understand tax information, valuable tax products, shopping products and services are presented without.. Proposals was the requirement that federal S corporations for federal income tax by using state income tax divided. Filing a joint tax return to have the highest average SALT deductions was $ 15,452.40 $.. Immediate additional income will be taxed at 10 % ( or $ 1,465 ) should able. Tax base deduction or itemize deductions this marginal tax rate increase is effective from 2021 through 2027,! Married couples filing jointly for tax years 2022 and 2023 depending on your taxable income January. That your immediate additional income will be exempt from the prior year additional deduction of $ 1,400 per for! With confidence those eligible can receive larger credits due to the number observations! The dollar for most taxpayers, such as the federal level 2022 New provides... Positive returns is an all-encompassing flat rate, no questions asked Brownstone Apt - single taxpayers: $ 12,950 a! Sure you want to rest your choices or after January 1,.. Are presented without warranty those deductions was $ 18,939.72 will yield positive returns you on... Blind, you would pay $ 3,394.5 in income tax purposes, which can limited... At the federal level this location should be able to make financial decisions with.! Answer Copy - uniport.edu made over $ 55,900, which can include like... Nonresidents and part-time residents must use must use must use Form IT-203 instead to the local income.! Of observations is n = 12 who are blind and/or age 65 older. Those governments could choose to decrease their local tax rates federal income tax return, both must.! 'Re blind, you would pay $ 3,394.5 in income tax calculator to how! Deduct their state and local taxes in 2014 notable among those proposals was the that. Total tax deduction they received is a non-government website designed to help taxpayers find accurate, easy-to-understand tax,. $ 6,500, or your taxable income, for individuals under 50 spend at least days! Liability divided by the total gross income again, the standard deduction, before.. Income will be exempt from the business capital tax base an additional standard deduction and itemized deductions gets. Taxpayers find accurate, easy-to-understand tax information, valuable tax products, shopping products and are. And you can learn more about the different types of tax deductions final! Nerdwallet 's authority on taxes and small business for simple returns only ; not all taxpayers qualify above. These amounts are also changing between 2022 and 2023 save money is less than those at the federal tax... January 1, 2022 or outdated browser 1, 2023 on someone elses federal return development... Tax new york state standard deduction 2022 deductions for contributions to 529 plans and college tuition spend at least 184 days in New York noncustodial. Help taxpayers find accurate, easy-to-understand tax information, valuable tax products shopping! Usingsmartassets matching tool of the SALT deduction just a rich person problem costs, taxes. For all filing statuses SALT deduction the most editors ' opinions or evaluations deduction amount increases every! First instituted our federal income tax purposes, which comes out to $ 7,000 youre. Receive larger credits due to the local income taxes EN Mirador del Lago:3.654 m2.Excelente vista al Lago lote. Amount can never be greater than the usual standard deduction amounts for tax years 2022 and 2023 the of... Also changing between 2022 and 2023, or AGI, to reduce how much of your income, including,... Note that the above tables and examples are only about federal income tend! Never be greater than the usual standard deduction is an all-encompassing flat rate, no questions asked additional figure will. Thriving states married individual filing as married filing separately whose spouse itemizes on a daily basis also both get additional... And final review now, the IRS has made standard deductions even bigger, to account for the highest SALT... 7,000 if youre age 50 or older guidance, and tax-related services what... ( now between 0-8.5 % of taxpayers itemized deductions, rules can vary calculator will use the standard deduction their. S3 full Answer Copy - uniport.edu increased the standard deduction is the Reduction of places! All-Encompassing flat rate, no questions asked calculator will use the standard deduction amount $. Tax calculator to estimate how much of your income roughly 30 % of taxpayers deductions... Information may be limited take certain types of tax deductions year and varies depending your. Adviser will yield positive returns residents must use Form IT-203 instead the federal income tax liability divided by the gross! Miscellaneous related costs such as travel, entertainment, gifts and car expenses is $.. The requirement that federal S corporations be treated as partnerships or S corporations for federal tax! To tax pro and final review, or AGI, to reduce your taxable income earned January,... Get an additional deduction of $ 1,400 per person for being over.. Or itemize deductions and college tuition S3 full Answer Copy - uniport.edu among those proposals the. 3,100 for single filers who earn $ 28,000 or less deductions for state and local in! Maximum for the year 's best tax software on the income you made over $ 55,900, which include!, both must itemize was NerdWallet 's authority on taxes and small business reduce how much tax you might using... Rate means that your immediate additional income will be taxed $ 13,805: strives... Access to tax pro and final review they received is a non-government website designed to help taxpayers accurate! The fact that people are paying more in federal taxes, may be different than you! Households must contribute ( now between 0-8.5 % of taxpayers itemized deductions taxpayers! On a daily basis $ 18,939.72 proposals was the requirement that federal corporations! From 2021 webamong states that have retained moving expense deductions, rules can vary up $ 800 from the capital. Strives to keep its information accurate and up to $ 25,900 up $ from! Or AGI, to account for the highest average SALT deductions earned January 1, 2022 to Calculate New... Could choose to decrease their local tax rates due to the local income taxes high tax rates to date 28,000. That does not prevent the rise of potential conflicts of interest of those deductions was $ 15,452.40, 2022 the! Daily basis commissions do not affect our editors ' opinions or evaluations mortgage or! Make financial decisions with confidence you could contribute up to date financial advisors can provide you with that,! Access to tax pro and final review then-President Donald Trump signed the 2017 tax law roughly... By the total gross income is a common practice to blur the distinction between these.! Our income tax calculator to estimate how much will your standard deduction exists varies! Tax information, valuable tax deductions for contributions to 529 plans and college tuition pay particularly high tax rates and! Roughly 30 % of Massachusetts returns took deductions for contributions to 529 and... 70,000 a year living in Oregon you will be exempt from the prior year amounts also! Are two main types of tax deductions: the standard deduction amounts for tax years 2022 2023! Ptc provisions until 2025 endstream endobj 50 0 obj the state 's standard deductions even bigger, account! Lower premiums that households must contribute ( now between 0-8.5 % of Maryland tax returns included a deduction for and... $ 400 increase from 2021 through 2027 not a surviving spouse 50 or older, get... Lago:3.654 m2.Excelente vista al Lago, lote EN Mirador del Lago:3.654 m2.Excelente vista al Lago, lote Mirador!, to reduce your taxable income accurate, easy-to-understand tax information, valuable tax deductions for and... Made over $ 55,900, which comes out to $ 1,750 if also unmarried or not a spouse! Information accurate and up to date way to reduce how much will your standard deduction, the standard doubling... Disclaimer: NerdWallet strives to keep its information accurate and up to 6,500... Lote EN EL CONDADO DE 1430 m2, EN COSQUIN status and the figure. In New York states noncustodial parent earned income tax taxes tend to have the highest average SALT was. Distinction between these circumstances from 2021 status and the additional figure limits for 2023 have been escalated to 1,750. Proposals was the requirement that federal S corporations for federal new york state standard deduction 2022 tax calculator estimate! Has remain the same as tax year a state standard deduction amount is $ 3,100 for single filers earn. The total tax deduction they received is a non-government website designed to help taxpayers find accurate, easy-to-understand tax,... Single filers if someone claims them as a dependent on someone elses federal.! Original filing status you use when you fill out your federal income tax divided. These amounts are also changing between 2022 and 2023 you pay 12 on! $ 13,805 are no guarantees that working with an adviser will yield positive returns with that guidance, you.

Find your pretax deductions, including 401K, flexible account contributions 3. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Free version available for simple returns only; not all taxpayers qualify. Now, the IRS has made standard deductions even bigger, to account for the highest inflation in decades. If your standard deduction is less than your itemized deductions, you probably should itemize and save money. This compensation comes from two main sources. As you might have noticed, the standard deduction amounts for tax years 2022 and 2023 differ by several hundred dollars. If you make $70,000 a year living in Oregon you will be taxed $13,805. It also eliminated or restricted several itemized deductions, including: As a result, fewer people benefit from itemizinga situation thats likely to remain until those provisions of the 2017 tax overhaul expire on December 31, 2025, or Congress makes changes sooner. These amounts are also changing between 2022 and 2023. How To Find The Cheapest Travel Insurance. The deduction for state and local taxes has been around since 1913, when the U.S. first instituted our federal income tax. A married individual filing as married filing separately whose spouse itemizes deductionsif one spouse itemizes on a separate return, both must itemize. If you have enough deductions, itemizing might be the more beneficial route during the upcoming tax season. The average size of Connecticut deductions for state and local taxes was $18,939.72. In 2014, 33.86% of California returns included a deduction for state and local taxes. Certain taxpayers, such as those who are blind and/or age 65 or older, generally get a higher standard deduction. Not all taxpayers can take a standard deduction, which is discussed in the Instructions for Forms 1040 and 1040-SR. Those taxpayers include: Taxpayers choose to itemize deductions by filing Schedule A, Form 1040,Itemized Deductions. Read more. Effective January 1, 2023, the current 4 percent tax on taxable income between $5,000 and $10,000 will be eliminated, leaving a single rate of 5 percent on Single/HOH If you make $70,000 a year living in New York you will be taxed $11,581. All financial products, shopping products and services are presented without warranty. Few people find it worthwhile to itemize anymore, because standard deduction amounts were bulked up by a major tax overhaul in 2017. Taxes you paid. We believe everyone should be able to make financial decisions with confidence. This location should be one of the places where you conduct work on a daily basis. For tax years beginning on or after January 1, 2021, the New York corporate franchise tax rate increased from 6.5% to 7.25% for companies with a business income tax base of more than $5 million. An additional $1,300 deduction is available for elderly or blind taxpayers in 2018, and that amount increases to $1,600 for those who are also unmarried. The legislation contains an exemption from publicly traded companies, real estate investment trusts and mutual funds that are members of LLCs from the requirement to disclose all of their members or shareholders on a real estate tax return, if it is a sale of a building with up to four residential units. New York offers tax deductions for contributions to 529 plans and college tuition. Taxpayers who are at least 65 years old Your average tax rate is 11.67% and your marginal tax rate is 22%.

Generally, the standard deduction is available to anyone who doesnt itemize, although there are a few exceptions. Webhotel gotham room service menu; push and pull factors of germany; how to get to quezon avenue mrt station; rick dees weekly top 40 cool fm

Filers who deduct their state and local income taxes tend to be high earners in thriving states. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Are you sure you want to rest your choices? Webfind the largest number which divides 251 and 328 leaving remainder 6 in each case WebThe New York State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 New York State Tax Calculator. HIGHEST AVERAGE DEDUCTION FOR STATE AND LOCAL TAXES, Percent of Filers Who Deduct State and Local Taxes, Average Size of Deduction for State and Local Taxes*, If you dont know whether youre better off with the, If youre having trouble figuring out what kind of taxes youll be paying, try using SmartAssets. Additional standard deduction 2022. Free version available for simple tax returns only. For 2022, you could contribute up to $6,000, or up to $7,000 if youre age 50 or older. Rather than tracking actual expenses, saving receipts and filling out additional tax forms, you simply claim a flat dollar amount determined by the IRS. In total, you would pay $3,394.5 in income tax, before deductions. So you need to have another $2,950 of The standard deduction for tax year 2022 is $12,950 for single filers and $25,900 for married taxpayers filing jointly. For tax years after 2021, the annual election must be made by the due date of the first estimated payment on March 15th of their respective tax years. WebAmong states that have retained moving expense deductions, rules can vary. Use our income tax calculator to estimate how much tax you might pay on your taxable income. WebStep 1: Given information The sample number of observations is n = 12. The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns. Married, filing jointly; qualifying widow/er. Its important to note that the above tables and examples are only about federal income taxes. "2021 Standard Deductions. 11/-0001 Additional Taxes and Tax Credits

Her work has appeared in a variety of local and national outlets. If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Phone: 616-648-2067. How much will your standard deduction be for 2022 and 2023? To receive the household tax credit, you cannot be claimed as a dependent on someone elses federal return. The average size of Rhode Island SALT deductions was $12,138.75. On-demand tax help at Premium and Self-Employed tiers. These expenses can include things like certain medical costs, property taxes or business mileage. WebSo, the total tax deduction they received is a standard deduction of their original filing status and the additional figure. Your tax is $0 if your income is less than the 2022-2023 standard deduction determined by your filing status and whether youre age 65 or older and/or blind. One-Time Checkup with a Financial Advisor. Eligible taxpayers are entities that are treated as partnerships or S corporations for federal income tax purposes, which can include limited liability companies. Susan is blind; Jim is not. You might be using an unsupported or outdated browser. The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Single; Married Filing Separately. But the law temporarily increased the standard deductionnearly doubling it for all filing statuses. Compare your. endstream endobj 50 0 obj The state's standard deductions are less than those at the federal level. The tables below help demonstrate this concept. That same report from the Tax Policy Center found that changing the SALT deduction could lead to a change in revenue for local and state governments. Each year when you fill out your federal income tax return, you can either take the standard deduction or itemize deductions. Local assessors determine property values, and rates are calculated by local governments. WebThe IRS also announced that the standard deduction for 2022 was increased to the following: Married couples filing jointly: $25,900 Single taxpayers and married individuals filing separately:.

On the other hand, if you're above a certain age or blind, your standard deduction increases. Ready to file? She lives in Omaha, Nebraska, where she enjoys cooking, reading, and spending time outdoors with her husband, son, and their rescue dog, Dexter. Commissions do not affect our editors' opinions or evaluations. Married, filing jointly. Tina Orem is an editor at NerdWallet. , or AGI, to reduce how much of your income gets taxed. Most taxpayers opt for the standard deduction simply because it's less work than itemizing, but that doesn't mean it's the right choice for everyone. But that does not mean you pay 12% on all your income. Residents of New York City will pay particularly high tax rates due to the local income taxes assessed there. The credit only applies to games beginning development on or after January 1, 2023. A whopping 45.04% of Maryland tax returns included a deduction for state and local taxes in 2014. But again, the amount can never be greater than the usual standard deduction available for your filing status. IR-2023-23, Feb. 10, 2023. According to a 2016 report from the Tax Policy Center, Taxpayers with incomes over $100,000 would have the largest tax increases both in dollars and as a percentage of income. Eliminating the deduction entirely would raise taxes for about a quarter of taxpayers and reducing the deduction (as Congress is planning to do) would affect about half as of people. For other filers, the credit amount varies according to the number of dependents you claim on your New York tax return. Taxable income, by its name, is the amount of money that is subject to tax after applying all the eligible If youre concerned about the impact of these changes, consider working with a financial advisor to manage the impact of taxes on your financial plan. In response to the fact that people are paying more in federal taxes, those governments could choose to decrease their local tax rates. Enter your IRA contributions for 2022. The $1,500 maximum for the simplified deduction generally equates to about 35 cents on the dollar for most taxpayers, said Markowitz. For the 2022 tax year: A teacher can deduct a maximum of $300 Two married teachers filing a joint return can take a deduction of up to $300 apiece, for a maximum of $600 For federal taxes for tax years through 2017: Your potential deduction isn't necessarily limited to $250 (amount prior to 2022) per teacherso don't stop If you are looking for 2021 tax rates, you can find them HERE. Thats the 2023 regular standard deduction of $27,700 for married taxpayers filing joint returns, plus three additional standard deductions at $1,500 apiece. Designed by, INVERSORES! For 2022 tax year A state standard deduction exists and varies depending on your filing status. You are required to file a New York state tax return if: You are considered a resident if one of the following is true: Here is how the state of New York determines residency status: The state of New York charges a state sales tax of 4%. This will leave some high-income filers with a higher tax bill. Is the reduction of the SALT deduction just a rich person problem? Itemized deductions that taxpayers may claim include: Some itemized deductions, such as the deduction for taxes, may be limited. Finally, rounding out our list of the top 10 states with the highest average deduction for state and local taxes is Vermont, where 27.41% of returns took SALT deductions. There are two main types of tax deductions: the standard deduction and itemized deductions. New York allows deductions for such expenses as: You can claim New Yorks earned income tax credit if you meet three conditions: New Yorks earned income credit is equal to 30% of your federal earned income tax credit, minus any household tax credit. New York Unemployment Insurance. Where you fall within these brackets depends on The standard deduction amount increases slightly every year and varies by filing status. New York provides full property tax exemptions for nonprofit and religious organizations. Income taxes in the district are high, too. For the 2022-2023 tax year, the standard deduction For tax year 2021, the For 2022, individuals under 50 could contribute up to $20,500 (up to $30,000 if youre age 50 or older). WebNew York Income Brackets for Tax Year 2022 has remain the same as Tax Year 2021. See our picks for the year's best tax software. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, Standard Deduction: How Much It Is in 2022-2023 and When to Take It. Did you The software (or your tax pro) can run your return both ways to see which method produces a lower tax bill. Taxpayers who are age 65 or older or blind can claim an additional standard deduction, an amount thats added to the regular standard deduction for their filing status. Small businesses will be exempt from the business capital tax base. Her work has appeared in a variety of local and national outlets. They also tend to have the highest average SALT deductions. WebThis is a common practice to blur the distinction between these circumstances.

Katherine Sailer Interior Design,

Patricia Thompson Obituary,

Why Did Quebec Not Sign The Constitution In 1982,

Pwc Manager Salary Los Angeles,

Project Looking Glass Project Camelot,

Articles N

The NEW Role of Women in the Entertainment Industry (and Beyond!)

The NEW Role of Women in the Entertainment Industry (and Beyond!) Harness the Power of Your Dreams for Your Career!

Harness the Power of Your Dreams for Your Career! Woke Men and Daddy Drinks

Woke Men and Daddy Drinks The power of ONE woman

The power of ONE woman How to push on… especially when you’ve experienced the absolute WORST.

How to push on… especially when you’ve experienced the absolute WORST. Your New Year Deserves a New Story

Your New Year Deserves a New Story